Obama Budget Disaster, Economists' in a Truman Show

Politics / US Politics Feb 15, 2012 - 08:40 AM GMTBy: BATR

David Stockman's Viewpoint on the Obama Budget Disaster

David Stockman's Viewpoint on the Obama Budget Disaster

Passing a Federal Budget is a rarity, especially under the administration of a committed Marxist. The Democratic Senate’s strangle hold on bringing up legislation, particularly a budget, goes without saying. What makes this new budget for 2013 any different? This time the day of reckoning hits hard the first of the next year. The recent interview with David Stockman on the Fox Business channel with Neil Cavuto is an extraordinary analysis why the economy will absorb a frightful tax increase all at one time. The fallout to commerce could become the real end of the world scenario. Take the time and watch the insightful observations from a courageous number cruncher who served this nation with distinction during the Reagan Presidency.

Bob Jennings in a written article from the same Fox News presents a written list that coincides with the risks that Stockman outlines.

Major Individual Income Tax Benefits Expiring 12/31/2011:

•Personal tax credits applied against income tax no longer apply

Higher alternative minimum tax exemptions revert back to extraordinarily-low thresholds

•$250 school teacher expense deduction ends

•Mortgage insurance premium deduction expires

•State and local sales tax deductions expire

•Tuition and related fees deduction end

•IRA to charity tax-free transfers stop

•2% Social Security tax reduction ends

Major Individual Income Tax Benefits Expiring 12/31/2012:

•Marriage penalty equalization ends

•Dividends taxed at capital gains rates removed, taxed at regular rates now

•Capital gains low tax rates expires

•Removal of itemized deduction phase out for higher income Americans

•Removal of personal exemption phase out for higher income Americans

•Child care deduction limit of $3,000 reverts to $2,400

•Child credit reduces from $1,000 per child to $500 per child

•Low 10% tax bracket for low income Americans is eliminated

•Lower income tax rates and smaller brackets expires

•Refundable adoption credit and reduced deduction

•American Opportunity college education credit expires

•Major reduction in earned income credits and refunds

•Income tax exemption for debt forgiven on home foreclosures and repossessions

•Deduction for student loan interest ends

•Education IRA limit drops from $2,000 to $500

Now these major tax changes are alarming enough and make the case that an additional business slowdown is on the horizon, but the underlying fact is that just continuing the current tax deductions never addresses the true causes that build in perpetual deficits.

The Ghost of David Stockman makes three points:

1. The stimulus was about implementing the Obama agenda.

The short-run economic imperative was to identify as many campaign promises or high priority items that would spend out quickly and be inherently temporary. … The stimulus package is a key tool for advancing clean energy goals and fulfilling a number of campaign commitments.

2. Team Obama knows these deficits are dangerous (although it has offered no long-term plan to deal with them).

Closing the gap between what the campaign proposed and the estimates of the campaign offsets would require scaling back proposals by about $100 billion annually or adding new offsets totaling the same. Even this, however, would leave an average deficit over the next decade that would be worse than any post-World War II decade. This would be entirely unsustainable and could cause serious economic problems in the both the short run and the long run.

3. Obamanomics was pricier than advertised.

Your campaign proposals add about $100 billion per year to the deficit largely because rescoring indicates that some of your revenue raisers do not raise as much as the campaign assumed and some of your proposals cost more than the campaign assumed. … Treasury estimates that repealing the tax cuts above $250,000 would raise about $40 billion less than the campaign assumed. … The health plan is about $10 billion more costly than the campaign estimated and the health savings are about $25 billion lower than the campaign estimated.

Lastly Stockman lambasts playing loose as "The Economists' in a Truman Show" for cooking the numbers.

"I don’t particularly believe in tin foil hats, but all of these mainstream economists treat the BLS and BEA (Bureau of Economic Analysis), data like it’s holy writ—when it’s evident that the reports are so massaged, estimated, deemed, revised, re-bench marked and seasonally adjusted that any month-to-month change has a decent chance of being noise. What deep secret might they be hiding?

So on the labor force participation rate they say, "No it didn’t go down in January because the 2012 numbers are re-bench marked for the 2010 census," but for some reason the BLS didn’t bother to update the 2011 civilian population numbers, including December. Thus, the BLS published apples-to-oranges numbers on this particular variable and the footnote says the December participation rate would have been the same as January, if they had revised it.

But the mainstream narrative never gets to the trend. In this case, the plain fact is that we are warehousing a larger and larger population of adults who are one way or another living off transfer payments, relatives, sub-prime credit, and the black market. My suspicion is that this negative trend and many others like it get buried by the monthly change chatter from mainstream economists and on bubble vision, and that these monthly deltas are so heavily manipulated as to be almost a made-up reality. Call it the economists’ Truman Show."

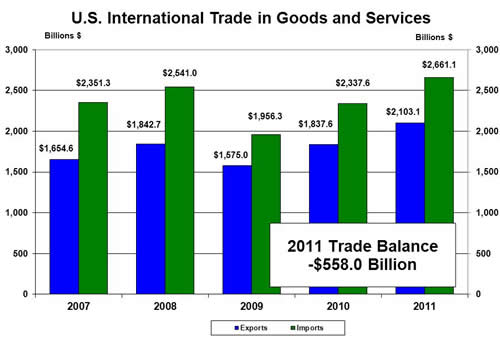

Folks, the federal budget will never get into balance as long as the trade deficit continues. However, the military budget and the social transfer payments with an aging society have the sharpest increase curve. When all the above tax benefits expire in 2013, the economy must contract. A second Obama administration will think up even higher stimulus schemes.

David Stockman understands the worst is still ahead. His advice is a sober warning to a political class of deficit spending addicts. Yet their record of rehabilitation seldom includes the policy-making actions and commitment to make fundamental spending reductions. As long the fantasy delusion continues, that everything will be all right and improvement is coming after the next election, no one will face the financial reality. Listen to Stockman, before it is too late.

James Hall – February 15, 2012

SARTRE

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2012 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.