The Pain in Spain, Debt Spiral and Housing Market Crash

Economics / Eurozone Debt Crisis Apr 24, 2012 - 03:47 AM GMTBy: John_Mauldin

It really does seem to be All Spain All the Time, but there is a reason. Unlike Greece, Spain makes a difference to the eurozone. It may be both too big to allow to fail and too big to save. Last week I came across a very informative 50-page PowerPoint on the situation in Spain from Carmel Asset Management. It is too big to send, but I asked Jonathan Carmel to draft a smaller document with some of the key points. I find it compelling. You can access the entire PowerPoint on my website. If you are not registered with me, you will need to enter your email address and, if you would, your zip code or country. There is a lot if information and data in the report. It will certainly make you think.

It really does seem to be All Spain All the Time, but there is a reason. Unlike Greece, Spain makes a difference to the eurozone. It may be both too big to allow to fail and too big to save. Last week I came across a very informative 50-page PowerPoint on the situation in Spain from Carmel Asset Management. It is too big to send, but I asked Jonathan Carmel to draft a smaller document with some of the key points. I find it compelling. You can access the entire PowerPoint on my website. If you are not registered with me, you will need to enter your email address and, if you would, your zip code or country. There is a lot if information and data in the report. It will certainly make you think.

I want to emphasize that I do not think Spain is hopeless. Rather, it has a narrow set of limited options that will require a great deal of austerity and economic pain on the part of Spain and significant help from the rest of Europe, combined with the forbearance and patience of the bond market or massive buying of Spanish bonds by the ECB for an extended period of time. I think it will need to be the latter, as the bond market is on the brink of breaking down on Spanish debt, failing a realistic path to economic balance and growth. The way ahead is most difficult and treacherous. It appears to me that at the end of the day only ECB participation can buy Spain the time it needs. If they give Spain the time, it can get through. But the pain will then be spread to the valuation of the euro and thus the entire eurozone.

Is a new fiscal compact a possibility? One with nations giving up control of their budgets and a euro-wide bond issue by which all the nations guarantee the others' debt? Or is there some middle option? Anything is possible and everything will be discussed, as the cost of a eurozone breakup would be massive.

This week's Outside the Box shows some of the reasons why the task is so daunting. Not to mention Italy. And the election results in France suggest a new government may be coming in May, whose leader has promised to renegotiate the recent eurozone agreement, although the details of what that really means are quite murky. And of course France is only a few years from its own crisis, if its deficit is not brought under control. Hollande has said no more austerity yet has not proposed a plan that promotes real growth.

We will soon plunge into yet more last-minute crisis meetings and summits, in which will be hatched yet more "plans." The German Bundesbank will complain about ECB largesse, but they don't control the ECB, as they once thought they did. They are toothless. But any pan-European plan that requires more German pledges (taxes and debt) must get through their legislature. And the Bundestag is most definitely NOT toothless. Can Merkel tame them once again? It will be difficult if the ECB ignores the Bundesbank warnings. You can only push so much.

A very narrow and treacherous path indeed. And it wends all through Europe, not just Spain.

I write this on my iPad from the train to Philadelphia, as I have managed to fry my computer. Somehow, the coffee spilled on the keyboard this morning did not seem to do it any good. Oh well. I get a backup laptop tomorrow. No data lost, just time and money. Sigh.

Your feeling like a rookie traveler analyst,

John Mauldin, Editor

Outside the Box

JohnMauldin@2000wave.com

The Pain in Spain

Carmel Asset Management

Spain grew a remarkable 8% per year in nominal GDP in the first nine years after the introduction of the euro in 1999. During this time, Spain focused its economy on housing and selling "the Mediterranean lifestyle." Millions flocked to its sun-drenched shores, buying houses along the way. As the demand for houses increased, construction became the industry. Housing prices exploded, tripling in just over a decade. Who wouldn't want to get in on the action? Indeed, people invested almost all their assets in real estate. Hundreds of thousands of homes were built; for two decades, one home was built for every additional person in the population.

Now the bubble is bursting. Home prices have started to fall but have much further to go. Housing construction employed one of every seven people. Most of those people will lose their jobs, and there are no new jobs available. Historically, countries facing this situation have devalued their currency, but the euro has made this impossible. Therefore an "internal" devaluation is needed, where prices of wages and goods fall in nominal terms. While this is possible, it is painful and slow.

Spain's national debt is 50% greater than the headlines report

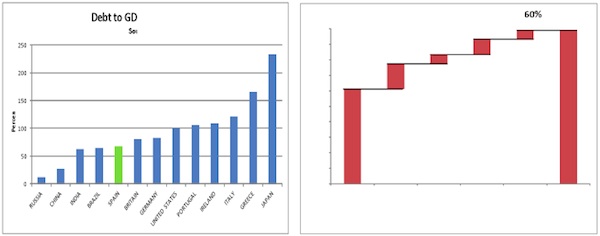

Spain's debt-to-GDP actually looks pretty reasonable compared to that of other countries. In fact, the United States is in worse shape than Spain on this measure alone. A more comprehensive account of Spain's debt, however, suggests that the country's debt-to-GDP is substantially higher, just at the 90% debt-to-GDP level that Rinehart and Rogoff have identified as diminishing GDP growth.

Between 2000 and 2006, Spain's decentralized autonomous regions grew spending, mostly on healthcare and education. None of this debt is counted in the country statistics. Yet health care has proven to be one of the hardest expenditures to cut any where in the world, especially with aging populations. When coupled with the fact that Spain is unlikely to be able to grow GDP, what seems to be a low debt-to-GDP ratio is actually much higher.

Spain's housing prices will fall by an additional 35%

Housing was an enormous driver of the Spanish economy, powering incomes from both the construction and real estate industries, as well as the wealth of homeowners from price appreciation. There is no doubt that there was a housing bubble in Spain. What is remarkable is the size of it in both building activity and prices. Here is a chart of houses and population over the last two decades. While the levels are different, the units are the same: a home for every new person added to the population.

In the United States, the picture is very different. We have been adding about 2.5 people to our population for each home we build. Just the sheer number of homes built in Spain is staggering. Some of this will be foreigners buying second homes, and certainly, this happens more in Spain than in the U.S. But the construction activity was furious.

Developers need an incentive to build a house; that incentive is price, usually appreciating. This spurred the market in the U.S., but it did even more so in Spain.

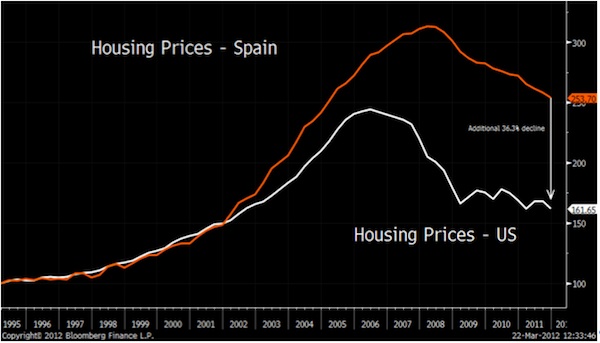

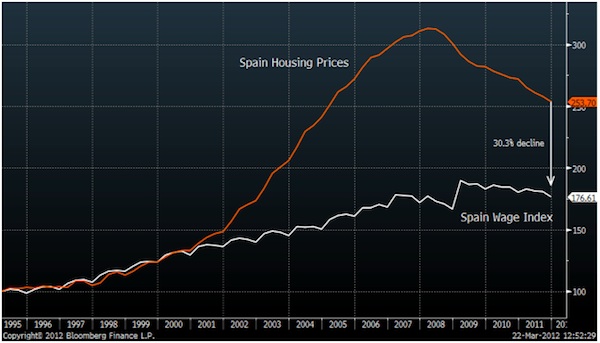

Remarkably, despite the fall from the top, housing prices in Spain are still above the peak in the U.S. Nor are they in line with Spanish wages, as you can see below.

This is before considering the internal devaluation that must occur. Wages must fall in Spain, and this will put even more pressure on housing prices.

One question is why prices have not yet fallen further. There are several reasons. First, mortgages in Spain are all recourse to the borrower. There is no possibility of "jingle mail," where an underwater borrower returns the keys to the bank. In Spain, the bank can come after other assets or earnings. So it is preferable to keep paying and hold onto your home in the hope that prices will come back rather than to declare personal bankruptcy. Second, the banks are desperate to keep loans as current and maintaining interest payments so that they can avoid further reductions to their already depleted capital. We believe that they are making such modifications as taking an amortizing loan and converting it to a bullet loan. This would reduce the monthly payments, but it increases the risk to the bank, as the borrower is not repaying the loan bit by bit.

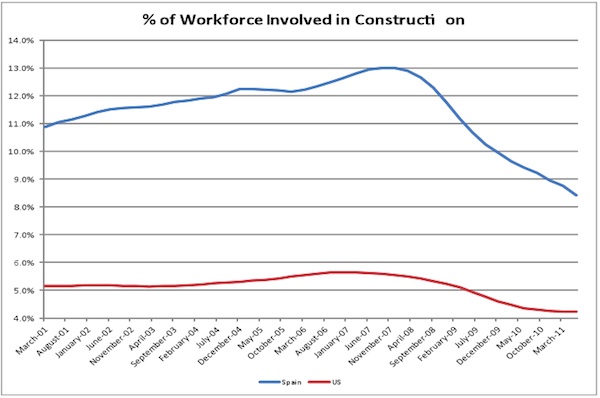

The number of houses being built and their rapidly increasing prices had the effect of generating lots of income and jobs. At one point, one in every seven workers was in construction.

This does not count the people that were involved with the marketing, selling, or financing of all of this real estate. The economy depended on housing and construction; now these jobs are gone and they will not return soon. The question remains, what will take their place in the Spanish economy?

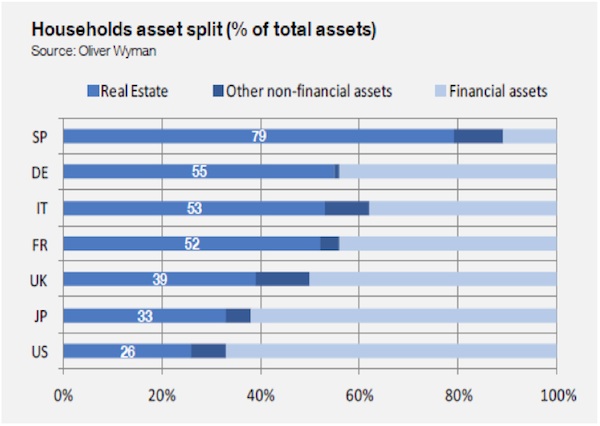

The rapid increase in prices had other dangerous effects as well. Housing provided the best returns on investment of any major asset class from 1990 to 2011. So Spaniards put a frighteningly high percentage (79%) of their wealth into housing.

As people age, they will need to sell their real estate to finance their retirement. This would work if there were people to buy the houses. According to the National Statistics Institute of Spain, those nearing retirement (ages 55-70) will swell by 1.4 million between 2011 and 2021 –these are the home sellers. But the people that are likely to buy (ages 25-40) will decrease by 3.3 million. Given lots of sellers and few buyers, the effect will be twofold. Housing prices will likely continue to fall in the intermediate future, and there will be additional pressure on the government to help retirees more, since their assets will be worth far less than they had planned.

Spain has "zombie" banks, which make massive loans to developers and homeowners

The banks that lent to homebuyers and to the developers of housing projects have not fully recognized the decline in the value of their assets. While Spain has a few notable, truly international banks (Santander and BBVA) with strong assets and franchises, most of the problems are concentrated among the domestic savings banks, known collectively as cajas. Spain has tried to reconcile the problems with its banking assets, but it has consistently raised the amount of money that is needed to restore solvency to the banking system in a piecemeal fashion. The latest estimate is that an additional €50 billion was needed. We believe that the number is more likely a multiple of that, perhaps on the order of €200 billion, given the expected fall in housing price and the highest unemployment in the developed world.

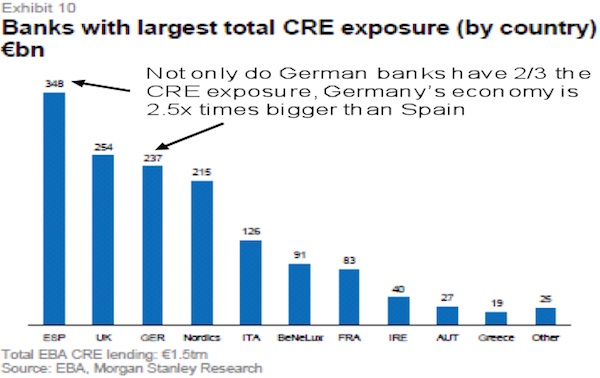

Spanish banks still have an inordinate balance sheet exposure to commercial real estate. Too many of these loans are still to real estate developments that are substantially worthless or to assets whose earning power has been diminished by the failing economy.

Spain's economy has not become stable and will continue to deteriorate

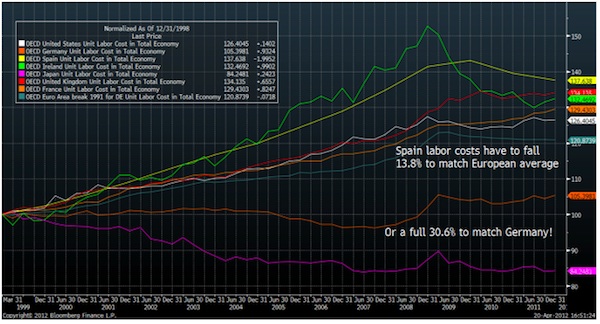

Spain's economy is neither competitive nor balanced. Something is needed to replace the jobs in construction and real estate that will not be coming back. Labor costs, however, are simply too high to attract business successfully. Spain's unit labor costs (in yellow in graph below) needs to fall ~15% to match the European average or a full ~30% to match Germany.

Falling wages will hurt Spain in multiple connected ways. Housing prices will be pressured as homeowners find that they can no longer afford to maintain their mortgages or their homes. Consumption is about 60% of the Spanish economy, so falling wages will reduce GDP until real job growth returns. The government will be pressured by this initially falling tax base, which will hamper its efforts to reduce the deficit. Finally, deflation in wages will lower GDP and make the debt-to-GDP ratio that much worse.

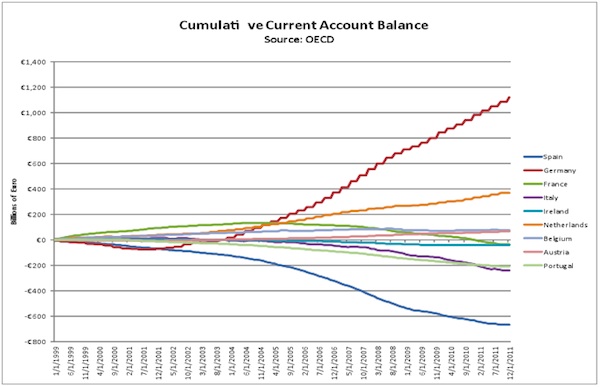

The introduction of the euro caused massive imbalances, and Spain was a net loser. Here is a chart of the cumulative current account balances of the eurozone countries since the inception of the euro.

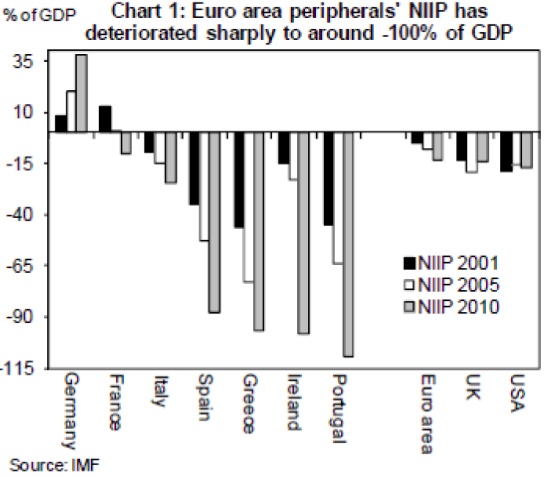

Spain imports far more than it exports, and it has been able to finance this only by leveraging the country to the hilt. The net international investment position (NIIP) of a country is the sum of all its external financial assets and liabilities. Countries with a strong positive NIIP have major claims on other nations' assets, either in the form of debt or equity, while those that are negative have many more foreign claims on them. Spain's NIIP has been a disaster over the last decade.

An NIIP can go sharply negative for "good" reasons. In the nineteenth century, America had a large negative NIIP, as mostly British capital financed the massive increase of productive capacity in the form of railroads, factories, roads, bridges, and other infrastructure. But too much of the decrease in the NIIP of Spain has gone into housing. Housing is not productive per se; it is consumption for the end user – even if it produces income for an owner.

Between 2001 and 2011, the NIIP of Spain decreased by €856 billion. We could find no figures that quantified the value that went into housing. But a back-of-the-envelope measure is this: roughly 5 million homes were built, the average size of Spanish homes is roughly 100 m2 and cost per m2 is in a wide range, from €400 to €1,200.Therefore Spain spent €200 to €600 billion on housing over the decade. Too much of the Spain's borrowing went into an asset that is unproductive.

The EU will not have the firepower or political will to bail out Spain

Spain will need some help from its neighbors. While there has been much talk of the increase in the size of the "firewalls" that Europe has constructed, we remain unconvinced that they have really grown substantially. For example, Germany pledged a maximum of €211 billion to the EFSF, which has been approved by the Bundestag and the Constitutional Court. Neither body has approved a change to this limit. The total size of the ESM and EFSF is not clear at this point, nor is the size of the IMF commitment. Should Spain be denied access to the capital markets like Portugal, Ireland, and Greece and come to rely on help from the public sector, the available resources would be severely strained. Should both Spain and Italy rely on financing, there simply isn't enough money.

Recently, the IMF has announced that it is close to raising $400 billion as a rescue fund. This will help meet the financial needs of the recipient country. But it will also subordinate all the other creditors of that country. The effect might be that creditors become reluctant to lend to a country for fear that they will just suffer subordination once the IMF starts to lend. If the market believes that the IMF loan is big enough to get the country through to stability, then it will continue to lend. If the market does not believe this, the IMF can precipitate the very run it was supposed to prevent.

This does not mean that the measures that the Europeans and the rest of the world have put together are for naught. At some point, there is enough financing to give Spain the time to go through the long and slow process of lowering wages and prices and rebalancing the economy. We are not predicting a sudden collapse, nor do we believe that a major restructuring in Spain is either imminent or even probable in the short or intermediate term. But the market will continue to test the resolve of the Spanish government and its people to find a way to restore balance to the economy.

In summary, Spain desperately needs to find other industries to replace the real estate sector. This will not be easy or quick – realignment of an economy takes time and patience, neither of which the bond market is known for. Spain's issues are not impossible to solve -- there might be time enough to fix what is broken -- but the path is a narrow one, and the problems involve interlocking variables (housing, wages, employment, and growth). There will be more moments of panic and relief before the final story is told.

By John F. Mauldin

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.JohnMauldin.com.

Please write to johnmauldin@2000wave.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.JohnMauldin.com.

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2012 John Mauldin. All Rights Reserved

Note: John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; Plexus Asset Management; Fynn Capital; and Nicola Wealth Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staffs at Millennium Wave Advisors, LLC and InvestorsInsight Publishing, Inc. ("InvestorsInsight") may or may not have investments in any funds cited above.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.