Citigroup Forecasts Gold $2,400 in 2012 and $3,400 "In Coming Years"

Commodities / Gold and Silver 2012 Mar 05, 2012 - 01:29 PM GMTBy: GoldCore

Gold’s London AM fix this morning was USD 1,698.00, EUR 1,286.17, and GBP 1,073.60 per ounce.

Gold’s London AM fix this morning was USD 1,698.00, EUR 1,286.17, and GBP 1,073.60 per ounce.

Friday's AM fix was USD 1,714.50, EUR 1,292.99, and GBP 1,076.14 per ounce.

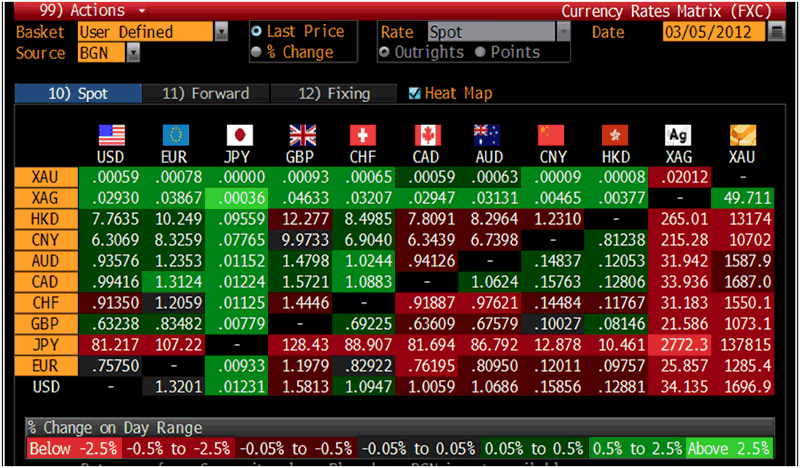

Cross Currency Table – (Bloomberg)

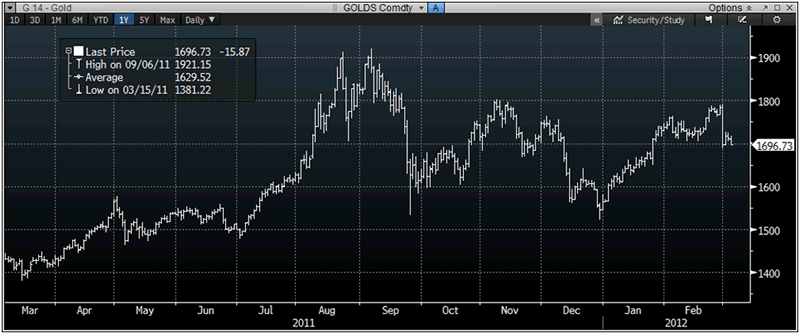

Gold fell $3.10 in New York Friday and closed at $1,711.60/oz. Gold fell in Asia prior to modest price falls in Europe which has gold now trading at $1,696.43/oz.

Gold fell by nearly 3.5% last week - the largest one week fall since the week of Dec 18. Gold's intraday and monthly low from the "Leap Year Gold Massacre" is $1,688/oz. Technical damage continues and a breach of this level could see gold quickly fall to support at $1,650/oz.

Gold 1 Year Chart – (Bloomberg)

Gold is being supported by Asian physical demand, which has picked up again and was robust in Asia overnight. Asian jewellery makers are reported to have been using this dip to stock up on gold.

Besides Asian jewellers, many Asian money managers and hedge funds continue to see the value in the yellow metal and buy on price weakness.

Gold is also supported by good retail and institutional demand internationally as seen in the new record ETF gold holdings last week. CFTC data shows that hedge funds, bullion banks and other institutions also remain positive on gold and increased their net long positions last week - rising by 12,259 contracts or 7% from a week earlier.

The EU’s second 3 year funding and a surprise policy easing by the Bank of Japan a few weeks ago has pressured the euro and the yen making gold increasingly attractive to holders of these currencies. Economists believe that the ECB will keep interest rates low at 1% until deep into 2013 on economic concerns and despite high oil prices and the impact of the money that they’ve flooded into the market.

Continuing negative real interest rates and global currency debasement are strong fundamentals leading most analysts to forecast much higher prices.

Citigroup have said that they believe that gold will rise to $2,400/oz in 2012 and by $3,400/oz in “the coming years”.

However, Citi’s Tom Fitzpatrick warned of price weakness in the short term and said there is a “real danger” that there may be a correction to $1,600/oz which would provide an even better buying opportunity.

Citi are also cautious near term on oil and silver.

Production of gold in Australia slid again last year, despite gold fetching higher nominal prices than ever before.

According to gold experts, Surbiton Associates, 264 tonnes of gold were produced last year, two tonnes less than in 2010.

The 264 tonnes equated to about 8.5 million ounces and ensures that Australia remains a major player in gold, with only China producing more last year. The United States was the world's third-biggest producer with 240 tonnes.

Australia's gold production was well below the nation's production peak in the late 1990s.

This further suggests the possibility of peak gold production. Of the world’s four biggest gold producers (China, Australia, the U.S. and South Africa), only China has managed to increase gold production in recent years and this Chinese gold is used in China to meet the rapidly growing demand for gold jewellery and coins and bars as stores of value in China.

Thus Chinese gold is not exported into the international market which means that the supply/demand balance in gold is remains tight and the last Wednesday's manipulated sell off provides yet another buying opportunity.

OTHER NEWS

(Reuters Global Gold Forum) -- Morgan Stanley this morning say stay long gold, even after Bernanke's comments last week were interpreted as signalling less chance of QE3. However, we believe that the move last week was profit taking predicated by the news rather than a change in fundamentals.

The drivers of the long-term uptrend in gold remain intact, most notably negative real rates," MS say.

According to their "Commodity Thermometer", MS are most bullish on gold and most bearish on zinc, although of the 20 commodities listed, platinum is in 17th place.

Morgan Stanley say: "We are less bullish on the Platinum Group Metals. Platinum lacks safe haven status and has limited investment demand. With jewelry and the automotive industry as key end markets, slowing global GDP and lower discretionary spending put demand at risk."

(Bloomberg) -- RBS Says Central Banks Will Buy 300 Tons of Gold This Year

Central banks will buy 300 metric tons of gold this year, Royal Bank of Scotland Plc said.

China, Russia and India have been the biggest buyers and Switzerland, France and the Netherlands the biggest sellers since the first European central bank gold agreement to limit sales, according to the RBS report e-mailed today.

(Bloomberg) -- Morgan Stanley Says ‘Stay Long Gold’ on Negative Real Rates

Gold will climb mostly because real interest rates are still negative, Morgan Stanley said. There is still a 75 percent chance of another round of quantitative easing in the U.S., Hussein Allidina, an analyst at Morgan Stanley, said in an e-mailed report today.

(Bloomberg) -- China’s January Gold Imports From Hong Kong 33,039 Kilograms

Hong Kong government announced January gold exports which showed China’s January gold imports from Hong Kong were 33,039 kilograms

(Bloomberg) -- Gold Traders Increase Bets on Price Rise, CFTC Data Shows

Hedge-fund managers and other large speculators increased their net-long position in New York gold futures in the week ended Feb. 28, according to U.S. Commodity Futures Trading Commission data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 193,220 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions rose by 12,259 contracts, or 7 percent, from a week earlier.

Gold futures fell this week, dropping 3.7 percent to $1,709.80 a troy ounce at today's close. Miners, producers, jewelers and other commercial users were net-short 245,351 contracts, an increase of 16,049 contracts, or 7 percent, from the previous week.

Each Friday the CFTC publishes aggregate numbers for long and short positions for speculators such as hedge funds and institutional investors, as well as commercial companies that buy or sell futures to protect against price moves. Analysts and investors follow changes in speculators' positions because such transactions can reflect an expectation of a change in prices.

(Bloomberg) -- Silver Traders Increase Bets on Price Rise, CFTC Data Shows

Hedge-fund managers and other large speculators increased their net-long position in New York silver futures in the week ended Feb. 28, according to U.S. Commodity Futures Trading Commission data.

Speculative long positions, or bets prices will rise, outnumbered short positions by 30,003 contracts on the Comex division of the New York Mercantile Exchange, the Washington-based commission said in its Commitments of Traders report. Net-long positions rose by 3,338 contracts, or 13 percent, from a week earlier.

Silver futures fell this week, dropping 2.5 percent to $34.53 a troy ounce at today's close. Miners, producers, jewelers and other commercial users were net-short 44,593 contracts, an increase of 5,405 contracts, or 14 percent, from the previous week.

Each Friday the CFTC publishes aggregate numbers for long and short positions for speculators such as hedge funds and institutional investors, as well as commercial companies that buy or sell futures to protect against price moves. Analysts and investors follow changes in speculators' positions because such transactions can reflect an expectation of a change in prices.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

SILVER

Silver is trading at $34.22/oz, €25.95/oz and £21.62/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,663.50/oz, palladium at $698.00/oz and rhodium at $1,475/oz

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.