A Nations Metallurgical Achilles Heel, Critical Materials Should be on Investors Radar

Politics / Metals & Mining Mar 16, 2012 - 01:12 PM GMTBy: Richard_Mills

The following have all combined to limit control of foreign minerals by US companies:

The following have all combined to limit control of foreign minerals by US companies:

- In 2011, Resource nationalism became the number one risk for mining companies

- Nationalization

- Expropriation

- Increased taxation

- Constraints on the degree of foreign ownership

- A trend in the less developed countries toward processing their own ores

- Increased completion from large eastern based mega mining companies

- Increasing competition from sovereign wealth funds and end users wishing to vertically integrate

Several major and uncontrollable factors have led to a decline in mining and in the US mineral processing industry:

- Sharply higher energy costs

- Most of the world's mineral wealth is not located in the US

- Foreign ore deposits are usually richer than those found in the US

- Foreign mines are usually located close to cheap energy sources and low-cost labor

Plenty Of Blame For The US:

- Restrictive environmental regulations have made mining and processing more difficult and costly, lead times for new mine development has increased - the nonfuel minerals industry is impeded by 80 different laws administered by 20 different agencies

- Approximately three-fourths of the 750 million acres of public land has been closed to exploitation, and closure continues

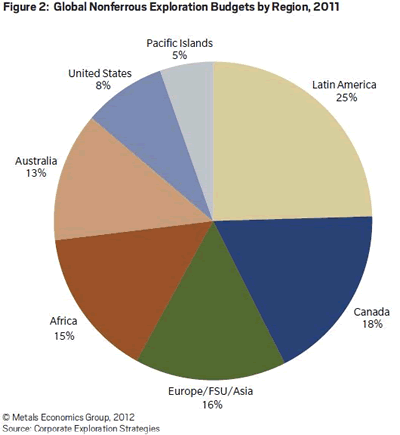

- The U.S. share of investment in mining is at an all-time low dropping from 21 percent of the world's mining investment in the early 1990's to 10 percent in 2000 and 8 percent today

"Gold and copper exploration in the United States kept it in sixth place regionally, ahead of the Pacific Islands." World Exploration Trends 2012 - A Special Report from the Metals Economics Group

The Metallurgical Achilles' Heel of the United States

"The United States has consistently maintained that a strong domestic minerals and metals industry is an essential contributor to the nation's economic and security interests...The United States has a fundamental interest in maintaining a competitive minerals and metals sector that will continue to contribute significantly to the nation's economic strength and military security. The industry represents an $87 billion enterprise that employs over 500,000 U.S. workers and provides the material foundation for U.S. manufacturing." The 1980 National Academy of Sciences executive summary of "Competitiveness of the U.S. Minerals and Metals Industry"

A concise summary of U.S. mineral vulnerabilities was presented to the Industrial Readiness Panel of the House Armed Services Committee as early as 1980 by General Alton D. Slay, Commander Air Force Systems Command. He pointed out that technological advances have increased the demand for exotic minerals at the same time that legislative and regulatory restrictions have been imposed on the U.S. mining industry.

The 1981 report "A Congressional Handbook on U.S. Minerals Dependency/Vulnerability" singled out eight materials "for which the industrial health and defense of the United States is most vulnerable to potential supply disruptions" - chromium, cobalt, manganese, the platinum group of metals, titanium, bauxite/aluminum, columbium, and tantalum - the first five have been called "the metallurgical Achilles' heel of our civilization."

In 1984 U.S. Marine Corps Major R.A. Hagerman wrote: "Since World War ll, the United States has become increasingly dependent on foreign sources for almost all non-fuel minerals. The availability of these minerals have an extremely important impact on American industry and, in turn, on U.S. defense capabilities. Without just a few critical minerals, such as cobalt, manganese, chromium and platinum, it would be virtually impossible to produce many defense products such as jet engine, missile components, electronic components, iron, steel, etc. This places the U.S. in a vulnerable position with a direct threat to our defense production capability if the supply of strategic minerals is disrupted by foreign powers."

In 1985, the secretary of the United States Army testified before Congress that America was more than 50 percent dependent on foreign sources for 23 of 40 critical materials essential to U.S. national security.

The 1988 article "United States Dependence On Imports Of Four Strategic And Critical Minerals: Implications And Policy Alternatives" by G. Kevin Jones was written in regards to what he thought are the most critical minerals upon which the United States is dependent for foreign sources of supply - chromium, cobalt, manganese and the platinum group metals (PGE). These metals represent the "metallurgical Achilles' heel" of United States strategic mineral supply because their role in the economy is pervasive and they are vulnerable to supply interruption.

The May 1989 report "U.S. Strategic and Critical Materials Imports: Dependency and Vulnerability. The Latin American Alternative," deals with over 90 materials identified in the Defense Material inventories as of September 1987. At least 15 of these minerals are considered "key minerals" because the US is over 50% import reliant. All these minerals are essential to domestic security and the national economy but four are referred to as the "first tier" or "big four" strategic materials because of their widespread role and vulnerability to supply disruptions - chromium, cobalt, manganese and platinum group metals.

"The U.S. depends on southern Africa's minerals for about the fifty percent of the "big four". Thus, a long-term cutoff of any or all of these materials has the potential for an economic and strategic crisis of greater proportions than the oil crisis of the 1970s. An embargo of South African minerals to the U.S. would affect millions of American jobs in the steel, aerospace, and petroleum industries, and could in effect shut down those industry groups." U.S. Strategic and Critical Materials Imports: Dependency and Vulnerability

Chromium, cobalt, manganese, the platinum group, and titanium have been labeled "the metallurgical Achilles' heel of our civilization" - MII, 1996, Gaston, 2001.

While much of the rest of the world is scrambling to tie up control of strategic minerals America has deliberately hamstrung itself. Americans don't get it, yet they've had plenty of warning starting as far back as WWl.

In World War I severe material shortages (tungsten, tin, chromite, optical grade glass, and manila fiber for ropes) played havoc with production schedules and caused lengthy delays in implementing programs. This led to development of the Harbord List - a list of 42 materials deemed critical to the military.

After World War II the United States created the National Defense Stockpile (NDS) to acquire and store critical strategic materials for national defense purposes. The Defense Logistics Agency Strategic Materials (DLA Strategic Materials) oversees operations of the NDS and their primary mission is to "protect the nation against a dangerous and costly dependence upon foreign sources of supply for critical materials in times of national emergency."

The NDS was intended for all essential civilian and military uses in times of emergencies ie guerrilla warfare in Zaire during the 1970s caused the worldwide price of cobalt to increase from $6 to $45 a pound, and a United Nations (UN) trade boycott of Zimbabwe (formerly Rhodesia) stopped legal exports of chromium from the country.

In 1992, Congress directed that the bulk of these stored commodities be sold. Revenues from the sales went to the Treasury General Fund and a variety of defense programs - the Foreign Military Sales program, military personnel benefits, and the buyback of broadband frequencies for military use.

"Without increased domestic exploration, significant declines in US mineral production are unavoidable as present reserves are exhausted. We will continue to ship American jobs overseas and forfeit our economic competitiveness unless we take steps to develop our own mineral resources." Subcommittee on Energy and Mineral Resources Chairman Doug Lamborn

The Five Horsemen

Chromium - is a mineral the United States Geological Survey (USGS) still considers "one of the nation's most important strategic and critical materials."

In 2011, the United States was expected to consume about 5% of world chromite ore production in various forms of imported materials, such as chromite ore, chromium chemicals, chromium ferroalloys, chromium metal, and stainless steel.

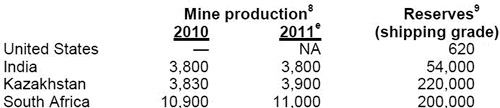

Import Sources (2007-10): Chromium contained in chromite ore, chromium ferroalloys and metal, and stainless steel mill products and scrap: South Africa, 34%; Kazakhstan, 17%; Russia, 9%; China, 5%; and other, 35%.

Net import reliance as a percentage of apparent consumption: 2007 - 67%, 2008 - 66%, 2009 - 12%, 2010 - 62%, 2011 - 60%, USGS

Some 90% of chromite mined worldwide is converted to ferrochrome - Ferrochrome (FeCr) is an alloy of chromium and iron containing between 50% and 70% chromium. Stainless steel production consumes most of the ferrochrome produced annually. Chromium is also used to make heat-resisting steel. Superalloys use chromium and have strategic military applications. Chromium is one of the major elemental resources that the United States depends upon. The Republic of South Africa and Zimbabwe contain 98% of the world's reserves of this mineral.

There is no good alternative for chromium in the manufacture of steel or chromium chemicals.

Global steel production is forecast to rise to 1.5 billion tons in 2012. Higher labor and fuel costs, as well as a substantial devaluation of the US dollar, has led to a sizeable increase in costs of ferrochrome and chrome ore production.

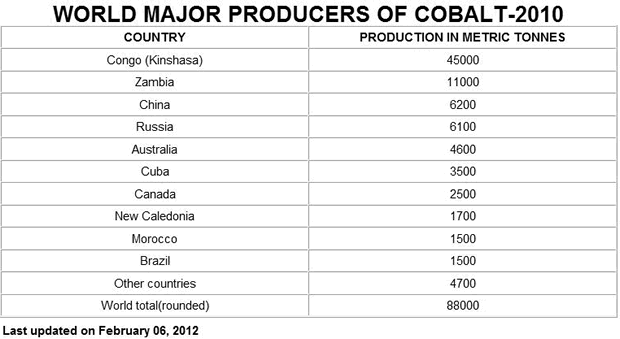

Cobalt has not been mined in the U.S. since 1971 - the US has no domestic production and is 100% dependent on imports for its supply of primary cobalt. The US is the world's largest consumer of cobalt and considers cobalt a strategic metal.

Source: mapsofworld.com

Approximately 48% of the world's 2007 mined cobalt was a byproduct of nickel mining from sulfide and laterite deposits. An additional 37% was produced as a byproduct of copper operations, mainly in the Democratic Republic of the Congo (DRC) and Zambia. The remaining 15% of cobalt mining came from primary producers.

The copper deposits in the Katanga Province of the Democratic Republic of the Congo are the top producers of cobalt and the political situation in the Congo influences the price of cobalt significantly. The politically unstable Democratic Republic of Congo contains half the world's cobalt supply and represents the lion's share of anticipated future cobalt supply - the DRC's 2007 output was equal to the combined production of cobalt by Canada, Australia and Zambia.

In a nine billion dollar joint venture with the DRC China got the rights to the vast copper and cobalt resources of the North Kivu in exchange for providing $6 billion worth of road construction, two hydroelectric dams, hospitals, schools and railway links to southern Africa, to Katanga and to the Congo Atlantic port at Matadi. The other $3 billion is to be invested by China in development of new mining areas. Approximately half of known global cobalt reserves are in the DRC, and close to 40%-50% of incremental cobalt production, over the next five years, is anticipated to emanate from the DRC.

Net import reliance as a percentage of apparent consumption: 2007 - 80%, 2008 - 81%, 2009 - 76%, 2010 - 81%, 2011 - 75%

In 2011, cobalt contained in purchased scrap represented an estimated 24% of cobalt reported consumption.

Import Sources (2007-10): Cobalt contained in metal, oxide, and salts: China, 18%; Norway, 16%; Russia, 13%; Canada, 10%; and other, 43%.

Nickel - Nickel, while not included in the list of top four or as a Metallurgical Achilles Heel is mentioned here because of its importance in regards to the mining of cobalt and Platinum Group Elements (PGE).

The United States does not have any active nickel mines but limited amounts of byproduct nickel were recovered from copper and palladium-platinum ores mined in the Western United States. The estimated value of apparent primary nickel consumption in the US was $2.93 billion.

The U.S. Government sold the last of the nickel in the National Defense Stockpile in 1999.

RBC Capital Markets forecasts nickel growth at 9.5% in 2012, 10.3% in 2013, and trend growth of approximately 5.0% thereafter. Citing Reuters, RBC Capital Markets Ltd. said Russia's OAO GMK Norilsk Nickel plans to trim output in 2012.

There are two main types of nickel sulphide deposits. In the first, Ni-Cu sulphide deposits, nickel (Ni) and copper (Cu) are the main economic commodities - copper may be either a co-product or by-product, and cobalt (Co), Platinum Group Elements (PGE) and gold (Au) are the usual by-products.

The second type of deposit is mined exclusively for PGE's with the other associated metals being by-products.

The long-term decline in discovery of new sulfide deposits in traditional mining districts has forced companies to shift exploration efforts to more challenging locations like the Arabian Peninsula, east-central Africa, and the Subarctic.

China is the leading consumer of nickel and is competing for supplies with recovering US industrial demand, as well as India, Russia and Brazil.

Import Sources (2007-10): Canada, 38%; Russia, 17%; Australia, 10%; Norway, 10%; and other, 25%.

Net import reliance as a percentage of apparent consumption: 2007 - 17%, 2008 - 33%, 2009 - 21%, 2010 - 34%, 2011 - 47%

Manganese - From the USGS - Events, Trends, and Issues: U.S. steel production in 2011 was projected to be 18% more than that in 2010. Imports of manganese materials were expected to be significantly more in 2011 than in 2010 - 17%, 20%, and 35% more for manganese ore, ferromanganese, and silicomanganese, respectively. As a result, U.S. manganese apparent consumption increased by an estimated 7% to 810,000 tons in 2011, which is less than might be expected based on increased imports because of a significant amount of manganese added to the Government stockpile.

The annual average domestic manganese ore contract price followed the decrease in the average international price for metallurgical-grade ore set between Japanese consumers and major suppliers in 2011. Improved economic conditions led to planned expansions at three manganese mines and the startup of two new manganese mines, which added about 4.2 million tons per year of additional manganese ore production capacity worldwide.

Net import reliance as a percentage of apparent consumption: 2007 - 100%, 2008 - 100%, 2009 - 100%, 2010 - 100%, 2011 - 100%

Import Sources (2007-10): Manganese ore: Gabon, 57%; Australia, 15%; South Africa, 12%; Brazil, 4%; and other, 12%. Ferromanganese: South Africa, 50%; China, 19%; Ukraine, 6%; Mexico, 6%; and other, 19%. Manganese contained in all manganese imports: South Africa, 33%; Gabon, 19%; China, 10%; Australia, 9%; and other, 29%.

World Resources: Land-based manganese resources are large but irregularly distributed; those of the United States are very low grade and have potentially high extraction costs. South Africa accounts for about 75% of the world's identified manganese resources, and Ukraine accounts for 10%.

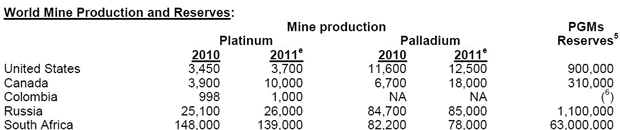

Platinum - South Africa contains 73% of the world reserves of platinum and virtually all of the United States need is met by this country.

Net import reliance as a percentage of apparent consumption: 2007 - 91%, 2008 - 89%, 2009 - 95%, 2010 - 91%, 2011 - 88%

The most important platinum-rich PGE district in the world is South Africa's Bushveld Complex.

The government of South Africa is proposing a 50 percent tax on company profits once a "reasonable return" on mining activities has been achieved - this in a sector that is facing rising labor and power costs.

South African is in the process of building a state mining company to ensure cheap domestic supplies of minerals. This may evolve into significant state control of specific areas of mining. While South Africa has flatly denied a general nationalization of its mining industry specific sector targeted nationalization is obviously on the table.

The second PGE district in importance is the Noril'sk-Talnakh district, which is exceptionally Palladium (Pd) rich as a by-product of its Ni-Cu ores.

Competition - Have supply concerns been mitigated over the years?

"Continued growth in consumption resources is being driven by growth in China and the rest of Asia. Chinese companies are increasingly acquiring assets, as are Indian companies, prompting other global miners into a race to secure mineral assets of their own." George Fang, Standard Bank's Head of Mining and Metals China

In his 1989 book "The Rise and Fall of Great Powers" historian Paul Kennedy argues that a country with a growing economy prefers to become wealthy instead of funneling its economic output into the military. While China's, and other developing countries military might has grown there is no doubt their greatest concern is to secure the needed energy and raw commodities necessary to continue their economic expansion.

The global mining industry is facing stiff new competition in getting deals done. The new competitor's for the world's resources have a mandate to secure long term resource deals for domestic use and have the financing capabilities any major mining company, or for that matter any government, would be envious of.

China's state owned enterprises (SOE) and sovereign wealth funds (SWF) were armed with hundreds of billions of US dollars from the country's foreign reserves and sent out to scour the globe for resources - they went on the hunt to fuel China's exploding economy.

China wants to diversify out of the massive US dollar component of its Foreign Reserves which means:

- SOE/SWFs have no problem dealing in straight cash and operating in what some might consider high risk areas

- The Chinese have a longer term horizon for their ultimate payoff because they are mostly after off-take supply agreements from early stage development projects

- The Chinese government funds infrastructure projects that secure the cooperation of the host country with regard to mine development and off-take agreements

- Thanks to the trillions of foreign exchange reserves it currently holds China offers loans at highly competitive interest rates. For example, the Export-Import Bank of China (Exim Bank) gave the Angolan government three loans at interest rates ranging from LIBOR (London Interbank Offered Rate - the rate banks charge each other on loans) plus 1.25 percent, up to LIBOR plus 1.75 percent, as well Exim Bank offered generous grace periods and long repayment terms

The future production from the deposits that the Chinese, Indians and others acquire and develop through state-owned entities will flow directly back to their respective countries and bypass the global commodity markets. It's obvious they are not putting these deposits into production so that they can make a profit selling output into the commodities market.

Conclusion

Many minerals were recognized as critical and strategic decades ago. Some - referred to as the big four, the top tier or the metallurgical achilles heel of the US - are more critical than others.

The Rare Earth Elements (REE) and most recently graphite, have caught investors attention and rightly so. But let's not forget the achilles heel's - chromium, cobalt, manganese and the platinum group metals (PGE) - are the basic building blocks any nation needs for its economic foundation.

The fact is, the US has a metallurgical achilles heel because it's still dependent on South Africa (and its march to Marxism), the politically unstable Democratic Republic of Congo (DRC) and an increasingly unreliable China for supply of what it considered stragetic or critical minerals 30 plus years ago.

Over the intervening decades these minerals have become ever more critical and supplier countries even more unreliable.

The 2011/2012 Fraser Institute survey rankings examines which jurisdictions provide the most favorable business climates for the resource extraction industry. Out of 93 places surveyed, the US depends on a large majority of its supply of its most critical minerals, it's Metallurgical Achilles Heel, from countries that ranked no higher than 50th in the survey:

Zambia 50th South Africa 54th China 58th Russia 71st Zimbabwe 74th DRC 76th Kazakhstan 81st India 89th

"As resource constraints tighten globally, countries that depend heavily on ecological services from other nations may find that their resource supply becomes insecure and unreliable. This has economic implications - in particular for countries that depend upon large amounts of ecological assets to power their key industries or to support their consumption patterns and lifestyles." Dr. Mathis Wackernagel, President of the Global Footprint Network

Accessing a sustainable, and secure, supply of raw materials is going to become the number one priority for all countries. Increasingly we are going to see countries ensuring their own industries have first rights of access to internally produced commodities and they will look for such privileged access from other countries.

Numerous countries are taking steps to safeguard their own supply by:

- Stopping or slowing the export of natural resources

- Shutting down traditional supply markets

- Buying companies for their deposits

- Project finance tied to off take agreements

The United States needs to figure out who its friends are and work with them to establish Security of Supply. The countries politicians, and its citizens, also need to figure out that true wealth, a growing economy and a strong country are built by resource extraction and manufacturing not a service based system pandering to the cries of non-government organizations (NGO).

Critical materials, and there sources, should be on every investors radar screens. Are they on yours?

If not, maybe they should be.

By Richard (Rick) Mills

If you're interested in learning more about specific lithium juniors and the junior resource market in general please come and visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Copyright © 2012 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.