Is Gold Money?… Don't Ask Ben Bernanke, Examine the Federal Reserve

Commodities / Gold and Silver 2012 Feb 13, 2012 - 06:28 AM GMTBy: Money_Morning

Peter Krauth writes:

If you really care about your financial future, here's something you need to know.

Peter Krauth writes:

If you really care about your financial future, here's something you need to know.

It's about a story that received almost zero coverage from the mainstream press. I can't say that I am surprised.

It involves gold.

Thanks to requests by Bloomberg News under the Freedom of Information Act, the Federal Reserve has revealed unprecedented details concerning the personal holdings of its regional bank presidents.

What they found is nothing short of stunning ...

Ben Bernanke on Gold

But let me back up a little.

There's an exchange between Fed Chairman Ben Bernanke and Congressmen Ron Paul you need to hear first.

During a monetary policy report delivered to Congress last summer, Congressman Ron Paul asked Bernanke if he thought gold is money.

After a clearly uncomfortable pause Ben said, "No. It's a precious metal." [By the way, if you haven't seen Ron Paul questioning Bernanke about gold, click here. It's already had over half a million views.]

Paul went on to ask Bernanke why it is then that central banks hold so much gold. Bernanke answered that it was simply a tradition.

Well, congrats Ben, you did get that one right, just for the wrong reasons. (Deep down, you surely know the true reasons).

The fact is gold has been a monetary tradition for millennia.

Nearly 2,000 years ago Aristotle laid out what characteristics make for good money. According to Aristotle:

1.It must be durable.

2.It must be portable.

3.It must be divisible.

4.It must be consistent.

5.It must have intrinsic value.

So it's no accident that the most common basis for money - in all of human history - has been gold.

You might want to reread that: the most common basis for money - in all of human history - has been gold. It's no accident.

After all, only gold meets all five of those requirements for sound money.

It is only in the past century that fiat money has supplanted gold or gold-backed currencies on a worldwide basis.

What makes today's central bankers and their system of printing fiat currencies and setting interest rates so special? It is hubris and nothing more.

Fiat currencies are just a relatively recent, and failing, experiment in economics. So much so, it's become exceedingly dangerous to hold them of late.

Here's why.

It has to do with characteristic No. 5, that bit about having intrinsic value. That's the real thorn in today's U.S. currency.

What intrinsic value does a piece of paper, with some ink saying "Federal Reserve Note," truly have?

Not much, aside from being able to buy things with them.

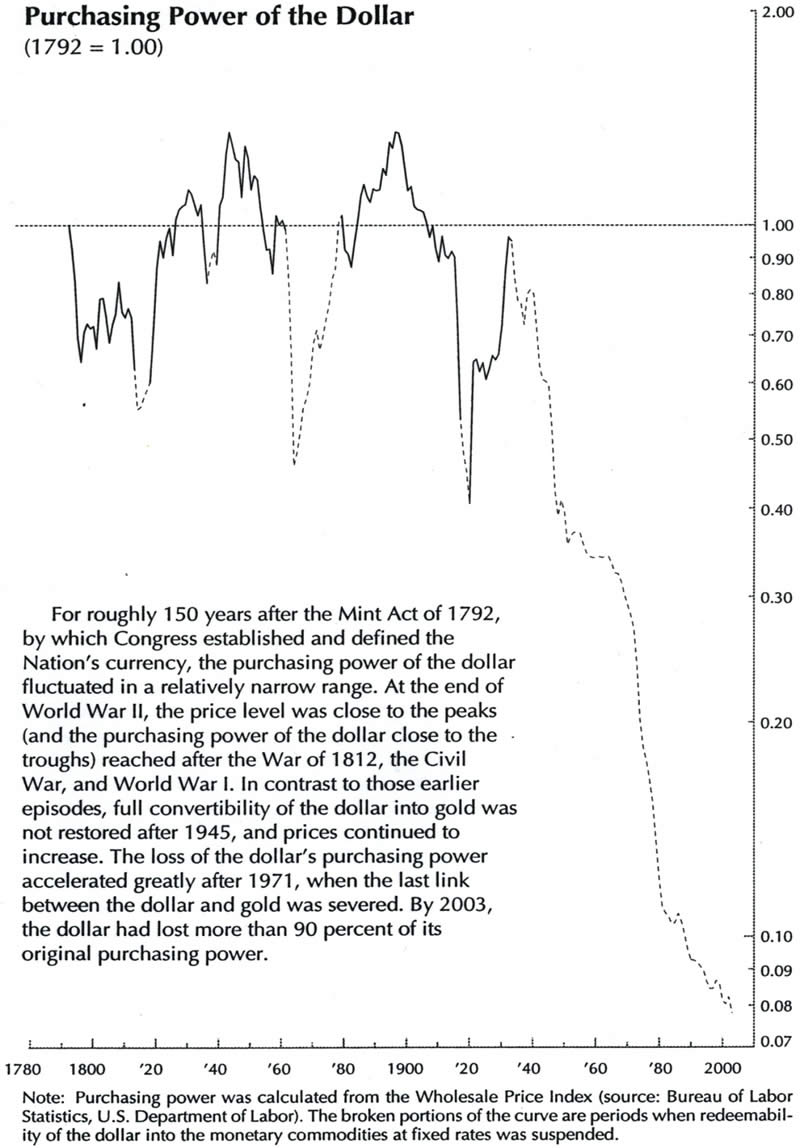

Since 1913, the very year the Federal Reserve was created, the dollar has lost 95% of its value.

And it's getting worse...

Before the late 2008 financial fallout, the Fed's balance sheet had $800 billion in assets. Today, it has tripled to $3 trillion.

That's a lot more dollars sloshing around. How could things possibly not go up substantially in price when there is three times the number of dollars chasing nearly the same amount of goods and services?

And here's another question.

Why does a group of Fed Governors think they know what interest rates (the price of money, really) should be? Why not let the market determine the price of money, as it does with most everything else?

The cure for all of this is gold because it is real money. Always has been. Always will be.

Gold is De Facto Money

If you don't believe gold is already reasserting its traditional role as money, consider this.

Dr. Stephen Leeb, Chairman and CIO of Leeb Capital Management, recently said, "Gold is now the de facto reserve currency."

Last week, Reuters reported that Iran is looking to skirt U.S.-led financial sanctions by paying for wheat using gold as payment. American grains giant Cargill said sales could still be made to Iran, particularly if they paid with non-dollar currencies.

There are also reports that India is buying Iranian oil, and paying for it with gold.

All of this is happening at a time when as many as 13 U.S. states want to issue their own currencies in silver and gold.

In fact, North Carolina Republican Representative Glen Bradley introduced a currency bill last year.

Bradley said, "In the event of hyperinflation, depression, or other economic calamity related to the breakdown of the Federal Reserve System ... the State's governmental finances and private economy will be thrown into chaos."

What's more, Utah has already signed a bill into law recognizing U.S. mint-issued gold and silver coins as an acceptable form of payment.

The coins are treated like U.S. dollars for tax purposes and Utah State citizens can now contract to pay each other in gold if they so choose.

A Classic Case of "Do As I Do, Not As I Say"

But back to the breaking news about the Federal Reserve bank presidents.

Thanks to the recent disclosure by regional Fed bank chiefs, we now know how some have chosen to invest.

To call it "revealing" would be an understatement.

Among others, New York Fed President Dudley owned shares of insurer American International Group (NYSE: AIG) and General Electric Co. (NYSE: GE) while the Fed negotiated massive emergency funding bailouts for the insurance and finance giants.

Even more stunning are the holdings of Dallas Fed President Fisher, one of the richest of the 12. He's an alumnus of the financial industry, having worked as a banker, broker, and hedge fund manager, accumulating at least $21 million in the process.

Fisher's inflation-hedging assets include over 7,000 acres of farmland, and $50,000 each in platinum and uranium.

He also owns some of that stuff Bernanke doesn't think is real money. Fisher is practically a gold bug with $1 million invested in the SPDR's Gold Trust (NYSE: GLD).

Can you say conflict of interest? I rest my case.

Keep in mind that Fed decisions are made at secret meetings. The transcripts of those meetings are destroyed; a procedure that began in 1970, ironically the same year the Freedom-of-Information Act was passed.

What information about the economy, interest rates, employment, and so on, is so "sensitive" that the American people can't know?

Fisher's own "access to information" is not only privileged, it probably includes a little reading on Aristotle, too.

Look, these guys are not idiots. They just happen to think that we are.

So let's learn from Aristotle, and prove them wrong by investing in gold.

[Editor's Note: If you or anyone you know is thinking about silver, please read this. We've just released a report that exposes a massive scheme behind the price of silver.

What we found after six months of research will raise the hairs on the back of your neck.

It stems from a massive scheme that appears to involve traders... investment banks... and, as some suggest, even the federal government itself.

Right now, these factors are converging to push silver to a historic high. The last time something like this happened, silver shot up 195%.

Please go here to access our just-released report.

And please, if you know of anyone who has a strong interest in silver, please forward this to them. They'll want to know the details.]

Source http://moneymorning.com/2012/02/13/is-gold-money-dont-ask-ben-bernanke-examine-federal-reserve/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.