What Commodity Bubble? Gold, Silver, Rare Earth and Uranium Miners Rebound

Commodities / Metals & Mining Mar 13, 2012 - 04:36 AM GMTBy: Jeb_Handwerger

Far be it for Gold Stock Trades to indulge in hubris, nevertheless with all humility we not only saw this risk on rally forming in early October but reiterated on many occasions "be not dismayed by recent declines." "Commodities are not in a bubble." "Patience and Fortitude."

Recent action exemplifies the importance of not being trigger happy when it involves the commodity arena especially precious metals, uranium and rare earths. Volatility can daunt even the most resolute of investors.

Gold Stock Trades is once again vindicated in sticking with the ebbs and flows of the resource arena which often contrive to misdirect, confuse and obfuscate the impatient investor. The eventual payouts are worth the swings as we look forward to halcyon profits.

What does this all mean for our patient subscribers? When many respected gray beards were calling the end of what they thought was a bubble in precious metals (GDX), uranium (URA) and rare earths (REMX), our obvious conclusion was that even experienced so called experts were calling it wrong. There are morals to be drawn here.

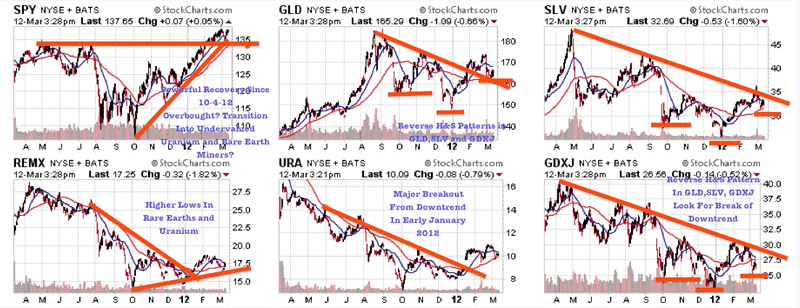

Adhere to the long term cyclical upswing in natural resources specifically in gold (GLD), silver (SLV), copper (JJC), uranium and rare earths. Breakouts occurring in 2012 are filling gaps to the upside which were created in 2011.

Do not be dismayed of major corrections in the long range move upward of our chosen sectors. Downside gaps are in the process of being filled and are bullish moves. Do not be turned off by whipsaws often engineered by the speculators.

We are in the time interval of the first quarter, which is often a period of favorable seasonality. Hopefully, may this force be with us. There is a turbulent atmosphere pervading the world, wherein hard assets may be regarded as appropriate safe havens as banks are buying treasuries at a record pace.

Observe the convolutions of the Eurozone nations as they attempt to upright the various ships of state. On the other hand we have just seen where Caterpillar is backlogged in its orders of mining machinery. In fact, Caterpillar in their quarterly report has stated that the demand for their machines represent a bullish and growing activity in commodity production. Note the concurrent breakout in rare earths and uranium despite any diversion caused by the European travails.

In conclusion, 2012 breakouts in gold, silver, rare earths and uranium is a welcome confirmation to our analysis and bullish for precious metals. General equities have hit some resistance after making a powerful move since our October 4th buy signal.

We are witnessing a rotation from treasuries into equities and the precious metals and natural resources arena as investors are realizing that the outcome of Europe's 1 trillion dollar LTRO program may be hyper-inflationary. The S&P 500 is hitting resistance after a powerful upmove and we may see a rotation into undervalued commodities such as uranium and rare earths. The uranium miners have been rallying as Rio Tinto entered the Athabasca Basin. The heavy rare earth miners are starting their breakout moves as well as Molycorp (MCP) announces the $1.3 billion dollar acquisition of Neo Materials.

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

© 2012 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.