Seniors Worried about the Debt They Are Passing on to Their Heirs?

Economics / Pensions & Retirement Apr 17, 2012 - 01:25 AM GMTBy: Paul_L_Kasriel

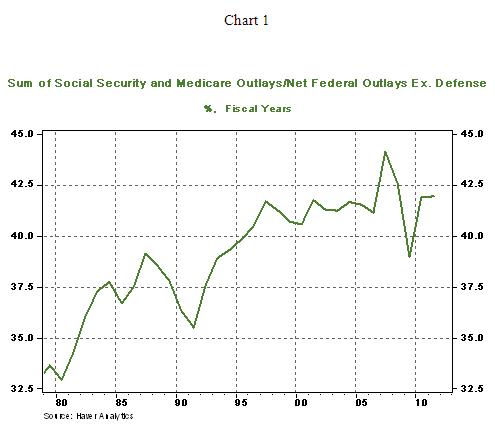

I recently celebrated my 65th birthday, which allowed me to become eligible for Medicare. On May 1, I will begin collecting Social Security benefits. I was curious to see what has been happening to combined federal expenditures on Social Security and Medicare in relation to total federal expenditures excluding those for national defense. My curiosity was satisfied by the data in Chart 1.

I recently celebrated my 65th birthday, which allowed me to become eligible for Medicare. On May 1, I will begin collecting Social Security benefits. I was curious to see what has been happening to combined federal expenditures on Social Security and Medicare in relation to total federal expenditures excluding those for national defense. My curiosity was satisfied by the data in Chart 1.

Back in FY 1979, combined Social Security and Medicare expenditures represented 33.7% of total federal nondefense expenditures. In FY 2011, this percentage had risen to 42%. Using current law, the Congressional Budget Office projects that in FY 2022, combined Social Security and Medicare expenditures will represent 51% of total federal nondefense expenditures. So, we seniors have been in recent years and will continue to account for larger and larger absolute and relative amounts of federal government expenditures.

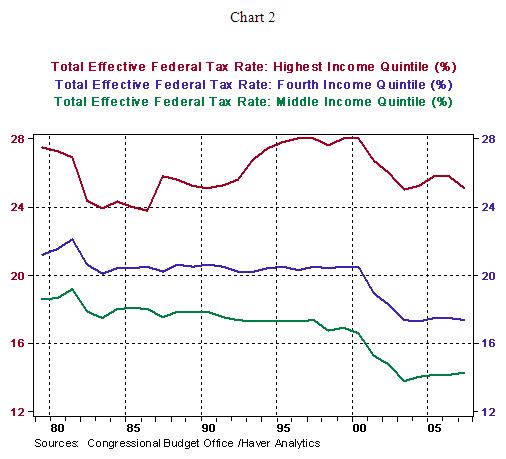

At the same time that we seniors are accounting for more government spending, our tax burdens have fallen. The effective federal tax rates for the middle, second highest (fourth) and highest quintiles of household income are shown in Chart 2. (Effective federal tax rates measure the tax burden on households. These rates are calculated by dividing taxes paid by or imputed to households by their comprehensive household income. Federal taxes include individual income, corporate income, payroll and excise taxes. Individual income taxes are generally distributed directly to households paying those taxes. Social insurance, or payroll, taxes are distributed to households paying those taxes directly or paying them indirectly through their employers. Corporate income taxes are distributed to households according to their share of capital income. Federal excise taxes are distributed to them according to their consumption of the taxed good or service.) For the middle and fourth quintile household incomes, effective taxes are near the lowest in the post-WWII era. For the highest quintile household income, the only time in the post-WWII era the effective tax rate was lower was during the Reagan administration.

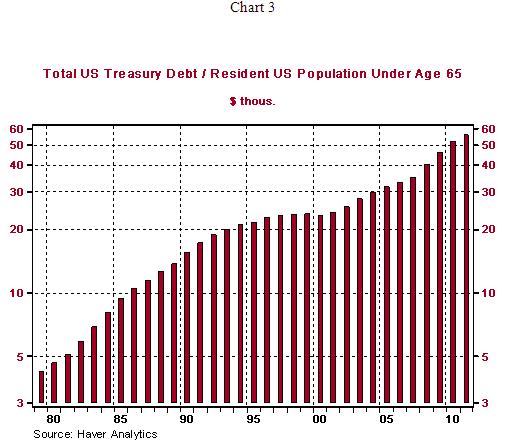

Chart 3 shows the total federal debt divided by the number of U.S. residents under the age of 65. In a sense, it is the federal debt we seniors are “leaving” to each of our children and grandchildren. Back in 1979, seniors “left” about $4.2 thousand of federal debt to each of their children and grandchildren. By 2011, we seniors had left about $55.9 thousand of federal debt to each of our children and grandchildren.

So, although I am worried about the federal debt I am saddling my descendants with, I am playing a large role in the cause of my worry through the collection of Social Security and Medicare benefits and the historically-low tax rate I am paying. What’s a worried senior to do? Leave the kids and grandkids a big inheritance. In other words, stay at home in the winter rather than taking that cruise and eat at home more rather than hitting the early-bird special at your local dining establishment. Because I am the beneficiary of the increased federal debt that is being piled up, perhaps I should be the one to sacrifice a little today for my beneficiaries of tomorrow. Nah. It is more fun to complain.

Post-April 30 email: Econtrarian@gmail.com

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2011 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.