Silver Speculators Absolutely Killed

Commodities / Gold and Silver 2012 May 07, 2012 - 02:18 AM GMTBy: Marshall_Swing

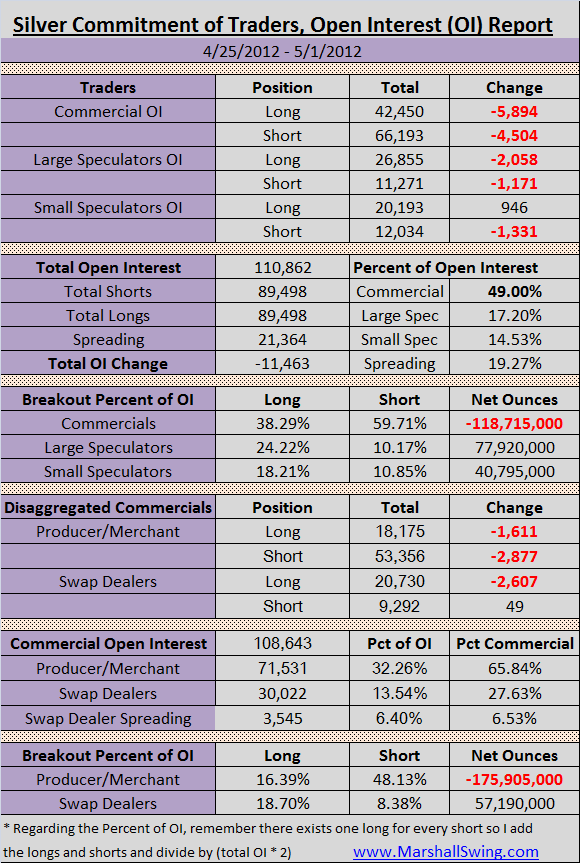

Commercials unloaded -5,894 long contracts and covered -4,504 shorts to end the week with 49.00% of all open interest which is an increase over the previous week. They are currently -118,715,000 ounces net short, a huge increase of about -7,000,000 ounces.

Commercials unloaded -5,894 long contracts and covered -4,504 shorts to end the week with 49.00% of all open interest which is an increase over the previous week. They are currently -118,715,000 ounces net short, a huge increase of about -7,000,000 ounces.

Large speculators were bounced out of -2,058 contract longs and were forced to cover -1,171 shorts for a net long position of 77,920,000 ounces, another dramatic reduction of almost -5,000,000 net longs from the previous week.

Small speculators held their longs and are now way, way out of the money as they added 942 longs this period and were blasted out of a huge -1,331 shorts for a net long position of 40,795,000 ounces an increase of over -11,000,000 ounces from the prior week. Our small speculators are in big trouble with their newer long positions.

In the disaggregated Commercials, the Producer/Merchant raked in the money by selling -1,611 longs in the money while also raking in millions in cash with the covering of -2,877 shorts for a net short position of -175,905,00 ounces net short. The Swap Dealers may have broken even or better by raking in some cash selling -2,607 long positions. Perhaps they get an ear full from their Producer/Merchant friendly traders at JP Morgan while diong lunch with our crooked bankers... Their net long position dropped over -13,000,000 oiunces.

Just as I predicted, last week, the speculators were absolutely killed, particularly the small speculators who bet against the tide last week as they are on the wrong side of long right now and out of the money. Whoever is trying to play the commercial's game is almost always going to lose.

I have documented these Producer/Merchant games, endlessly, and I sincerely hope someone at the CFTC or in the Congressional oversight committee is listening. How long will the people, the large and small speculators, remain silent and not call the CFTC at least once a week and blast the telephones of Gary Gensler and Bart Chilton?

For your convenience, if you would like to contact the CFTC and express your views to them, I have provided you their phone numbers: http://www.cftc.gov/Contact/index.htm and email addresses as well:

GGensler@cftc.gov

MWetjen@cftc.gov

Bchilton@cftc.gov

Jsommers@cftc.gov

SOmalia@cftc.gov

How long must the there exist no free market for speculators in the COMEX metals? How much ill-gotten gain at the hands of these producer/merchants is enough for these commissioners to act and do their jobs to ensure a free market can counter their massive open interest monopolies?

The only way to beat the producer/merchants at their game is to go long and stay long. Easier said than done when you watch price drop significantly below your buy price, I know.

See you next week!

Marshall Swing

The Got Phyzz? Report

© 2012 Copyright Marshall Swing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.