Metals and Mining Paradigm Shift, Exiting Easy And Cheap

Commodities / Metals & Mining Feb 25, 2012 - 03:24 AM GMTBy: Richard_Mills

The massive growth of global prosperity over the last five centuries has been driven by easy and cheap access to critical materials:

The massive growth of global prosperity over the last five centuries has been driven by easy and cheap access to critical materials:

- Food

- Fibre

- Energy

- Minerals

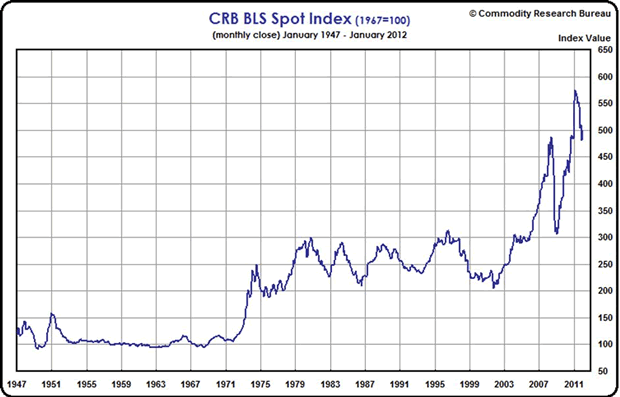

However since October 2001 the CRB BLS Spot Index has reached record levels.

The Spot Market Price Index is a measure of price movements of 22 basic commodities. The spot price is the price at which a commodity is selling for immediate delivery.

Commodity price rises could be caused by:

- Raw materials shortages

- Resource nationalism

- Emerging market demand

- Speculation

- Intense weather pattern changes

- War

- Inflation

- Hoarding

- Low interest rates

Many people might assume that out of all the reasons given these three would be the main drivers:

- War

- Inflation

- Emerging market demand

Inflation & War

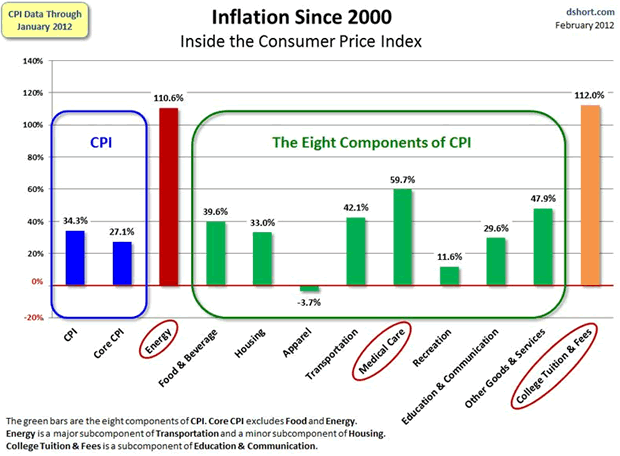

Because central banks can increase the supply of money virtually at will, and do so, the value of all existing money decreases. The amount of goods and services remains the same, but now the amount of money chasing them has increased, this increased competition - more money (inflation) for the same amount of goods and services - causes prices to rise.

Doug Short, advisorperspectives.com

Governments and Central Banks want slowly rising prices. They pour money into the market to encourage growth so prices increase rather than decrease. Price decreases, or deflation (less money growth), slows economic activity - if people think prices are going to be lower next week they will not buy today, they will wait, this leads to a contraction in economic activity, something all governments fear.

Low interest rates play their part as well. When governments lower interest rates to stimulate borrowing businesses expand and consumers borrow to buy homes, cars and other goods. Demand for goods and services increase and so to do prices of commodities used in manufacturing.

Nations in Europe, and the U.S. will inflate (print more of) their currencies rather than cutting back spending or raising taxes. In a global race to worthless Asian economies will also have to print massive amounts of their currencies so they stay weaker then the US dollar. Asian exports have to be cheap for American consumers and American exports have to be more expensive then locally produced goods.

The buildup to war, and the actual running of a war is expensive. Governments will typically devalue their currencies by printing the money needed - very few people would ever consent to go to war if they were made to pay for it out of their pockets. How many Americans would consent to the trillions of dollars necessary for America's endless wars and vast military complex if the money required came directly off their paycheques? Government control over the money supply makes the business of war easy to finance because the financial support of its citizens is not needed.

Actual war does not seem to be one of the main causes of the decade long commodities price increase, rather it's the creation of the money necessary to go to war - government created inflation. In regards to recent wars, we haven't had a global conflict, and the resultant massive global destruction and rebuilding, since World War II. Wars today are localized affairs and do not bring about the massive use of commodities for rebuilding as a global conflict would.

Throughout history periods of rising money supply growth has coincided with rising commodity prices, and falling money supply growth coincided with periods of falling commodity prices.

A key driver of higher commodity prices, global government sponsored inflation (and quite likely continuing war inflation) are locked in place for years to come.

Developing Country Demand

China's plus nine percent annual growth, and other developing nations growth (averaging much less), are usually named as the biggest cause of price rises in the commodities markets. China has been growing at plus nine percent annually for well over two decades. Compounded that's a lot of growth, add in other developing countries growth then realize a considerable period of this growth was spent in the commodity bear market. The growth story is suddenly an overnight sensation, inflations effects start to percolate, wars are started and speculators play.

A mismatch between demand and supply is not a new problem in commodity markets. It can and does take years to find and develop new resources and bring the commodities to market. If war and emerging country demand cause prices to rise - shortage caused price spikes - an increase in production (after a war or ramping up for developing country demand) would satisfy increased demand. But it hasn't happened yet and it's been over a decade since commodity prices have gone on their spectacular run.

So far inflation would seem to be the driver for commodity price increases, everything else seems temporary or if permanent, such as developing country demand, fixed with an increase in production.

But

There is a major paradigm shift taking place in the mining industry and it concerns the supply, not the demand side we hear so much about.

Supply

Supply shortages always lead to high enough metal prices for further increases in production, thus supply will eventually exceed demand and prices will drop...right? Well maybe, maybe not. Margins (not price) motivates investment and if the cost of metal production is increasing margins might not be sustainable.

Lets state the obvious:

- For over the last ten years supply has struggled to keep pace with demand

- Metal supply is finite and subject to compounding demand from developing nations

- Metal production is highly cyclical, with intermittent peaks and troughs which are closely linked to economic cycles - declining production has historically been driven by falling demand and prices, not by scarcity

- Rates of production and amounts of reserves continually change in response to movements in markets and technological advances

- Most mineral resources will not be exhausted in the near future

- If energy was cheap and unlimited then recoverable resources would be unlimited

But

- Discovery and development is increasingly becoming more challenging and expensive

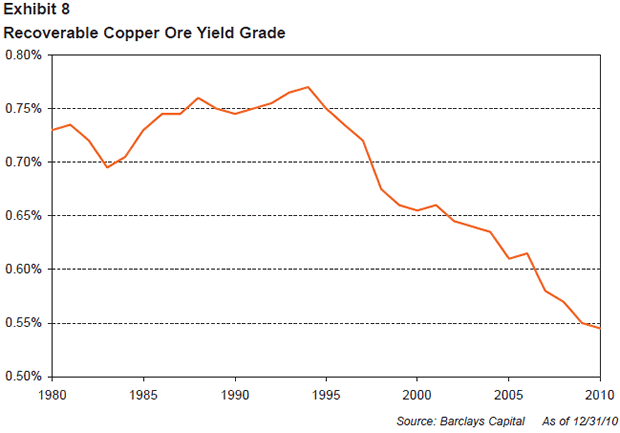

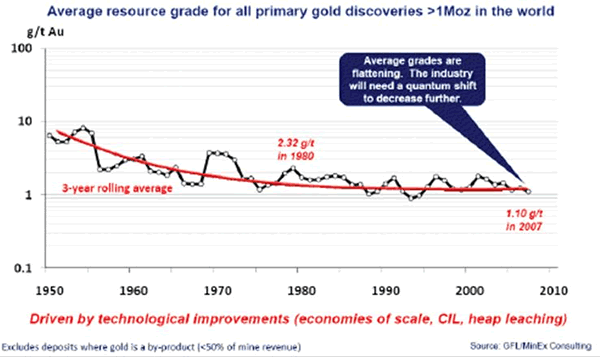

- Average ore grades are in decline for most minerals, yet production has increased dramatically

- Our most important metals are suffering from declining ore quality and rising extraction (ore is a different and inferior chemical or structural composition) costs

- Our prosperity has always been based on the fact that producing resources yielded more resources than it cost. However the cost of *energy is climbing, the amount used is climbing but the returns from energy expended is declining. Eventually the quantity of resources used in the extraction process will be 100% of what is produced

- Most older existing mines, the foundation of our supply, have increasing costs with production rates stagnating or even declining

- The rate of discovery is not keeping pace with the rate of depletion, let alone being higher

*Energy can be thought of as a proxy for labor, materials, energy and externalities - environmental, community impact etc.

Copper and Gold as Proxies

The metal content of copper ore has been falling since the mid 1990s. A miner now has to dig up an extra 50 percent of ore to get the same amount of copper. As grade drops the amount of rock that must be moved and processed per tonne of produced copper rises dramatically - all the while using more energy that costs several times more than it use to. With the lower grades of ores now being mined energy becomes more and more of a factor when considering economics.

Conclusion

Complicated more expensive extraction of metals from increasingly harder to find, lower grade ore bodies in almost inaccessible and hostile parts of the world is going to affect our lifestyles.

What changes are we going to have to make as nature - the finite supply of materials and energy constraints - dictates lifestyles and aspirations?

"We took the nice, simple, easy stuff first from Australia, we took it from the U.S., we went to South America. Now we have to go to the more remote places." Glencore CEO, Ivan Glasenberg in the Financial Times describing why his firm operates in the Congo and Zambia

We are experiencing a paradigm shift. If nothing else, right now at this point in history, we all have to realize that the mining industry is exiting "easy & cheap" and is starting the upward slope of chronic lower supply, permanently higher prices and higher risk.

We all have to agree that the planet's booming population and rising standards of living are going to put unprecedented demands on supply.

This should be on everyone's radar screen. Is it on yours?

If not, maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about specific lithium juniors and the junior resource market in general please come and visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Copyright © 2012 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.