Gold Will Advance to $2,500 If Euro Zone Breaks Up

Commodities / Gold and Silver 2012 Feb 09, 2012 - 08:40 AM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,733.00, EUR 1,304.77, and GBP 1,094.20 per ounce.

Gold’s London AM fix this morning was USD 1,733.00, EUR 1,304.77, and GBP 1,094.20 per ounce.

Yesterday's AM fix was USD 1,743.00, EUR 1,315.17, and GBP 1,095.95 per ounce.

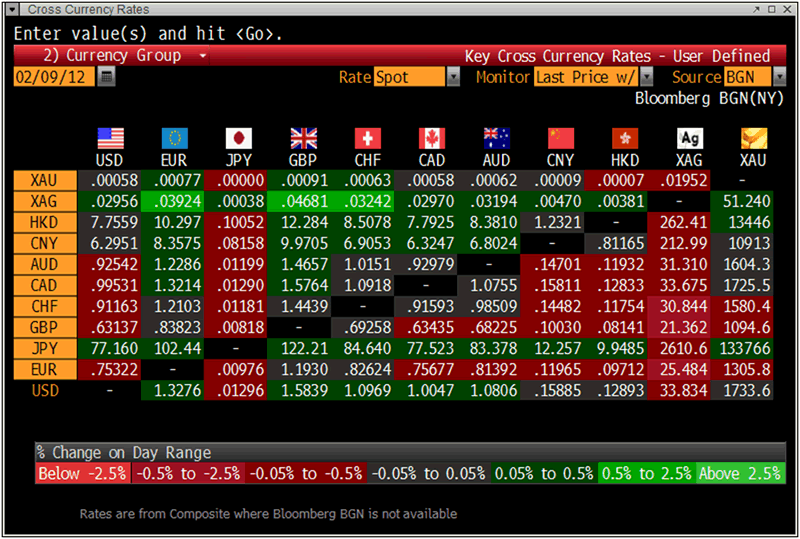

Cross Currency Table – Bloomberg

Gold tested yesterday's lows near $1,725/oz in early trading in Asia prior to ticking higher to $1,740 towards the end of the trading day with surprisingly strong inflation figures from China helping.

Gold corrected to $1,730/oz as markets in Europe opened and has traded in a range between $1,730/oz and $1,740/oz since.

It is believed that Greek political leaders are still holding out with regard to pension cuts. Market participants are again looking for some closure today. Failure could lead to a sharp bout of risk aversion.

A resolution will boost the euro against the dollar and gold short term but with Greece remaining fundamentally insolvent the latest exercise in ‘kicking the eurozone can down the road’ will not restore confidence in the euro in the long term.

Gold Spot $/oz 3 Days (Bloomberg)

The European central bank has a rate decision out today at 12.45 GMT and interest rates are expected to remain at record lows, near 0%, supporting gold.

Bank of England Governor Mervyn King looks set to engage in more QE by injecting another 50 billion pounds, nearly $80 billion, into the U.K. economy today as he ramps up protection for a nascent recovery from the threat posed by Europe’s debt crisis.

More QE by the BOE and loose monetary policy by the ECB is gold bullish.

China's annual inflation rate (CPI Index) accelerated to 4.5% in January, surprising market expectations and breaking a five-month trend of easing price pressures. Consumers hitting the shops hard spending during the Chinese Lunar New Year holiday break may have contributed to the inflation.

The inflation jump in the world’s second-largest bullion consumer, China, should lead to continuing demand for bullion there.

“Gold will rise to $2,500/oz and commodities will plummet if the euro area starts to break up, “said Capital Economics yesterday.

“Greece may leave the system this year, followed by Portugal and Ireland in 2013, "Julian Jessop, chief global economist at the macroeconomic consultancy, told a conference in London on Wednesday.

A drop in commodity prices could be "pretty bad" if the Eurozone breaks up, while smaller than the 2008 collapse.

Gold and silver will rise, he said. "It's almost certainly bad for all commodities, excluding gold and perhaps silver as a safe haven," Jessop said.

European Central Bank governing council member Ewald Nowotny said last month he "can't be sure" Greece will be able to stay in the single currency, while some economists including Nouriel Roubini have said that the country may leave the euro within a year.

Greece, facing a 14.5 billion-euro ($19.2 billion) bond payment on March 20, is struggling to arrange financing to avert a collapse of the economy, risking a new round of contagion in the euro area.

In the longer term, the breakup of the euro could be "very positive" for the global economy and commodity prices, Jessop said, as peripheral countries and Germany would have greater freedom to set their economic policies.

OTHER NEWS

(Bloomberg) -- South African Gold Output Fell 8.2% in December From Year Ago

South African gold production fell 8.2 percent in December from a year earlier, Statistics South Africa, said by phone from Pretoria today.

(Bloomberg) -- South Africa Mine Output Rose 0.9% in December From Year Earlier

South African mine production rose 0.9 percent in December from a year earlier, Statistics South Africa, said by phone from Pretoria today.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

SILVER

Silver is trading at $33.83/oz, €25.50/oz and £21.36/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,654.00/oz, palladium at $705/oz and rhodium at $1,400/oz.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.