Double Liability for Bank Shareholders, Officers and Directors

Politics / Credit Crisis 2012 Feb 06, 2012 - 04:02 AM GMTBy: Chris_Kitze

Most people don't realize that for about 75 years after Civil War, in the United States, a bank's officers, directors and shareholders had personal liability in excess of the value of their shares. If a bank were to be declared insolvent by the regulator, they were required to make up the shortfall in an insolvency with their personal assets. This tends to focus the attention of the bankers to be more responsible in terms of their lending and other business practices and provides an automatic way to self-regulate. When you have no personal responsibility, other than maybe not getting a bonus next year, why not take big chance for a bigger personal payout? There is no downside for bankers with today's limited liability and the public is now stuck with these losses because the bankers have shifted their responsibility to the public.

Most people don't realize that for about 75 years after Civil War, in the United States, a bank's officers, directors and shareholders had personal liability in excess of the value of their shares. If a bank were to be declared insolvent by the regulator, they were required to make up the shortfall in an insolvency with their personal assets. This tends to focus the attention of the bankers to be more responsible in terms of their lending and other business practices and provides an automatic way to self-regulate. When you have no personal responsibility, other than maybe not getting a bonus next year, why not take big chance for a bigger personal payout? There is no downside for bankers with today's limited liability and the public is now stuck with these losses because the bankers have shifted their responsibility to the public.

From Yale Law School Legal Scholarship Repository:

For three quarters of a century - between, roughly, the Civil War and the Great Depression-shareholders in American banks were responsible not only for their investments, but also for a portion of the bank's debts after insolvency. If a bank failed, the receiver would determine the extent of the insolvency and then assess shareholders for an amount up to and including the par value of their stock.

Bank officers, directors and investors took this responsibility very, very seriously. This article was written in 1994, following the previous worst banking crisis since the Great Depression, the Savings and Loan debacle and outlines the reasons why it should still be in use today:

The regime of bank double liability was rejected and abandoned on three grounds: (1) that it had failed to protect bank creditors; (2) that it did not maintain public confidence in the banking system; and (3) that depost insurance was a far preferable means for accomplishingg the regulatory objectives. These arguments have a certain irony in light of recent history, in which deposit insurance itself has proved incapable of protecting the soundness of the banking system or maintaining public confidence in the nation's depository institutions. Double liability, on the other hand, holds the promise for instilling sound banking practices through the application of incentives and shareholder monitoring, rather than the pervasive regulatory scrutiny necessitated under deposit insurance systems. History shows that the nation took a wrong turn when it abandoned double liability for a system of governmentally administered deposit insurance.

Think about this in light of today's banking system, which rewards incompetence with taxpayer underwritten bailouts and ignores the responsibility of those paying themselves huge bonuses.

Under double liability, if there were a run on a bank and it closed, within days of the regulators shuttering the bank, counting all the assets and liabilities, there would be an auction of all the assets of the bank AND that of it's responsible directors, officers and shareholders. This took place literally on the front lawn of the executive's home, because that home and its contents would also be auctioned off, too. For the author, there is also a personal story I'd like to share with you.

This is a store that was owned by a long deceased relative of mine from Granton, WI. It's a postcard from 1912.

The P.J. Kemmeter General Store. P.J. Kemmeter was one of the leading businessmen in town, owning a heading mill, this general store and a home on one entire city block. He was also a shareholder in the Granton Farmer's State Bank.

According to the local newspaper:

"The Farmers State Bank probably does the biggest business of any bank in the state with a capital stock of $10,000. The deposits range from $175,000 to $200,000 and the business done for the wealthy farmers in the vicinity would put to shame many an institution which is more pretentious in the larger cities."

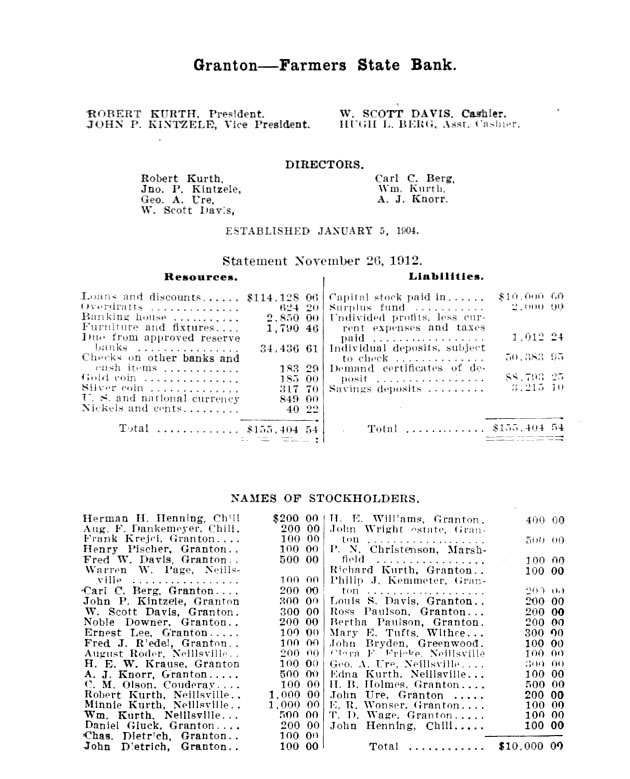

Here is a balance sheet, as well as the the roster of the officers, directors and shareholders of the Farmer's State Bank in Granton, WI, where he had invested $200 in the total capitalization at the bank, which was $10,000 (he's near the bottom right). This is from 1912, long before the collapse.

Unfortunately, it ended badly as this bank was swept up in the depression of 1930 and it was declared insolvent by bank examiners. The bank building was eventually purchased by Citizens State Bank of Loyal:

Many milestones mark the progress of Citizens State Bank of Loyal. In 1934, the Board of Directors voted to purchase the former Farmers State Bank building in Granton, which folded during the Depression.

Shortly after the bank went under, P.J. Kemmeter did as well.

From the Clark County News, May 1930:

M. E. Wilding, trustee in bankruptcy, last week disposed of the P. J. Kemmeter property in Granton. The store building was sold for $3,000 and the home for $2,250, both purchased by John Pietenpol.

The store, the bank, the mill, his home, everything was lost in that crash from the bank failure, which he and the other shareholders had to personally make good. Maybe the answer to today's banking crisis is to have more personal liability and Regulator wall clocks to remind the bankers of the responsibility they carry for society. A Regulator for their heart will no doubt do more good than any new law or government Regulator.

members.beforeitsnews.com/story/1720/343/...

By Chris Kitze

A long career in digital media led to Before It's News, the People Powered News site that is quickly becoming a leading source for alternative news. We've got a great team of very bright and hardworking people with an incredible market opportunity that's been handed to us by a corrupt media and government. We're here to help you get your news out, that's why this site exists.

© 2011 Copyright Chris Kitze - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.