Gold Stocks: Timing Your Next Purchase

Commodities / Gold and Silver 2012 Apr 09, 2012 - 06:21 AM GMTBy: Bob_Kirtley

Gold prices continue to trade in the $1800.00/oz and $1550.00/oz range exhibiting scant regard for the current state of world. The Arab Spring looks set to run and run as the dethronement of each leader creates a power vacuum and the opportunity for one of the many political factions involved to make their move and gain control. The North Koreans are about to launch a long range missile, albeit for peaceful purposes, the news of this action as put the Chinese on red alert. (please excuse the pun) Turkey is now seeing an increase in the influx of refugees at their border with Syria as the carnage continues there, despite the protestations of many nations.

Gold prices continue to trade in the $1800.00/oz and $1550.00/oz range exhibiting scant regard for the current state of world. The Arab Spring looks set to run and run as the dethronement of each leader creates a power vacuum and the opportunity for one of the many political factions involved to make their move and gain control. The North Koreans are about to launch a long range missile, albeit for peaceful purposes, the news of this action as put the Chinese on red alert. (please excuse the pun) Turkey is now seeing an increase in the influx of refugees at their border with Syria as the carnage continues there, despite the protestations of many nations.

In Europe, Spain is starting to see its bonds rise suggesting that a bailout much larger than that of Greece will be required, if only to buy the eurocrats a little more time. The yield on the Spain's ten-year bond spiked around 0.20 of a percentage point, on Thursday, to 5.61 percent compared to a month ago, when the rate was down below 4.9 percent. The latest proposed budget cuts are severe and it remains to be seen if the newly appointed premier, Mario Monti, can implement such measures.

Over in the United States the jobs numbers were a disappointment as the March figures saw a lowly 120,000 jobs created. Expectations were for 200,000 new jobs following on from the 240,000 new jobs created in February. This poor performance will not spur the Fed Chairman into action, however, if these figures are followed by equally poor job numbers in April and May, then Ben Bernanke will be looking to fire the big QE3 bazooka. Once the market gets a hint that QE3 is a starting to look more like a probability than a possibility, then we will see gold commence its next rally to higher ground.

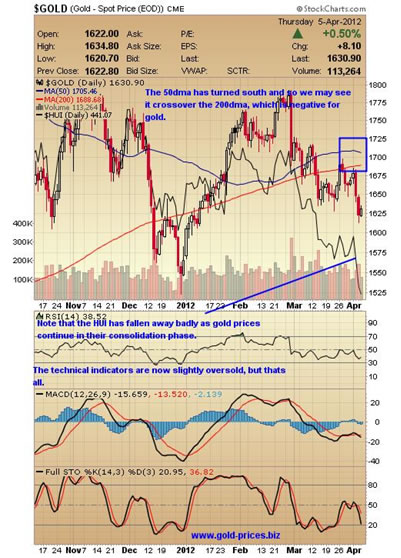

Although gold is range trading at the moment, the true disappointment in its lack of progress can seen in the poor performance of the mining shares, such as those who are constituents of the the HUI, the Golds Bugs Index. We have plotted the HUI on the gold chart above so you can see that it is dropping and is a reflection of investors impatience, as they cash up and move to the sidelines. To a large extent we agree with them and been advocating a 'keep your gun powder dry' strategy for some time.

As investors we have skin in this game, in that we have a core position of mining stocks along with our holding of physical gold and silver. Having realized that the stocks were not returning a leveraged return on our capital we steadfastly refused to increase our exposure to them and we are pleased in having done so as many of the stocks that we follow are a whole lot cheaper now than they have been over the last few years.

So, in terms of actionable allocation of our cash, our intention is to hold onto our core positions in both the precious metals and mining stocks. However, we will continue to resist the temptation to increase our exposure to the mining sector, as the risk/reward environment is not yet in our favour. We may indeed miss the beginning of the next rally and we should mention that many of our peers are anticipating a large move north for mining stocks and they may be correct. Again though, timing is a critical component of a good decision and we are of the opinion that the 'time' lays ahead of us and not behind us, so don't panic if you are not fully allocated, as stock prices may crumble a tad further from this point. We are aware of just how difficult it is at times like these but the important thing is to make the 'right' decision for your own particular needs and objectives and not be carried along by hoopla.

Jumping back to the chart above we can see that gold prices recently managed to avoid the cross of death, as the 50dma almost crossed over the 200dma in a downwards movement, but managed to survive. However, the 50dma has turned south again and so we may see it crossover the 200dma, which would be negative for gold. This is of course only one of many indicators and is not one hundred percent accurate, however, some traders are guided by any such event, which to their way of thinking would indicate a sell trade, thus putting even more downward pressure on gold.

Apart from holding the physical metal and our core position in the mining sector, our forays into the options market has generated some good returns for us, but you do need a cast iron stomach and the ability to sleep easily despite the precarious state of the financial markets.

For now we will hold fast and continue to look for absolute bargains and we will try to be patient enough to wait until whats on offer is the real deal.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. Winners of the GoldDrivers Stock Picking Competition 200

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit.

Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.