FX Markets Analysis, Risk Trades Elongate

Currencies / Forex Trading Feb 20, 2012 - 06:14 AM GMTBy: Capital3X

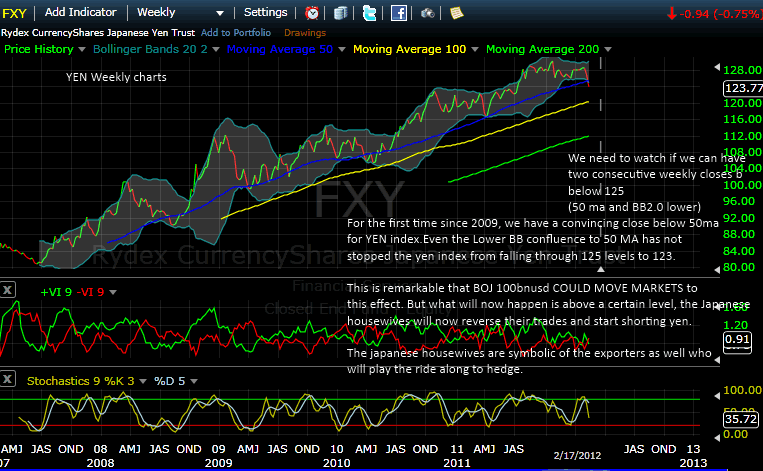

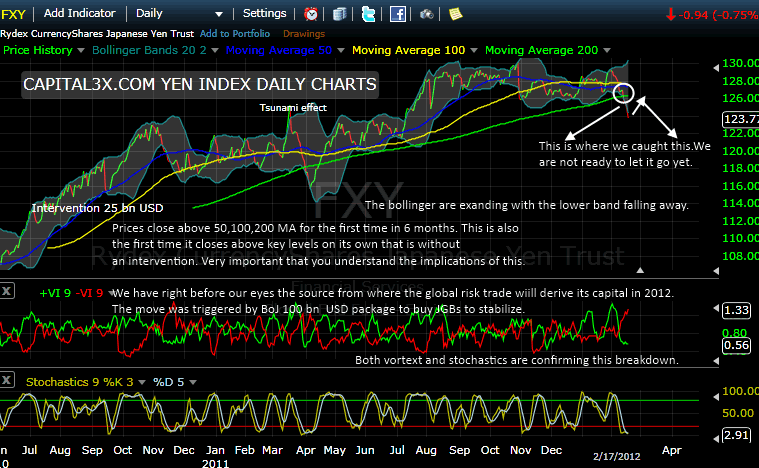

Before we begin this analysis, please do make it a point to go through Yen charts and analysis. We were among the first to have seen through the yen weakness in early feb and has now caught over 550 pips in key yen pairs like EUR/JPY, AUD/JPY and CAD/JPY. The yen analysis has been updated with one of the charts provided in the current analysis.

Before we begin this analysis, please do make it a point to go through Yen charts and analysis. We were among the first to have seen through the yen weakness in early feb and has now caught over 550 pips in key yen pairs like EUR/JPY, AUD/JPY and CAD/JPY. The yen analysis has been updated with one of the charts provided in the current analysis.

The week has seen strong moves up and down for risk assets but more often than not, they have been in the channel. We take this opportunity to look at some of these pairs.

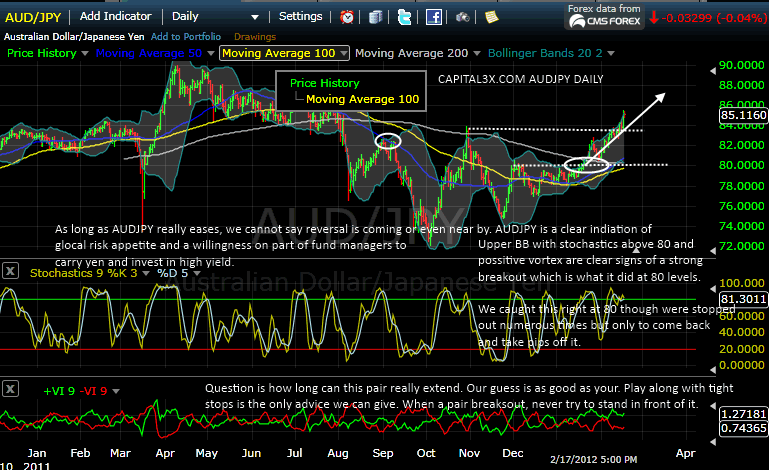

AUD/JPY DAILY

AUD.JPY breakout at 80 was well caught by our portfolio….

but we understand that our stops have been wiped out many times over. This is part of trading and one needs to understand that keeping the right stop is always going to messy affair. So it is not enough to know the trend but also to get a but lucky on stops. We will be the first to stand and say we were lucky to make strong pips in Oct, Nov and we will be the first to stand and say now that we apparently failed in keeping the right stops.

The truth of the matter right now is AUDJPY stands over 500 pips in one week spurred by yen weakness. We have already covered Yen weakness here.

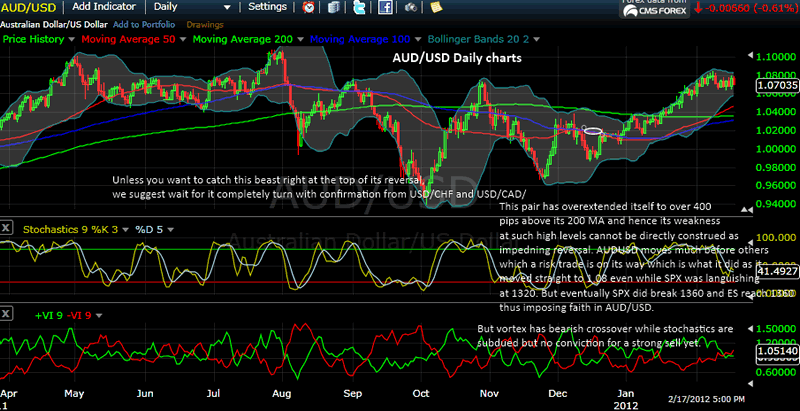

AUD/USD DAILY

The pair has been on steroids as it reaches 1.08 but has weakened ….

considerably since then even while risk trades are in full vogue. While traditionally AUDUSD is a precursor to risk aversion, which might be true this time around as well, the timing of it may be a few days away. AUDUSD has moved over 300 pips above its confluence while other pairs are still working their way to confluence. In keeping with AUDUSD, ES has broken out and reached 1360 levels. Question is whether AUDUSD failure at 1.08 is indicative of risk reversal? Even if there be a reversal, we need AUDUSD to retrace quite bit to 1.0375 to even question the bull market for 2012 in which we are firmly entrenched.

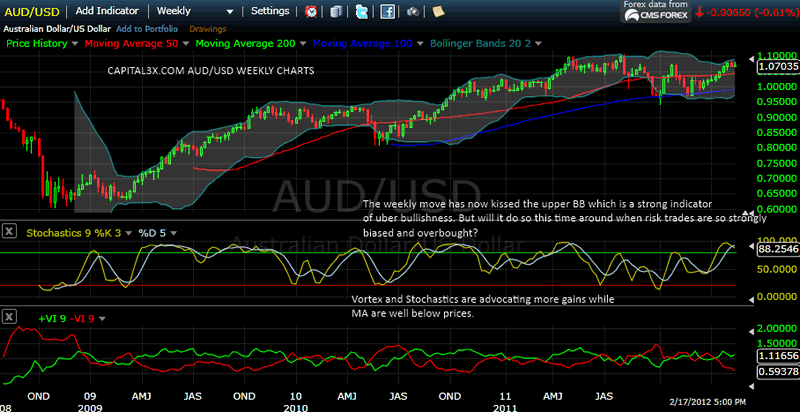

AUD/USD WEEKLY

On the weekly, things look a bit more….

sanguine as AUDUSD reaches upper BB 2.0. The weekly charts are bullish but they lag the daily and hence less helpful. Commentary on the charts.

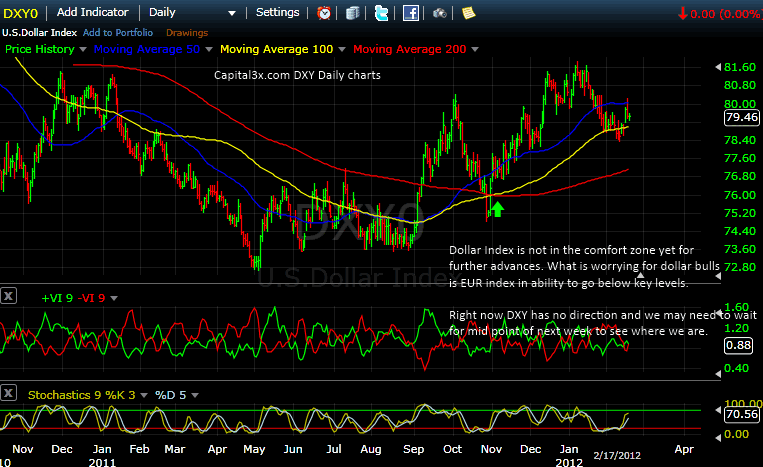

DXY DAILY

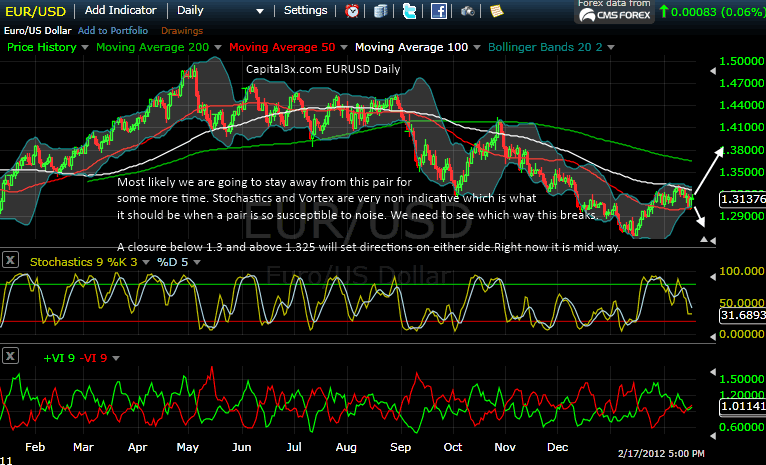

EUR/USD DAILY

We have shied away from this pair given its….

high reaction to news and rumors from EU quite surely would have wiped stops on both sides. EUR/USD stands in a ever so slight bullish zone threatening a move up but this could change very fast in Asia on Monday.

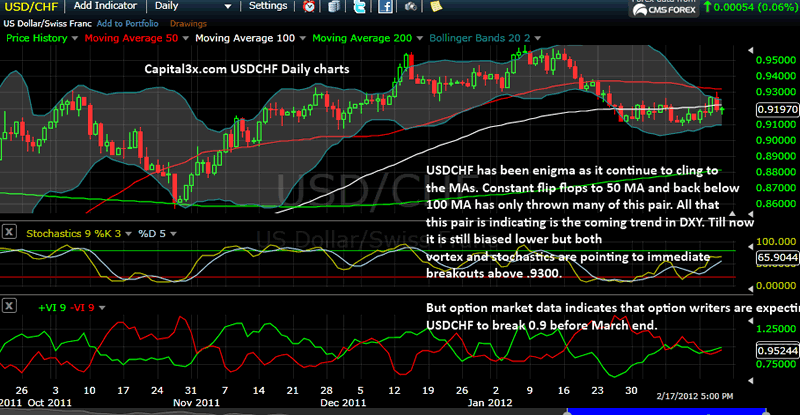

USD/CHF DAILY

USD/CHF reluctance to play ball with risk fx has not gone unnoticed. Even while technical are mildly

bullish, we expect this pair to hit those Fib levels at .9060.

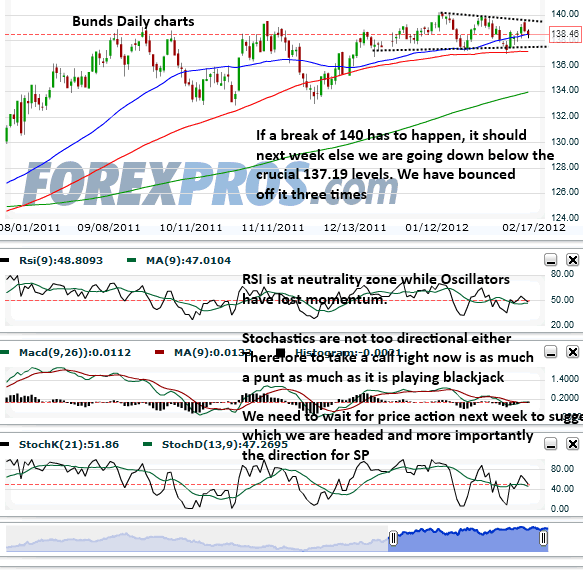

Bunds Daily

If yen was topping out and now has broken down as we discussed here, bunds too are….

showing strong tendency to fall quite dramatically in 2012. Question is whether it will happen now or after some kind of mild consolidation. The close below 139 is now targeting 137.2 for the fourth time since it bounced of it in January and early Feb. A break means flush of liquidity flowing into risk assets. We dont care whether they are overbought.

Please do make it a point to go through Yen charts and analysis. We were among the first to have seen through the yen weakness in early feb and has now caught over 550 pips in key yen pairs like EUR/JPY, AUD/JPY and CAD/JPY. The yen analysis has been updated with one of the charts provided below:

Japan’s central bank added 10 trillion yen ($128 billion) to an asset-purchase program and set an inflation goal after an economic slide fueled criticism it has been slower to act than counterparts.

An asset fund increased to 30 trillion yen, with a credit lending program staying at 35 trillion yen, the Bank of Japan said in Tokyo today. The BOJ also said that it will target 1 percent inflation “for the time being.”

A few technical charts and analysis on how price action stands.

YEN Index weekly

YEN Index Daily

A lot more on yen trades and analysis here

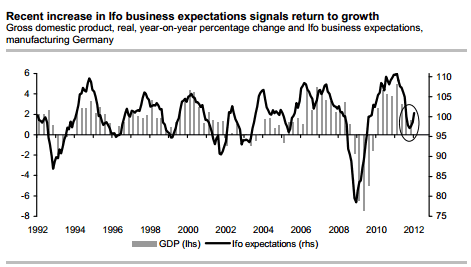

Macro News

Adjusted for price and seasonal effects, German GDP contracted in the fourth quarter of 2011 by 0.2% on the third quarter. The consensus and we were for a slightly steeper decline by 0.3%. The Federal Statistical Office will only release the demand components on 24 February, but it has signalled that the decline in the fourth quarter was attributable mainly to net exports and private consumption. The office revised the past data, raising growth in the third quarter from 0.5% to 0.6%. Together with the somewhat smaller than expected drop in the fourth quarter, this has improved the basis for our 2012 GDP forecast by 0.2 percentage points.

Source: Datastats

Following the EU summit on 21 July 2011, the uncertainty emanating from the sovereign debt crisis, measured by various market prices, surged massively. This weighed on the economy. Survey-based leading indicators plummeted – unlike in the US – and official order intake data of the German economy dropped in the second half of the year. The fact that GDP fell in the fourth quarter fits in this picture. Since then, the ECB’s threeyear tender has fundamentally changed the situation. Especially banks from the peripheral countries used this safe and cheap way of financing to buy bonds from their countries. Financing conditions for Italy and Spain have improved massively, and the uncertainty emanating from the sovereign debt crisis has declined noticeably. Most leading indicators have recovered. The Ifo business climate climbed three consecutive times and is thus signalling an end to the recession. This is also true for the Ifo expectations component (see chart). The German economy should see slight growth in the first quarter. The main risk to this forecast remains the unsolved sovereign debt crisis, as the ECB cannot finance the peripheral countries’ public spending by printing money in the long run.

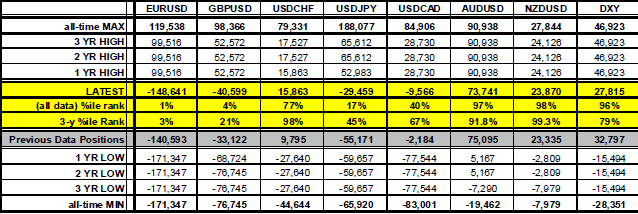

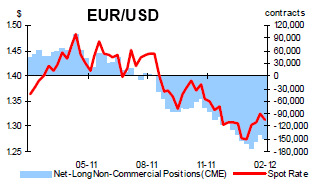

CFTC Analysis

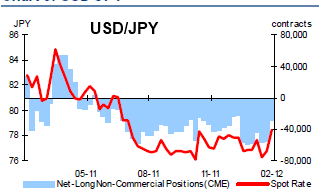

The latest CFTC data, for period ending Tuesday 14th February, shows that the non-commercial long USD position (against G10 currencies) rose by $6.3bn. This positioning shift was dominated by the surge in short USD-JPY covering, after the Bank of Japan loosened policy by extending asset purchases. The data suggests that speculators currently hold a long JPY position of 29.5k contracts and our analysis indicates that the current position (into Friday’s close) is likely to be around +15k contracts (long JPY). The other major contributor (towards this week’s USD purchases) was EUR-USD, where the fragile rally gave way to a

move lower.

• In USD-JPY, speculators have reduced their long JPY position after the Bank of Japan loosened monetary policy. The current position is now long JPY, at 29.5k contracts (correcting from the previously reported 55.2k contracts). With a large portion of this week’s USD-JPY rally occurring outside of the reporting period (1.5%) – we forecast that the current position in USD-JPY (into Friday’s close) is approximately long 15k JPY contracts. This suggests that this small long JPY position is likely to come under further pressure if USD-JPY pushed significantly through the October (BoJ intervention) high of Y79.53.

• In GBP-USD, the reported data indicate a net short position of 40.6k contracts (increasing from the previously reported 33.1k contracts). However, the dataset does not include price action post the Quarterly

Inflation Report, which triggered short covering. We forecast that the current short GBP position (into Friday’s close) is likely to be around only 30k contracts.

• In EUR-USD, speculators increased their long USD position by $1.1bn, to 148.6k contracts (from the previous 140.6k contracts). This increase in the long USD position highlights how fragile the EUR-USD rally is, as the currency pair now begins to stall into a trading range.

• In the remaining currency pairs (AUD-USD, NZD-USD, USD-CAD and USD-CHF) positioning changes were small. Positioning remains stretched in AUD-USD and NZD-USD (where speculators hold a short USD position).

We do not trade on these data points but just to keep an eye on these numbers, we attach them above.

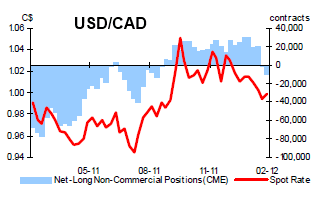

ECB deal

Finally we close this week analysis with a comment on the ECB deal. ECB decision to swap its Greece bonds for new ones which cannot take haircuts, may have more sideffects than previously imagined. The CDS on Greek debt may be triggered, as Greece is now free to retroactively insert collective action clauses regarding the bonds held by private investors.

“The European Central Bank’s plan to shield its Greek bond holdings from a restructuring may hurt private investors while paving the way for debt insurance contracts to be triggered.

The ECB will exchange its Greek debt for new bonds with an identical structure and nominal value, though they’ll be exempt from so-called collective action clauses the government is reportedly planning. That implies senior status for the ECB over other investors, according to UBS AG, and the use of CACs may lead to credit-default swaps protecting $3.2 billion of Greek bonds being tripped.

“It may appear that the ECB is receiving preferential treatment, raising questions about whether the ECB is senior to private-sector bondholders,” according to Chris Walker, a foreign exchange strategist at UBS, the world’s third-biggest currency trader. “If a coercive default does indeed eventually take place then a CDS event seems very likely with all the negative consequences for risk appetite that may bring.”

Government officials are separately negotiating a writedown of the nation’s debts with private investors before a 14.5 billion-euro ($19 billion) note comes due on March 20 that risks sending Greece into default. The yield on the nation’s benchmark 10-year bond jumped 28 basis points today to 33.67 percent as of 1:30 p.m. in London, its sixth straight day of increases.

Art Cashing, UBS, was a worried man as he believes the ECB decision to swap will test the CDS markets as they could be tripped in case of default.

“Now traders fear the issue will come back again with a vengeance. The [finance] ministers do not want to see a lot of CDS contracts triggered since they don’t know who owns them or, more importantly, who wrote them. That could become a domino-like contagion ala 2008.

But, traders fear a worse outcome might occur if the CDS contracts do not kick in. What good is insurance that doesn’t pay off. That could lead to the assumption that all CDS insurance was useless. That would stratify debt around the globe. Great credits could get all the money they wanted, but less than great credit would be shut out because it could not be insured. That could make the future one in which “the haves” will have whatever they want and all others nothing. Welcome back to the Middle Ages.”

But we argue that 3.2 bn euros is negligible problem in comparison to the overall debt of 320 bn euros. Even if the CDS is tripped there is a high possibility of the market to be able to withstand the initial shock and let the insurer pay up but we do add caution on secondary effects as CDS of other peripheral countries will go through the roof. Not even Germany will then be safe from the domino.

5 year CDS on Portugal, Italy, Greece and Spain – the recent move higher in CDS on Greece continue for now.

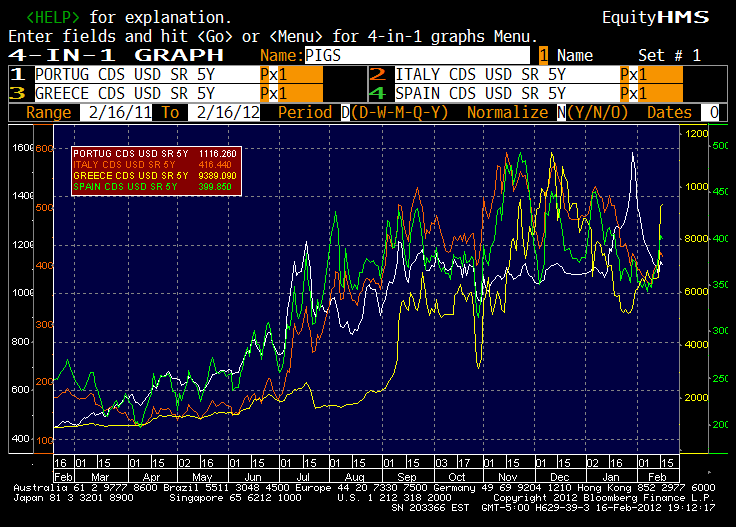

5 year CDS on France, Belgium, Ireland and Japan

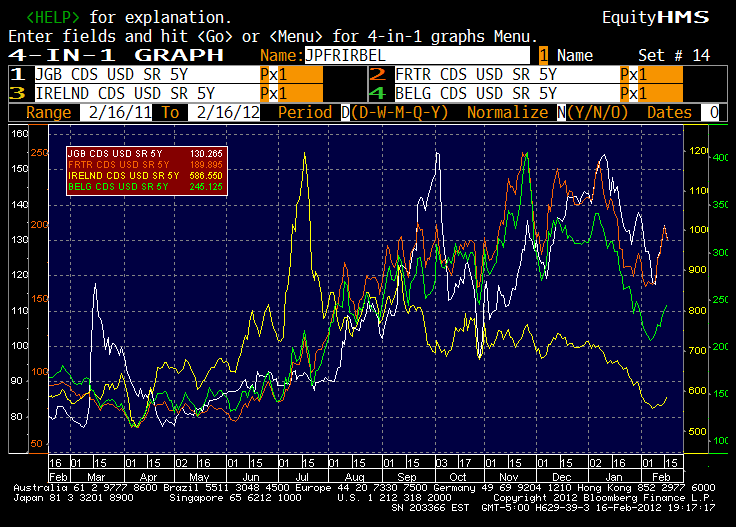

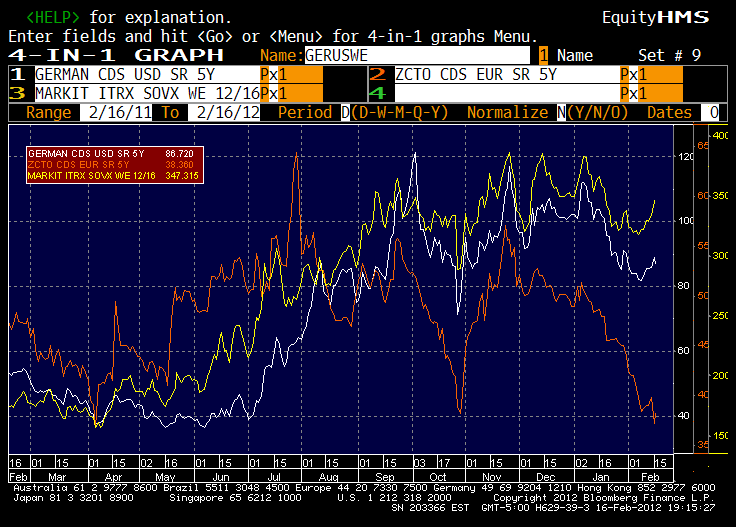

5 year CDS on Germany, the US and the Markit SovX index of CDS on 19 Western European sovereigns.

Thats it for now folks. More to follow later.

We continue to watch the price action and will update our premium subscribers with new analysis and charts. Our trade portfolio (Forex, SPX Emini, Crude, Gold, Silver) is visible to our premium subscribers

Our feeds: RSS feed

Our Twitter: Follow Us

Kate

Capital3x.com

Kate, trading experience with PIMCO, now manage capital3x.com. Check performance before you subscribe.

© 2012 Copyright Capital3X - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.