Explaining Central Banking to the Publicly Educated

Politics / Central Banks Mar 28, 2012 - 05:18 AM GMTBy: Jeff_Berwick

Don't understand economics? And the thought of even trying makes your eyes cross?

Don't understand economics? And the thought of even trying makes your eyes cross?

That's what they want. Government, which is an artificial, unnecessary construct has made a concerted effort to make economics sound as difficult as possible for decades. The reason? They can use your programmed ignorance as the publicly "educated" to confuse you about how they manipulate the economy for their benefit.

Economics is simple. Nearly the full extent of it can be taught in a near pamphlet, as has been done in Henry Hazlitt's "Economics in One Lesson". That is the full extent that any individual needs and should know about economics.

Those four to eight years in college to get a bachelor or PhD in Economics? Pure mental masturbation - at best.

ECONOMICS ON AN ISLAND

Most everything can be broken down to its most basic components in order to simplify things. When faced with a large question always try to break it down. Let's do that with economics to show how simple it is and why central banking is a central tenet of communism and is an abomination that makes no sense in a free market.

Let's say that you and four other people live on an island. As far as you can tell there are no other humans on Earth. Each of the people on the island do things which help the collective although they have selfish reasons for doing so (ie. they want something in return).

Perhaps you fish. Another gathers coconuts. And another is good at building and repairing thatch huts and collecting rainwater for drinking. Amongst yourselves you trade. You offer some fish for coconuts, water and a nice maintained hut. The others offer their services in trade for your fish.

In comes the fourth person - a bearded man with no particular skills who thinks he is better than everyone else. He produces nothing but tells you that he has come up with a better system using "money" where you don't have to wait until the man who gets coconuts wants fish before you can get coconuts. Instead you can trade money... perhaps a piece of paper that the fourth person has inscribed with pictures and denominations on it.

So far it doesn't sound too bad. But here is where he becomes a "central banker". First, he pulls out a spear and tells you that you must, under all circumstances use his money and no other money. Then, during times when the fishing is poor or there is a drought he tells you that he can help everyone out by "stimulating" the economy of the island by drawing up more money.

If things got really tough he could double or triple the amount of money on the island. At first, everyone thinks they are richer, so they buy more fish or water or housing than they otherwise could afford. This ends up using up more resources than would otherwise be prudent. Soon the money has circulated and now coconuts just cost twice or three times more than before in currency units. The same for fish... the same for water and housing.

How has this central banking scheme "helped"? It hasn't. It actually ended up destroying scarce resources as it fooled the participants in the economy for a period of time into thinking they were more wealthy than they really were.

That is all there is to central banking. Of course, what then happens is the entire island gets corrupted and people begin to look to get favors from the central banker to get the newly created money first. And, then, if the printing of money begins to get out of control and the central banker stops printing money in order to salvage the "value" of the money before hyperinflating it into worthlessness, because of the fact he uses violence to enforce its use, all of a sudden there will not be enough money in the system to transact basic transactions and people will not be able to survive. There will be either war (over the resources) or starvation as the denizens of the island find themselves unable to acquire the currency they are forced to use to survive. Either that or the banker will take control of your future productivity in exchange for some easily printed cash today effectively putting you into slavery just to survive.

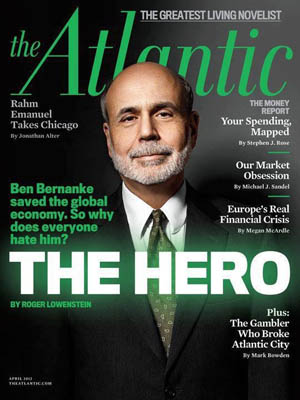

The only thing missing on the island at this point is someone to start a fascist media conglomerate who, in cahoots with the central bank, put out the following magazine cover showing the one non-productive member of the island as being the hero:

THE HERO?

"Ben Bernanke saved the economy, so why does everybody hate him?"

First of all, not enough people know enough about him to hate him. If they did, however, a public sodomization and lynching like Hillary did unto Khadaffi would be in order.

Here is the man who destroys economies. The man who funds and makes all wars possible. The man who puts senior citizens on treadmills and makes them run just to be able to eat cat food. And he does it all with a smug look on his face reminiscent of the last time this kind of nonsense was attempted:

Remember that one? Three of the smuggest looking conmen in the world posed as saviors just months before the collapse of the global economy - which they all brought about. That Slime cover story came out on February 15, 1999 proclaiming that the money changers had saved us all from the global economic meltdown.

How'd that all work out for everyone?

Are they pulling the same tricks again now to try to salvage a few more months of the fantasy economy? Probably.

I declared victory when in 2008 Gannett (the parent of USA Today) hit $1 after being $60 in 2000... despite the dead cat bounce it has done since.

Today, The Dollar Vigilante and it's parent company, TDV Media, is one of the fastest growing media organizations on the planet.

Why? Because we spread truth and help awaken the brainwashed. A revolution is going on whether you realize it or not. The internet has exposed the cockroaches. Government, nor central banks, have any right to exist. Only propaganda and subterfuge has enabled them to survive this long.

DO YOU UNDERSTAND?

If you understand what central banking is really about then you are preparing now for the final stages of the collapse of the western monetary system. This means investments in hard assets such as gold and silver bullion and speculative bets in a final inflationary bubble into precious metals stocks. If you understand central banking and the governments that are subjugated to them then you know by now to get a significant portion of your assets outside of the control of the government that purports to own and control you. You understand that getting a second or a third passport is now as common sense as saving a significant percentage of your income in the past. Or, if you want to stay and fight in the coming years, you understand the importance of becoming self sufficient in terms of food and energy and preparing to protect yourself via armaments.

And if you understand all of this then you have broken out of the brainwashing of your public education and are thinking for yourself. You are now enemy number one of governments in the western world. We're happy you joined us.

The Dollar Vigilante is a free-market financial newsletter focused on covering all aspects of the ongoing financial collapse. The newsletter has news, information and analysis on investments for safety and for profit during the collapse including investments in gold, silver, energy and agriculture commodities and publicly traded stocks. As well, the newsletter covers other aspects including expatriation, both financially and physically and news and info on health, safety and other ways to survive the coming collapse of the US Dollar safely and comfortably. The Dollar Vigilante offers a free newsletter at DollarVigilante.com.

© 2012 Copyright Jeff Berwick - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.