.

delete / Articles Jan 20, 2007 - 07:54 PM GMTBy: Dominick

The Jan 14th update stated: So, what's next? NOW we are finally getting to where I can become comfortable looking for the market to complete my count. I may have started to sound like a broken record, saying, “I still didn't see confirmation of a top and that I needed another new high”. But it's the market's that's been playing this same old sideways tune.

Sentiment indicators have tried to provide sell signals intraday but we haven't closed into those levels. Indicators are diverged, but this recent rally has kept them from triggering sell signals. With that said, the good news is that if I do get the signals any time soon, I can finally be comfortable labeling a chart complete, knowing it's correct.

Well, nothing has changed. I still don't have a sell signal and I don't gauge sentiment at the end of an options expiry week. We opened the week on the S&P trying to poke our heads to higher levels only to find sellers out playing whack-a-mole. We tried on Tuesday, and then again on Wednesday only to selloff into Thursday. Basically, the market's still playing the same sideways tune.

I'm sure many traders were either buying into the new highs or sold the reversal of it thinking it was the big one again . We instead, had our roadmap to use, and it went well. The chart below was posted at 11:00 on Tuesday morning and the rest of the week we waited for the S&P to find its way into and out of the target area. We weren't chasing any moves but instead, buying and selling support and resistance. In 4 th waves, you either trade it back and forth or find a different market that is moving. We did both.

In all, it was a pretty boring week for index trading, seeing more of a healthy pullback than anything else, but it was nice to see members use the Forums to their advantage in other markets. We spent most of the time taking advantage of the drama on the financial news stations in regards to oil. The talking heads have officially gone from bracing us for $100 oil to an almost palpable sense of disappointment as they start to anticipate the price will drop under $30? What happened to peak oil? I think the point to take is that watching the news is no way to make money. Folks, wake up and use your charts or go broke!

I've been looking for a bottom in oil over the last week or two and expressed last week that I was looking to buy it above 54.61. With all the non-stop talk of oil, I posted on Wednesday at 11:00 that I was going to take a small long position. The next day, after rallying off the lows, oil made a slight new low, and has since started to advance upward. It was actually nice to start getting questions like, “What is the symbol for oil futures”, or, “What is the symbol for the ETF?” There are many markets to trade and people are realizing that many of them are actually easier because they move more transparently. Many traders at the Forum took home 2 points of profit from oil and, after they turned off CNBC, laughed their way into the weekend.

If I could have my way, oil would play around at this level a bit and then spike down and reverse leaving no one on board for the next train going to $60 plus. But oil is going to do the deciding and, if it blasts off from here, I have no problem paying up after confirmation that the low is in. We're still under the 54.61 and it's questionable if a low has been established or if another low is needed. The March contract has resistance right above it and I've been taking my profits into the weekend. Once I can see confirmation, I'll either wait for the low or chase the price higher. But, as you can see from this daily oil chart, there was a reason for traders to start buying recently.

If we do get lucky and see a spike to a higher low, a double bottom or a take out of the lows, I expect it to be fast and to reverse. There could be a nice bear trap at 50.50. Being so close to $50 makes you think that it will be penetrated, if only to open the trap door. If that were to happen, I'll be watching 49.70 closely, but the March contract does have targets down to 47.60.

So, as you can see, even though last week was boring, we kept busy. Going forward, we may have plenty of chances to do it again, but we'll definitely be keeping our eye first and foremost on the major indexes. Friday's advance on the S&P will probably have early next week taking off to new highs, where we have the potential of creating a reversal pattern. Otherwise, the S&P's are looking to buy time into either the end of the month, or possibly around February 8th . If so,

we might trade sideways to down until we approach those dates.

The only surprise here would be an impulse move lower, and that wouldn't come as a shock to anyone following the Nasdaq, which might be already heading south. I rather have a pop to short as I patiently watch to see if my NYSE target mentioned months ago reaches perfection. The chart below shows the NYSE weekly at the 9314 target. Sure, at this proximity it would already be considered a hit, but why get in the way of Mother Nature?

And could the DAX be running into nice resistance and getting ready to lead us to what we've been waiting for in the S&P? The chart below seems to think so. Generally, the Dax has been behaving excellently and is another example of a market that's much cleaner than the S&P.

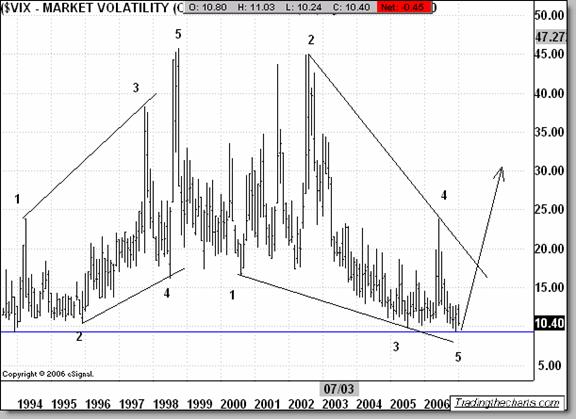

Another area to watch going forward is the volatility index. For years I've joked that the markets would not top until the VIX closed under 10. Not only has it done so, but it now seems to like this level and may want to consolidate or poke even lower in the short term. The chart below, however, shows what the direction of the larger move should ultimately be.

Grains

When one door is closed, another is opened. When the indexes got slow we traded oil. If oil decides to consolidate at this low, we'll find another market to trade. It just so happens that we are watching another hot new item everyone's talking about. I think we have a great technical setup possibly waiting in the grain markets. The chart below, which members can view in the gr a i n forum, shows the setup in detail.

Last week's idea was,

Long positions should now adjust their stops to the idea of resistance close above.

After a 60 point rally, the double top kicked in as the RSI diverged. Nothing has changed. We now need to see what it wants to do, hit my target or start heading down in a big way. I'll lean a bit in favor of my target until proven wrong, but there isn't a good risk/reward trade here in my opinion. Staying out of a market until there is something to work with is a good choice. Again, when one door is closed . . .

Metals

Precious metals have been swinging pretty nicely of late, even though they holding roughly to sideways consolidation patterns. For more in depth analysis, be sure to read Joe's weekly Precious Points updates.

Have a great week trading, and don't forget:

“Unbiased Elliott Wave works!”

By Dominick

For real-time analysis, become a member for only $50

If you've enjoyed this article, signup for Mar k e t U p dates , our monthly newsletter, and, for more immediate analysis and market reaction, view my work and the charts exchanged between our seasoned traders in TradingtheCharts forum .

Continued success has inspired expansion of the “open access to non subscribers” forums, and our Market Advisory members and I have agreed to post our work in these forums periodically. Explore services from Wall Street's best, including Jim Curry, Tim Ords, Glen Neely, Richard Rhodes, Andre Gratian, Bob Carver, Eric Hadik, Chartsedge, Elliott today, Stock Barometer, Harry Boxer, Mike Paulenoff and others. Try them all, subscribe to the ones that suit your style, and accelerate your trading profits! These forums are on the top of the homepage at Tradi n g the Charts. Market analysts are always welcome to contribute to the Forum or newsletter. Email me @ Dominick@tradingthecharts.com if you have any interest.

This update is provided as general information and is not an investment recommendation. TTC accepts no liability whatsoever for any losses resulting from action taken based on the contents of its charts, commentaries, or price data. Securities and commodities markets involve inherent risk and not all positions are suitable for each individual. Check with your licensed financial advisor or broker prior to taking any action.

Dominick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.