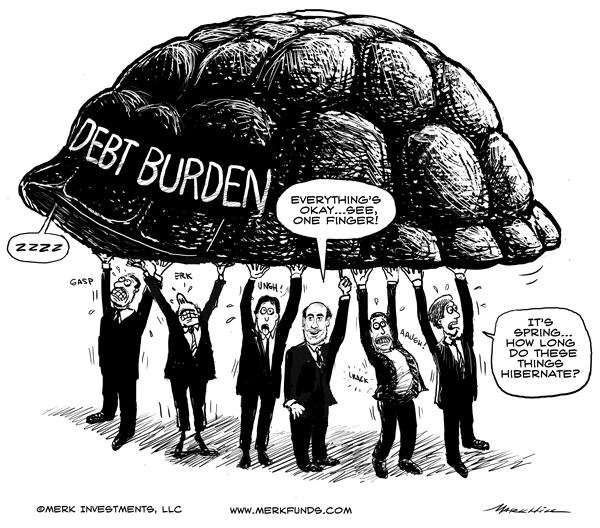

Economic Recovery - Who are We Kidding?

Economics / US Economy Apr 10, 2012 - 09:30 AM GMTBy: Axel_Merk

The global economy is healing, so we are told. Yet, the moment the Federal Reserve (Fed) indicates just that - and thus implying no additional stimulus may be warranted - the markets appear to throw a tantrum. In the process, the U.S. dollar has enjoyed what may be a temporary lift. To make sense of the recent turmoil, let's look at the drivers of this "recovery" and potential implications for the U.S. dollar, gold, bonds and the stock market.

The global economy is healing, so we are told. Yet, the moment the Federal Reserve (Fed) indicates just that - and thus implying no additional stimulus may be warranted - the markets appear to throw a tantrum. In the process, the U.S. dollar has enjoyed what may be a temporary lift. To make sense of the recent turmoil, let's look at the drivers of this "recovery" and potential implications for the U.S. dollar, gold, bonds and the stock market.

In our assessment, what we see unfolding is the latest chapter in the tug of war between inflationary and deflationary forces. During the "goldilocks" economy of the last decade, investors levered themselves up. Homeowners treated their homes as if they were ATMs; banks set up off-balance sheet Special Investment Vehicles (SIVs); governments engaging in arrangements to get cheap loans that may cost future generations dearly. Cumulatively, it was an amazing money generation process; yet, central banks remained on the sidelines, as inflation - according to the metrics focused on - appeared contained. Indeed, we have argued in the past that central banks lost control of the money creation process, as they could not keep up with the plethora of "financial innovation" that justified greater leverage. It was only a matter of time before the world no longer appeared quite so risk-free. Rational investors thus reduced their exposure: de-levered. When de-leveraging spreads, however, massive deflationary forces may be put in motion. The financial system itself was at risk, as institutions did not hold sufficiently liquid assets to de-lever in an orderly way. Without intervention, deflationary forces might have thrown the global economy into a depression.

The trouble occurs when the money creation process takes on a life of its own, because the money destruction process is rather difficult to stop. However, it hasn't stopped policy makers from trying: in an effort to fight what may have been a disorderly collapse of the financial system, unprecedented monetary and fiscal initiatives were undertaken to stem against market forces. Trillion dollar deficits, trillions in securities purchased by the Fed with money created out of thin air (when the Fed buys securities, it merely credits the account of the bank with an accounting entry - while no physical dollar bills are printed, many - including us - refer to this process as the printing of money).

Will it work? The Fed thinks it might. But nobody really knows. We do know that a depression works in removing the excesses of a bubble. However, the cost of a depression may be severe, both in social and monetary terms. Critics of the "let 'em fail" argument say that businesses and jobs beyond those that have engaged in bad decisions will be caught by contagion effects and may ultimately be bound to fail too. Fed Chair Bernanke, a student of the Great Depression, frequently warns against repeating the policy mistakes of that era. So does the reflationary argument work, i.e. does printing and spending money help bring an economy back from the brink of disaster? We cannot find an example in history where it has. As Bernanke points out, policy makers have learned a great deal by studying crises of the past. Our reservation comes from the following observation: central bankers at any time have always been considered amongst the smartest of their era, yet - with hindsight - they may have engaged in terrible mistakes. While we certainly wish that Bernanke is right, we nonetheless maintain a degree of skepticism and believe it is any investor's duty to take the risk that the world does not evolve the way he envisions into account. Our policy makers also might be well served to be more humble, as they are putting the world's savings at risk.

Yet, the reason central bankers are bold, not humble, is because they fear hesitation will lead to deflationary forces taking the upper hand yet again. Bernanke's contention, that one of the biggest mistakes during the Great Depression was to tighten monetary policy too early, stems from that fear. In its recently released minutes, the Federal Reserve Open Market Committee (FOMC) placed that fear in today's context: "While recent employment data had been encouraging, a number of members perceived a non negligible risk that improvements in employment could diminish as the year progressed, as had occurred in 2010 and 2011, and saw this risk as reinforcing the case for leaving the forward guidance unchanged at this meeting."

In our view, the reason why the Fed is committed to keeping rates low until the end of 2014 is precisely because the Fed does not want to be perceived as tightening too early. Why the end of 2014? Well, because it's not today or tomorrow. We believe nobody - not even at the Fed - knows whether the end of 2014 is the right date. The problem with that policy will be when the market no longer buys it. The market just needs to see one member of the FOMC turn more hawkish, as a result of improving economic data, to interpret that we may be starting down the road of monetary tightening. Yet, if the market thinks the Fed may tighten, deflationary forces take over, possibly unraveling all the "hard work" the Fed has done.

Will tightening ever be bearable for the economy again? U.S. financial institutions are in a stronger position than they were in 2008. Conversely, governments around the world - not just the U.S. government - are in far weaker positions, given the large amounts of debt they have incurred, in an effort to manage the financial crisis. Many consumers have downsized (read: lost their homes / filed for bankruptcy), but there continues to be downward pressure on the housing market, as millions of homes remain in the foreclosure process and are only slowly making it to the market. Bernanke may have chosen the end of 2014 as the earliest time to raise rates because it represents a date when the housing market may have freed itself from much of the foreclosure pipeline. Indeed, Fed research suggests that residential construction won't fully recover until 2014. We don't think that is a coincidence. To Bernanke, a thriving home market appears to be key to a healthy consumer and thus a healthy and sustainable recovery in consumer spending.

Tying monetary policy to the calendar has created alarm with economic "hawks" - not just the Fed itself, with the lone hawkish voting FOMC member, Richmond Fed President Jeff Lacker, openly dissenting. But if one follows Bernanke's line of thinking, what's the alternative? The alternative would be to firmly err on the side of inflation, as the Fed thinks inflation is the one problem it knows how to fight. Except that a central bank must never communicate that it wants to induce inflation, as it may derail the markets. So the 2nd best option, from Bernanke's point of view, may be to commit to keeping rates low until the end of 2014; the "risk" that the economy might perform better than expected (and thus earlier tightening warranted) appears to be shoved aside. Just to make sure the markets behave, the Fed also introduced an inflation target, assuring the markets not to worry, all will be fine on the inflation front.

Unfortunately, we don't think Bernanke's plan will work. The reason is that inflation may not be as easily fought as Bernanke thinks. The extraordinary policies that have been pursued have not only planted the seeds of inflation, but have re-introduced leverage into the system. While Bernanke claims he can raise rates in 15 minutes, we believe there is simply too much leverage in the economy to raise rates as much as former Fed Chair Paul Volcker did in the early 1980s to convince the markets the Fed is serious about inflation. Given the increased interest rate sensitivity of the economy, much less tightening would likely be necessary. We are not as optimistic as many current and former Fed officials that it will be possible to engineer a sustainable economic growth while adhering to the Fed's inflation target. The Fed is ultimately responsible for inflation; however, we have also learned that the modern Fed is unlikely to risk severe economic hardship to achieve its price stability mandate.

What does it all mean for the markets? Deflationary forces have favored the U.S. dollar and been a negative for gold. As indicated, however, we don't think the Fed will sit by idly as the markets price in tightening before the economy is "ready". As such, a flight into the dollar out of gold might be an opportunity to diversify out of the dollar into a basket of hard currencies, including gold. With regard to the bond market, we are rather concerned that the long end of the yield curve has been extraordinarily well behaved until just a few weeks ago. The reason for our concern is that periods of low volatility in any asset class usually means that money has entered the space that might leave on short notice: we call it fast money chasing yields. We don't need a crisis for investors to run for the hills in the bond market; we may just need a return to more normal levels of volatility. As such, investors may want to consider keeping interest risk low, i.e. staying on the short-end of the yield curve, both in U.S. dollars and other currencies. With regard to the stock market, it may do well should the Fed think of another round of easing, but let's keep in mind that the stock market has had a tremendous rally in recent months.

If investors consider investing in the stock market because of the Fed's monetary policy, why not express that same view in the currency market? After all, currencies - when no leverage is employed - are historically less volatile than domestic (or international) equities. Currencies may give investors the opportunity to take advantage of the risks and opportunities provided by our policy makers without taking on the equity risk.

Please subscribe to our newsletter to be informed as we provide food for thought about the relationship between gold and currencies. We will also discuss what investors may want to do in a world that has moved further and further away from the gold standard. Subscribe to Merk Insights by clicking here. Also, please click here to register for the Merk Webinar: Quarter 1 Update on the Economy and Currencies which will take place on Thursday, April 19th at 4:15pm EF / 1:15pm PT. We manage the Merk Funds, including the Merk Hard Currency Fund. To learn more about the Funds, please visit www.merkfunds.com.

By Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.