Silver Price Could Challenge $50

Commodities / Gold and Silver 2012 Feb 24, 2012 - 08:17 AM GMTBy: Hubert_Moolman

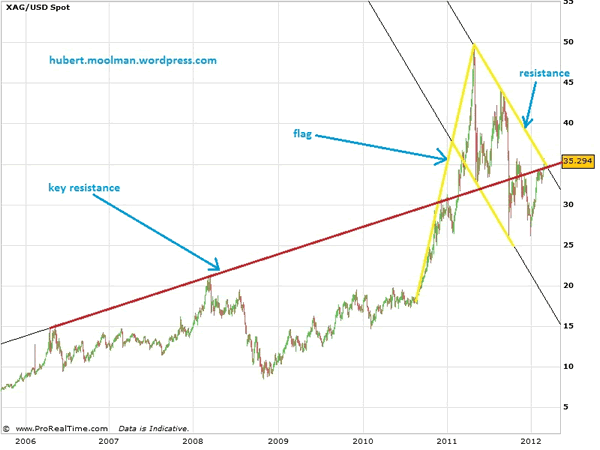

Silver is currently trading at key resistance levels. See below, a six-year silver chart (all charts generated at fxstreet.com):

Silver is currently trading at key resistance levels. See below, a six-year silver chart (all charts generated at fxstreet.com):

On the chart, I have drawn a significant upward sloping resistance line (red line). Silver has now reached that line, trying to breach it and stay above it. It has also reached the top resistance line of a big flag pattern. If the silver price gets through these resistance lines, and stays above them, then it is likely to continue its rise, but likely in a more accelerated manner.

These resistance areas can be very tricky. Price can often react in a violent manner downwards; however, there are no certainties.

What silver will do at these resistance areas is a short-term problem. From a longer point of view, it is clear to me that silver is going much higher. Eventually, it will successfully break out of the big flag and spike upwards past the $50 level.

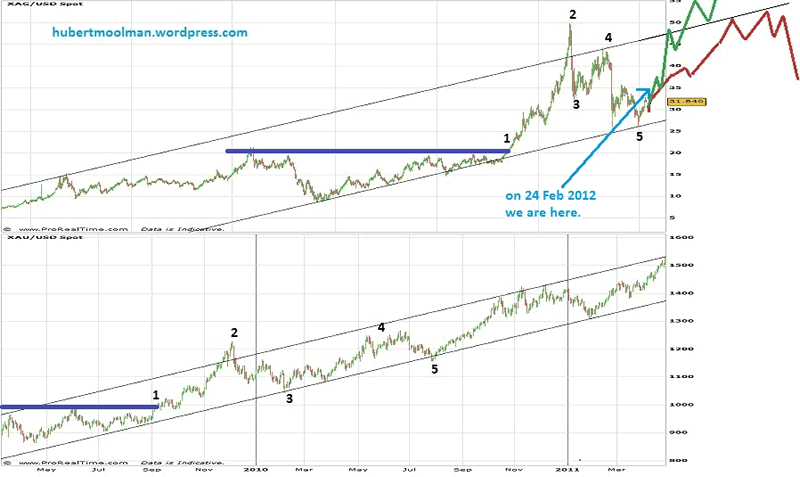

In a previous article, I have shown how closely silver is following a past pattern on the gold chart. That comparison also suggests that the silver price will eventually successfully breach the resistance lines indicated above. Below, is the chart from that comparison:

On the charts (silver is the top one and gold is the bottom one), I have marked the two patterns (1 to 5) that are similar on the gold and silver chart. For more details and explanation of the two patterns, please read that full article. If the silver pattern continues to follow the gold pattern, then the silver price would pass the resistance lines indicated in the first chart, and eventually challenge the $50 level.

"And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved"

For more detailed analysis of gold, silver and the Dow, you are welcome to subscribe to my free or premium service.

Warm regards and God bless,

Hubert

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2012 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.