Currency Forecasts 2008 - Protracted Selling of the British Pound

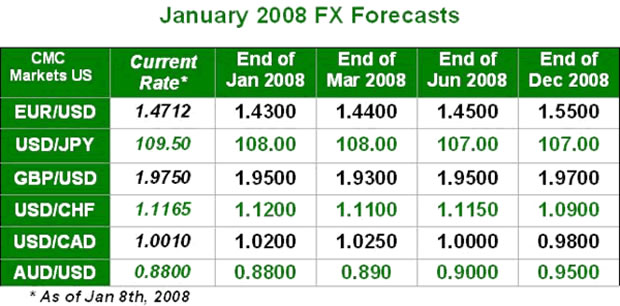

Currencies / US Dollar Jan 10, 2008 - 07:52 AM GMTBy: Ashraf_Laidi

A likely major FX theme of 2008 is already being playing out; Protracted selling in the British Pound, broad strength in the Australian dollar and continued rally in gold. We had described the British pound as the likely "dollar of 2008" and so far it hasn't disappointed. GBP drops to new all time lows against the euro, 8-month lows against the dollar, and 10-year lows against the Australian dollar. The latest catalyst to sterling's gloom is a decline in consumer confidence a 13-month low, decline in job placements to a 54-month low, and 2.2% decline in like for like Christmas sales from major retailer Marks & Spencer.

A likely major FX theme of 2008 is already being playing out; Protracted selling in the British Pound, broad strength in the Australian dollar and continued rally in gold. We had described the British pound as the likely "dollar of 2008" and so far it hasn't disappointed. GBP drops to new all time lows against the euro, 8-month lows against the dollar, and 10-year lows against the Australian dollar. The latest catalyst to sterling's gloom is a decline in consumer confidence a 13-month low, decline in job placements to a 54-month low, and 2.2% decline in like for like Christmas sales from major retailer Marks & Spencer.

The latest flurry of negative news is raising pressure on the Bank of England from the media and industrial interests to cut interest rates tomorrow. The embattled central bank has already been forced into a unanimous decision to cut rates in December, one month earlier than it predicted at the November inflation report. We continue to expect the BoE to cut by 100 bps in 2008, taking down rates to 4.50%. From a currency standpoint, the rate action will be several punishing for a currency, which has attracted large flows of asset allocation funds and central banks funds seeking to capture the currency's high yield (highest in G7). But sterling's high yield is also its biggest adversary as it implies considerable downside potential than any other major central bank.

Today's dismal retail sales data lead us to increase chances of a quarter-point cut tomorrow to 60% from yesterday's 20%. Pressure had already mounted on the central bank for not anticipating the Black Rock fallout and its slow handling of the liquidity crisis. A 2.2% decline the Kingdom's most iconic store (and biggest clothing stores) in a holiday shopping season will be hard ignore by the central bank, as it protends similar erosion in other retailers.

GBPUSD breaks below the June 2007 low of 1.9620, eyeing 1.9560 and sets up for further declines towards 1.95.Upside recovery seen limited at 1.9660 ahead of the BoE decision.

Aussie Rebounds to 88.50 cents

After a brief interruption triggered by the sharp sell-off in Wall Street, Aussie soared right back from 87.77 cents to 88.58 cents on a 0.8% increase in October retail sales, beating expectations of a 0.5% rise . The report fuelled speculation that the RBA will raise rates next month to a fresh 11-year of 7.00% from the current 6.75% and further boost the high yielding high growth currency. Q3 GDP growth jumped 4.3%, the highest in 3 years. Yesterday's retreat from 88.30 to 87.70 following the Wall Street sell-off reflects the currency's vulnerability to periodic bouts of risk appetite reduction, but these are also considered as entry opportunities in the currency. Resistance stands above the 50 day MA at 88.70, followed by 88.90. Support starts at 88.20, followed by 87.90.

AUDGBP faces interim resistance at 45.20, which can set up ground for 45.55 and 45.90 in the medium term.

EUR Eyes $1.4640

Euro breaks below the $1.46 figure after German industrial output fell 0.9% in November from October's revised 0.1% increase, undershooting expectations of a 0.5% increase. The sluggish data have been partly attributed to the rising euro. The much anticipated decline below the 1.47 figure clears the path for 1.4670, followed by the 50-day MA of 1.4630, which is also the 38% retracement of the move from the 1.4315 low to the 1.4824 high. We expect the upside to remain limited at 1.4730 due to the lack of potentially euro boosting data from the US.

Considering the retreat in the euro and ascendance of risk reduction trades, we anticipate EURJPY downside to emerge at 160.20, followed by 159.90.

Yen Takes over Amid Surging Volatility

The yen's comeback in late Tuesday US trade was tempered in Asian Wednesday trade as regional equities did not repeat the 1.5%-2.0% declines in US equities. US stocks are increasingly proving that the general trend will continue to be lower and any intermittent gains are a result of 1) capital purchases from sovereign wealth funds; 2) indications of prolonged and aggressive Fed cuts. Not only is this a sign of a structural bear market but is also medium term positive for the Japanese currency.

USDJPY faces interim support at 109.10, followed by 108.60. Upside remains corrective at 109.60, followed by 109.90.

By Ashraf Laidi

CMC Markets NA

Ashraf Laidi is the Chief FX Analyst at CMC Markets NA. This publication is intended to be used for information purposes only and does not constitute investment advice. CMC Markets (US) LLC is registered as a Futures Commission Merchant with the Commodity Futures Trading Commission and is a member of the National Futures Association.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.