Financial Markets Waiting on European 'Surprise'

Stock-Markets / Financial Markets 2012 Mar 06, 2012 - 03:24 AM GMTBy: Paul_Lamont

Last month, we compared the investment herd to the buffalo that were stampeded over the cliffs of the Great Plains by Native American hunters.

Last month, we compared the investment herd to the buffalo that were stampeded over the cliffs of the Great Plains by Native American hunters.

Buffalo don't meander over cliffs. Neither does the stock market. The stampede is on and investors won't see that the ground has given way until it's too late.

Greece

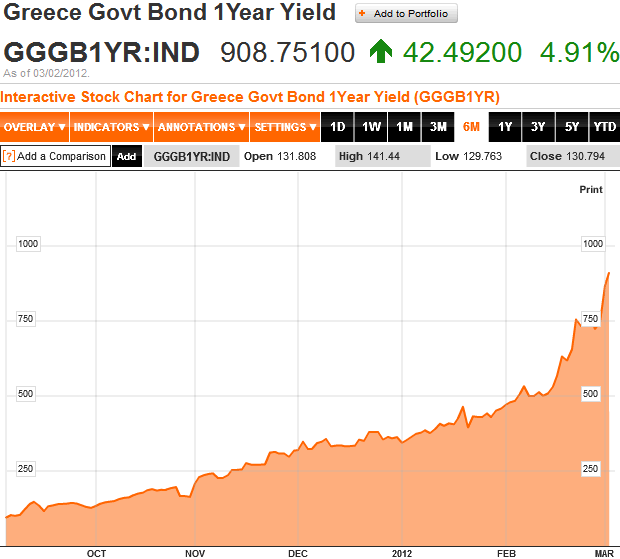

Every time we hear that Greece has been bailed out and that it has 'bought more time', we just pull up a chart of the 1 year Greek Bond (chart below).

As you can see, the yield of the 1 year Greek Bond is greater than 900%. So despite the hope and hype surrounding the Greek debt situation, the market is telling us that the crisis has continued to worsen (and at a quicker pace!).

In order to get its €130bn international bail-out package agreed to in February, Greece was forced to give the European Central Bank preferential treatment bonds at the expense of private bondholders. Ninety-five percent of these private bondholders must volunteer to take a 70% loss on their bonds by March 12th; otherwise Greece will face an imminent default according to S&P. More likely, if the hedge funds that hold the Greek bonds refuse, credit default swaps would be triggered (insurance bets that brought down AIG). Greece has also already been downgraded by S&P to 'selective default' on February 27th and to 'default' by Moody's on March 2nd. Perhaps, the authorities will get it right over the next few days. But they can't make people keep their money in the weak European banks.

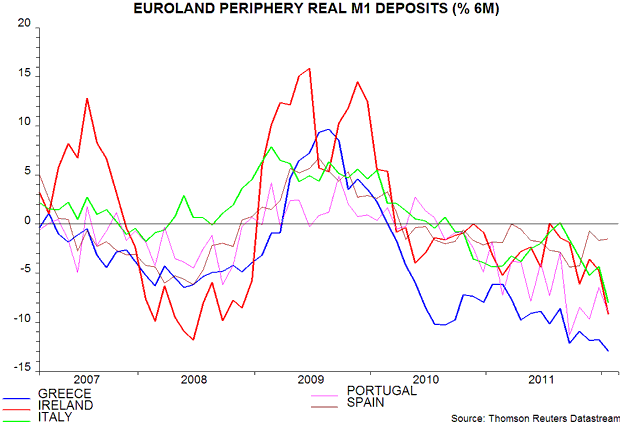

In January's How European Failures Affect U.S. Investors, we stated that we expect credit downgrades to "deliver the coup de grace" on the "weak and leveraged banks of Europe." This would "spark the contagion." The European banks will have to hurry and fail if they are going to get ahead of the country of Greece. Fortunately, their depositors (especially in Ireland and Italy) have increased the speed at which they are pulling out their bank deposits (chart below). Perhaps, they might just make it.

By Paul Lamont

www.LTAdvisors.net

At Lamont Trading Advisors, we provide wealth preservation strategies for our clients. For more information, contact us . Our monthly Investment Analysis Report requires a subscription fee of $40 a month. Current subscribers are allowed to freely distribute this report with proper attribution.

***No graph, chart, formula or other device offered can in and of itself be used to make trading decisions. This newsletter should not be construed as personal investment advice. It is for informational purposes only.

Copyright © 2012 Lamont Trading Advisors, Inc. Paul J. Lamont is President of Lamont Trading Advisors, Inc., a registered investment advisor in the State of Alabama . Persons in states outside of Alabama should be aware that we are relying on de minimis contact rules within their respective home state. For more information about our firm, or to receive a copy of our disclosure form ADV, please email us at advrequest@ltadvisors.net, or call (256) 850-4161.

Paul Lamont Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.