Will Gold be Paulson's Next "Greatest Trade Ever"?

Commodities / Gold and Silver 2012 Feb 24, 2012 - 05:41 AM GMTBy: Money_Morning

Peter Krauth writes

And it's no wonder.

Peter Krauth writes

And it's no wonder.

Paulson made his way into the financial history books thanks to what many now call the "greatest trade ever".

Paulson & Co. shorted the subprime mortgage market before the collapse banking a $15 billion gain.

So when Paulson went big again by buying gold in 2009 and 2010, investors took notice.

At the time he said, "As an investor, I became very concerned about having my assets denominated in U.S. dollars," Paulson told his audience. "So I looked for another currency in which to denominate my assets in. I feel that gold is the best currency."

In fact, Paulson's holdings in the SPDR Gold Trust (NYSE: GLD) make his firm the biggest stakeholder in this ETF, with a position currently valued at $2.9 billion.

So that begs the question....

Is Paulson still a gold bull?

In a recent letter to investors he wrote, "By the time inflation becomes evident, gold will probably have moved, which implies that now is the time to build a position in gold."

And he's not alone.

Recent filings showed that another legendary hedge-fund investor, George Soros, has nearly doubled his stake in GLD to 85,450 shares.

But "Bond King" Bill Gross's latest words and actions may well be the most significant of all.

In his February newsletter, Gross mused "Recent central bank behavior, including that of the U.S. Fed,... may as well induce inflationary distortions that give a rise to commodities and gold as store of value alternatives when there is little value left in paper."

So not only do some of the largest and most successful fund managers all agree on gold, but now even central banks and entire nations are figuring this one out.

Last year global demand for gold hit the highest level since 1997 - 4,067.1 tonnes.

Most of the gains are thanks to a 5% increase in investment demand which largely originates in Asia.

What's especially eye-catching is the stepped-up buying by central banks.

Last year, they bought 439.7 tonnes, which is six times the level in 2010, and the most since the gold standard ended in 1971.

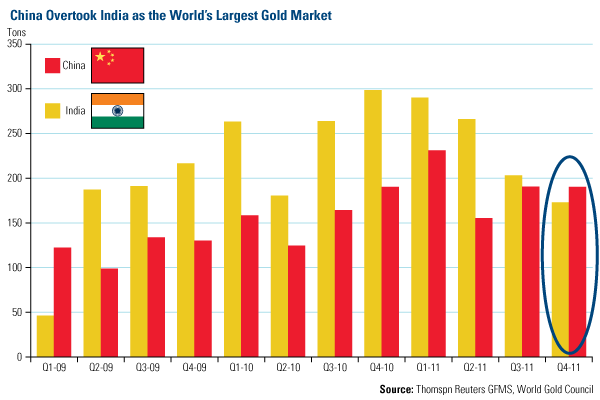

According to the World Gold Council (WGC), China became the largest gold market in Q4/2011, overtaking India's top seed, and soaking up 770 tons for the year.

(CHART SOURCED FROM U.S. GLOBAL INVESTORS)

Overall for 2011 however, India remained the leader, consuming a total 933 tons.

But China's appetite for gold seems insatiable. Hong Kong imports were 10 times their average levels from January through November.

And the World Gold Council expects China's jewelry and investment demand to continue at a frenetic 20% growth pace this year.

Seeking Shelter in Gold

None of this should come as much of a surprise.

China in particular, holds a $1.1 trillion hot potato in U.S. debt. But China's U.S. debt holdings have declined by $73 billion since July. Russia's holdings have also seen a significant decrease to $88 billion from $127 billion last March.

Increasingly, emerging market central banks have been the most aggressive buyers of gold.

According to the WGC central banks are wary of the reserves they hold, most of which are denominated in fiat dollars and euros. Ongoing sovereign bond downgrades and low yields have helped push developing nation central bankers to seek shelter in gold.

Large holders of quickly depreciating western debt are becoming apprehensive. They're looking for alternatives that will retain and grow their value.

There are ever more attempts by eastern creditors at buying up hard assets.

So I expect stepped-up efforts by developing nations' central banks to acquire and hoard gold. I also expect Asian companies and sovereign wealth funds to buy significant stakes in hard assets like energy, base metals, and especially gold producers.

As the demand for gold continues to climb, its scarcity will become a major factor. Those who want exposure to gold will look progressively toward gold stocks.

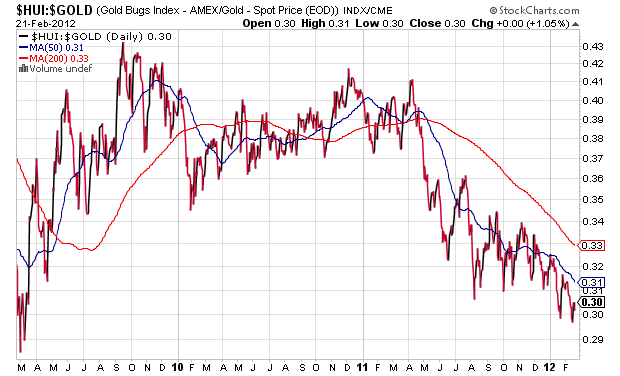

Right now, gold equities are trading at levels near the lows of early 2009 relative to the gold price.

At current prices, gold stocks are historically very cheap, and certainly worthy of consideration by all investors who think they are under-allocated in this sector.

That being said, the ultimate safe haven is physical gold itself. In fact, over time, today's price of $1,750/oz. is going to be looked upon as a bargain.

Here's why...

Even when gold prices do drop significantly, savvy investors refuse to relinquish their holdings.

Today, the allure of gold is not only gaining momentum- but it's maintaining its current rise.

The way I see it, now's your chance to grab your piece of the next "Greatest Trade Ever."

[Editor's Note: In today's Private Briefing, Peter Krauth explains why the current surge in gold prices has caught Wall Street flatfooted.

Indeed, Peter thinks that investors who ignore these Wall Street "pros" can make three to five times their money on the "right" gold investments.

He even details two investments to consider. To find out more, just click here.]

Source http://moneymorning.com/2012/02/24/will-gold-be-paulsons-next-greatest-trade-ever/

Money Morning/The Money Map Report

©2012 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.