Fed Actions Speak Louder Than Words

Interest-Rates / US Interest Rates Apr 04, 2012 - 03:13 AM GMTBy: Axel_Merk

Investors may be taken for a ride by today's Minutes of the Federal Open Market Committee (FOMC), which expand on the FOMC's March 13, 2012 statement; in the interim, we believe the Federal Reserve (Fed) Chairman Bernanke has gone out of his way to assure the markets that monetary policy will remain "highly accommodative," at least through late 2014.

The Fed does indeed have a credibility problem: having assured investors that rates will remain low for an extended period, it may only take one or two FOMC members to turn more optimistic about the economic outlook to cause the markets to more aggressively price-in tighter monetary policy. Conversely, Bernanke has made it clear that he is most concerned about a recovery in the housing market and that low interest rates - throughout the yield curve - are desirable. Operation Twist is specifically aimed to achieve that, lowering long-term rates and flattening the yield curve. However, should investors become increasingly optimistic about economic improvement, odds increase that investors sell bonds, putting upward pressure on long-term rates.

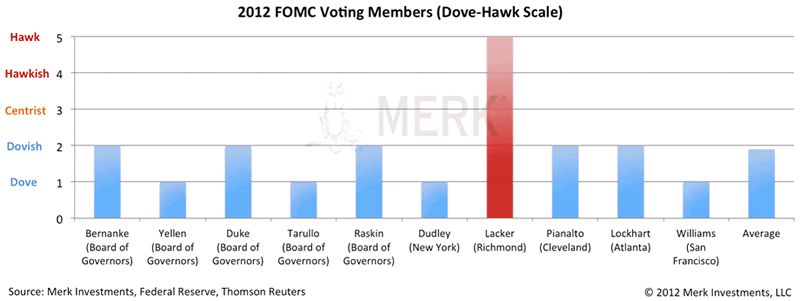

To understand the Fed's "communication strategy", one needs to be aware of who is calling the shots. We are not just talking about Fed Chairman Bernanke, but also the composition of voting FOMC members. Without a doubt, the "hawks" (hawks are FOMC members considered to favor tighter monetary policy compared to "doves") on the FOMC are getting more vocal. At the same time, the only voting "hawk" on the FOMC this year is Richmond Fed President Jeff Lacker:

The scale may tilt a tad towards the centrist/hawkish side should Congress fill the two vacant seats with the candidates under consideration. Still, when all is said and done, it is the voting members who ultimately determine imminent monetary policy decisions, rather than the noise created by non-voting members. And those actions remain, in our interpretation, decisively on the dovish side:

- "almost all members again agreed to...maintain a highly accommodative stance..."

- "a number of members perceived a non-negligible risk that improvements in employment could diminish as the year progressed"

Obviously, should economic data continue to surprise to the upside, the Fed will have an ever-more difficult time defending its dovish position. The credibility of the Fed will be seriously tested as the Fed has committed to keeping rates low until late 2014. However, should we enter a weak patch, we believe the odds are rather high that the FOMC will "take out insurance" against another slowdown. In a world where everyone hopes for the best, but plans for the worst, central banks around the world - including the Fed - may keep the world awash in money.

After all, a world laden with debt may need inflation if deflation is to be avoided. Bernanke has argued many times that tightening monetary policy too early was one of the biggest mistakes the Fed made during the Great Depression. We don't think Bernanke will repeat this. Indeed, we consider he will err firmly on the side of inflation. As such, when the dust settles, look at actions, not words. We see doves, not hawks, managing the monetary aviary.

Please subscribe to our newsletter to be informed as we provide food for thought about the relationship between gold and currencies. We will also discuss what investors may want to do in a world that has moved further and further away from the gold standard. Subscribe to Merk Insights by clicking here. Also, please click here to register for the Merk Webinar: Quarter 1 Update on the Economy and Currencies which will take place on Thursday, April 19th at 4:15pm EF / 1:15pm PT. We manage the Merk Funds, including the Merk Hard Currency Fund. To learn more about the Funds, please visit www.merkfunds.com.

By Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.