Is The Multi-Month Consolidation In Gold, Silver and Mining Stocks Ending?

Commodities / Gold and Silver 2012 Apr 26, 2012 - 01:57 AM GMTBy: Jeb_Handwerger

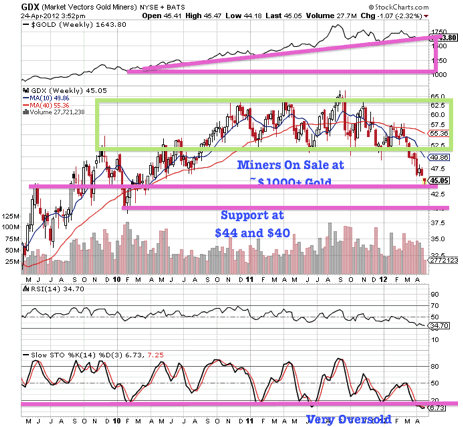

We are encountering storms in the market rarely seen. The volatility has affected many mining equities with many high quality assets selling at record low prices. Portfolios have rarely seen such see saw price activity as they have this year. Sacrosanct rules are simply not working. The markets are thwarting and aborting attempts to use time tested approaches.

We are encountering storms in the market rarely seen. The volatility has affected many mining equities with many high quality assets selling at record low prices. Portfolios have rarely seen such see saw price activity as they have this year. Sacrosanct rules are simply not working. The markets are thwarting and aborting attempts to use time tested approaches.

The great Scottish Poet Robert Burns described the current market by writing, “the best made plans of mice and men go oft astray.” He also observed “alas in this world there is more offal than poetry.” But poetry hardly pays and compost does.

We try to tell it like it is. We do not use the technical jargon of the engineers and the economists that serve more to confuse and obfuscate the investor. In fact it was Einstein who stated, “the nth degree of complexity is simplicity.” We attempt to cut away the fat from the meat. So how do we direct you through these present swamps of despond and misdirection?

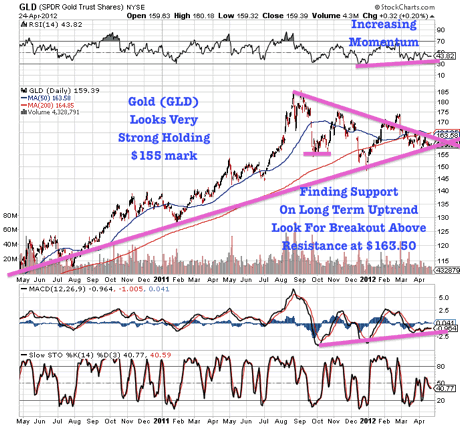

Remember the October 4th low and our reversal signal at 1074 on the S&P 500 made a “V” turnaround and vaulted to a new 52 week high. It remains to be seen whether the rally we have called will mark a rotation into the resource markets and precious metals. If blood is not flowing for mining investors, they are certainly coloring our screens red, while the moribund banks and housing stocks soar driving the S&P higher. Fundamentally something is just not right. The U.S. debt crisis is far from over and this basing period in precious metals and commodities may turn out to be an exceptional buying opportunity as investors rotate from overbought U.S. equities, treasuries and dollars into high quality wealth in the earth assets.

In such a scenario, the U.S. dollar and long term bonds by comparison looks attractive when stacked up against the crumbling currencies of the Eurozone. The chart shows an anomaly occurring. In 2008 and 2010 during the credit crisis and sovereign debt crisis, the dollar and treasuries rallied together. In 2011 and 2012, treasuries hit record highs, yet the U.S. dollar is not at comparable levels. This may indicate that the greenback is losing the safe haven appeal of yesteryear.

We note with interest that in 2011 the Chinese Metal Exchange in Shanghai made ominous noises about raising the margin rate on silver. It would seem that the bankers consistently choose to handicap silver and gold while favoring U.S. bank stocks, dollars and treasuries.

Eventually we believe this suppression of precious metals can only be kept down for a discrete period of time before the pressure mounts in the favor of gold and silver, as if and when Bernanke and his European colleagues return to the printing presses as they have done before and are now indicating to do again.

The miners (GDX) are once again declining and are testing two year lows creating a firesale discount on blue chip producers. The miners are trading at a significant discount to gold at less than $1200 an ounce. Some top notch mining assets in the United States are trading at less than $17 an ounce of resource. This indicates investors are forecasting lower gold prices. We disagree and believe the crowd is wrong here. We are actually near a bottom in precious metals and miners. A turn around should be coming sooner rather than later.

For many months GST has said that there may be a master Keynesian strategy that is being followed to revive the moribund banks of Europe and the United States. This is an ideal time to make this move, the U.S. dollar appears to be stronger for the time being, U.S. bonds are selling at relatively record low yields, unemployment remains high, commodities/precious metals have significantly corrected and the risk of inflation has abated. In fact, they may be already printing LTRO 2 to staunch the Eurozone collapse. Just as QE2 was used by the Federal Reserve Board to staunch the bleeding of the Eurozone in 2010, it is entirely possible that they will institute the latest version of can kicking down the road. Let us hope they “follow the yellow brick road” and we may witness a rotation from overbought equities into tangible assets, commodities and mining equities.

DISCLOSURE: LONG GLD, SLV, GDX

Subscribe to my free newsletter to get up to the minute updates on rare earths, uranium, gold and silver.

By Jeb Handwerger

© 2012 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.