Credit Crisis to Escalate as Mortgage Bond Market Losses to Pass $3 Trillions!

Interest-Rates / Credit Crunch Jan 24, 2008 - 06:18 PM GMTBy: Jim_Willie_CB

Bankers, Wall Street hucksters, financial network commentators, and floating analysts seem to have flunked basic arithmetic in grand fashion. Maybe they only expose the next link in a long chain of deception, their apparent expertise. One hears estimates of $200 billion on total mortgage bond losses from the Secy of Inflation Ben Bernanke. One witnesses the series of bond writedowns by Wall Street banks. One can read of Wall Street economists like Jan Hatzius of Goldman Sachs, who cites $400 billion in potential bond losses, a favorite figure cited by other bankers. One is subjected to press anchors and their simplistic echoes of bond losses. One is endlessly lectured by highbrow analysts of the extent of bond damage. The trouble is, they all cannot do simple arithmetic and observe the billboards on mortgage bond indexes, fully available.

Bankers, Wall Street hucksters, financial network commentators, and floating analysts seem to have flunked basic arithmetic in grand fashion. Maybe they only expose the next link in a long chain of deception, their apparent expertise. One hears estimates of $200 billion on total mortgage bond losses from the Secy of Inflation Ben Bernanke. One witnesses the series of bond writedowns by Wall Street banks. One can read of Wall Street economists like Jan Hatzius of Goldman Sachs, who cites $400 billion in potential bond losses, a favorite figure cited by other bankers. One is subjected to press anchors and their simplistic echoes of bond losses. One is endlessly lectured by highbrow analysts of the extent of bond damage. The trouble is, they all cannot do simple arithmetic and observe the billboards on mortgage bond indexes, fully available.

Put aside for a minute the fact that the mortgage debacle in the United States is described as a subprime loan problem. The entire gaggle of banker goons and press parrots have their reasons for insisting on focusing entirely on subprimes. It makes the problem more marginal, more understandable, more excusable. Dumb lenders gave home loans to bad borrowers. OK! Follow this path of incredibly easy math. The total of all US $-based mortgage bonds is $10.4 trillion. A conservative estimate of the prime mortgages within this giant mass is $7 trillion. We all know it is more, so bear with my lowball for argument sake.

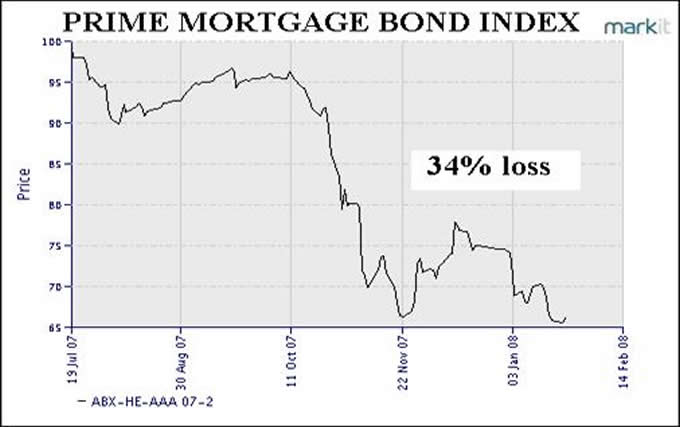

The prime mortgage bond index measures an aggregate of prime rated bonds scattered across the beleaguered fifty states, varying over loan size from large to medium to small. The ‘AAA' mortgage bond index has lost a whopping 30%, a fact that continuously eludes the big bankers and their legion of obsequious monitoring mavens. Simple math, within the grasp of a 9-year old kid, results in prime mortgage losses amount to at least $2.1 trillion. The kid might have trouble with all the zeroes though, and even be confused by what a trillion is. A trillion is a million millions.

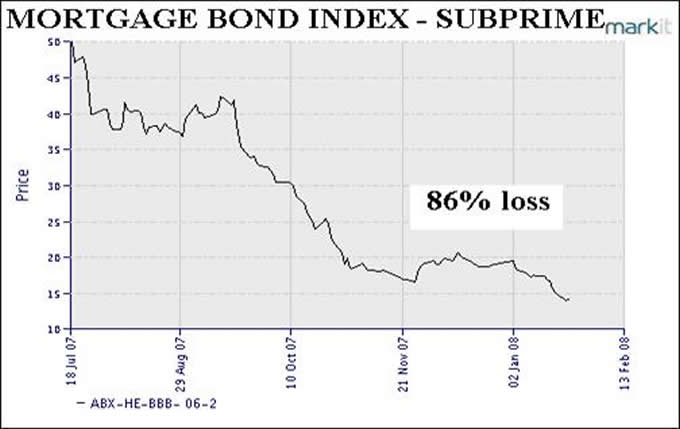

The size of the subprime mortgages in the United States is estimated at $1.4 trillion. The ‘BBB' mortgage bond index has lost 80% of its value. It too measures an aggregate of such mortgage bonds across the US , of various size loans. So subprime mortgage bonds have lost over $1.1 trillion. If subprime bonds have lost a trillion$, why cannot supposed experts estimate that the total asset backed bond losses to be at least a cool trillion$?

Add the two numbers from subprime and prime together to reach a $3.2 trillion in their bond losses. This total does not account for the middle tier ‘Alt-A' mortgages, no small sum either. That is probably close to another $1 trillion in bond losses. Alt-A mortgages do not receive much attention. They are essentially more subprime slime with a more obscure name. Their decline rate for associated bonds is almost as horrible as the subprimes. Even if they are omitted in the argument, the point remains just as dire. This summer the avalanche of innovative prime adjustable mortgages will be the wreckage to report. The bonds have fallen in value, but the writeoffs have yet to make the news. All in time.

DAMAGE SUMMARY ON A NAPKIN

Let's summarize in plain bold letters so as to avoid any confusion. These comments require plan language. Clear numbers are needed in clear statements.

PRIME MORTGAGE BOND LOSSES AT LEAST $2 TRILLION

SUBPRIME MORTGAGE BOND LOSSES TOTAL OVER $1 TRILLION

THE TOTAL MORTGAGE BOND LOSSES ARE OVER $3 TRILLION

THE OFFICIAL ESTIMATES ARE WRONG BY A FACTOR OF 10 !!!

GOLD WILL SKYROCKET WHEN THESE NUMBERS ARE FINALLY REPORTED

So why are all the so-called experts spouting about $200 billion in total bond losses? Why are Wall Street economists talking about $400 billion in extensive losses? A simple conclusion is that they prefer to lie and deceive, as they defend their industry. Most savvy observers are hard pressed to identify the last time Wall Street and their gaggle of advertisement vehicles actually told the truth. When people ask me why such a huge volume of lies is routinely told, my answer is always the same. Check the advertisers of CNBC, Wall Street Journal , Barrons , even Investors Business Daily .

They are almost all the same: big banks, brokerage houses, mutual funds, mortgage lenders, and related firms, mostly of them headquartered in New York City . By the way, not a single felony conviction has stuck against a New York City defendant in court. All the convictions are of non-club members roaming other regions. The consequence of being beholden to such a chorus of advertisers is lost objectivity, blatant bias, active deception, and comprehensive obstruction to present the facts in a truthful light. Their message has become simple. “Do not panic, wait it out, because we are desperately trying to sell from our cratering portfolios.”

The USGovt stimulus package at $150 billion is being floated, replete with minor tax cuts, and a puny amount of money doled to each households. This is peanuts. Ben Bernanke is a bit late in living up to his name of ‘Helicopter Ben' actually. The name ‘B-52 Ben' is in no way deserved, not yet. Questions are asked if the USGovt fiscal plan is enough. Of course not!

The stimulus is ten times smaller than required, because the estimated size of the problem is ten times smaller than reality. Unless and until the authorities in charge of this implosion of financially engineered tinkertoys get serious, when a rescue package and resolution platform are designed and put into action valued in the trillion$, they are urinating on raging bonfires. The USFed has put a very small amount of money into the banking system since August, under $20 billion net.

BIAS AMONG BANKERS

Without any doubt, the Wall Street conmen and the clueless rookies running the US Federal Reserve choose not to properly assess the problem. They are totally unwilling to tell the public that the risk price modeling system is being unraveled totally, that the mortgage debacle has wrecked the banking system totally, that the USEconomy is going to be dragged down in a tragedy. The USFed and even the US Dept of Treasury are delighted to see a recession, since it makes demand grow for USTreasurys. Therein lies a blatant bias. These clowns talk a lot about transparency, when such spotlights have exposed the banking system as insolvent.

These charlatans talk a lot about the virtues of home ownership, when they have become agents to destroy life savings. A grotesque transfer of wealth has taken place using mortgage bonds as the theft vehicle, from the homeowners to the mortgage originators and mortgage bond sales force, FROM FEES. Big investment institutions are bag holders, like pension funds, insurance firms, hedge funds. As USTBill yields decline, borrowing costs for the increasingly bankrupt US book of business decline. Borrowing costs might become a huge portion of the ongoing federal budget and its deficit.

The banking leaders much prefer a recession to a big bout of price inflation. They have a destructive policy at work, to prevent what they call ‘Secondary Inflation Effects' from taking root. In other words, they can tolerate systemic price inflation in energy costs, material costs, service costs, insurance costs, but heaven forbid any increase in wages. They steer the system towards a Middle Class squeeze. Wages have fallen by USGovt nitwit analyses by 4% to 5% since 2003 on an inflation adjusted basis. So if realistic inflation adjustment is used, employing the 7% to 10% CPI rise seen in the last few years, the Middle Class has suffered a 20% to 25% wage crush in real terms!

Those analysts who have been forecasting severe problems do not receive proper credit. Instead, they are criticized, disrespected, and called lucky. They are even called part of the problem, as they contribute to the erosion of confidence. My position is steadfast, consistent, and stern. The US financial system embodies institutional dishonesty, fully intertwined throughout the entire system. With each passing month, another huge story of fraud is revealed. We need a new cable television network just to track US financial fraud.

Today we were treated to yet another deceptive home sales report. The December existing home sales were down 2.2% in sequential sales. Yet, the home inventory supply improved to only 9.6 months, down from 10.2 months in November. Just how did inventory improve when sales continued to decline? EASY, people are removing homes for sale, taking their listing off multi-listing services, in response to a lousy market. They hope for a better day, one which will not come. The homes were not sold, so supply was reduced by decisions.

RESILIENT GOLD, SHINY TOO

Gold is resilient. Its price has a fail-safe mechanism against declines. When gold falls in price, the factors weighing it down are the same as what forces central banks to cut interest rates. At the Vancouver Gold Show on Monday, on stage my words were to watch gold bounce back when the USFed made an interim rate cut in the next couple days. My guess was given a 30% chance of occurrence. It happened the next day! An argument was claimed that in several months, the decline in the gold price toward 850 would be part of a uptrend not even recognized for the one-day big selloff. My words at the breakout session were to expect the gold price to rebound with strength as soon as the USFed took responsive action, since London bankers were making telephone calls now. And London guys share the big power with other guys in Old Europe. The Swiss uber-bankers are angry. They are taking back control. See Basel 2 bank rules and their changes.

When the Europeans soon join in the coerced rate cuts, the gold price will rise in Europe . In a competing currency war, gold wins across the board since they all devalue their currencies versus gold!!! The gold price is back over 900 again, set to retest the 915 high. Notice the mild ‘Bull Hammer' signal evident this week, an incomplete week. The intra-week lows have been erased. The reversal was bullish. The Arabs and Asians would have come to rescue gold if not for the USFed. Be totally assured that Goldman Sachs was buying gold contracts on Monday, knowing full well that the USFed would make an interim cut. Such are the benefits of the Fascist Business Model. The rally is back, but my suspicion is the 915 gold price will hold and a retest under 900 must be completed. The key here is the Euro Central Bank. They can force a recession across the Eurozone, or else join in the global price inflation engineering. Debts cannot be permitted to grow out of control. A bank crush cannot be permitted to spill over to the mainstream economies.

JUSTICE SERVED AND TO BE SERVED

The financial sector to date has avoided felony charges, but not lawsuits. Regulators have permitted untold fraud, sitting on their hands. Those committing fraud have friends in the regulatory agencies, even the federal prosecutor posts. The lawsuits might possibly bring some semblance of justice to the big picture. Of course, the compromised USGovt officials, the hapless USFed chairman, the omnipotent Goldman Sachs henchmen, the sleazy hidden JPMorgan spooks, they might deliver a message or phone call to some judges to interfere with the lawsuit process.

WE MIGHT JUST FIND OUT HOW ANGRY INDIVIDUAL STATES ARE AT THE FEDERAL YESMEN AND CANCEROUS CONMAN NEW YORK BANKERS.

The nation is a collection of states, after all. The federal government has usurped powers. The Manhattan Made Men have sucked so much blood out of the living American corpse, that the states might be in the process of fighting back. Watch the Cleveland city lawsuit set against a dozen big banks for a clue. The state of Ohio has been hard hit by home foreclosures. The city mayor accuses the big banks of predatory practices and worse. He likens them to organized crime. Wow! Finally an accurate description. He might be in line for a car accident, or a heart attack, or much missing funds in the city coffer, some smear.

For the longest time white collar crime has been minimized and tolerated. Rob a store of $500 with a gun and receive 10 years in prison. Rob a pension fund of $500 million with a pen and not even be indicted, let alone even be deemed in need of social isolation. Why are Wall Street bankers not being indicted for fraud? Of course, it makes sense. Because the banking system would collapse without their beneficence and key role steering the economy. We all need their guiding hands. And also, because they run the government prosecutor agencies, a minor fact. In the last month, when watching the debacle unfold, a mindboggling thought came.

The criminals on Wall Street are designing the solution. Why is that? Only in America can perpetrators of fraud design solutions to the grotesque problems they caused. Not only that, they will probably administer the programs as part of the solutions, thus profit more. More fraud will appear in the programs as well, just like with the Hurricane Katrina relief program. Neither has the fraud been prosecuted in the Hurricane programs nor the Wall Street bond fraud. Watch the lawsuits, especially the class action suits. Class actions are different, and involve federal courts, unlike the individual cases. When an account holder challenges the brokerage house, the case goes to compulsory arbitration with a former brokerage firm official presiding, and very few wins for more minions. Watch the class action lawsuits!!!

REALITY SINKING IN

As the situation becomes more clear on the broad and deep extent of the wreckage, more and more people will realize that my summertime forecast of a $2 to $4 trillion bailout makes sense. They will trot out their insane platform of a New Resolution Trust, built atop an acidic cesspool of Fannie Mae and Freddie Mac. Some wonder why fresh new platforms are not built, why fresh new banks are not erected as the old fraud-ridden Wall Street banks are let go to liquidation in bankruptcies.

The answer is simple: liquidation of old corrupt financial entities would require a complete accounting of their mountain of credit derivatives, of their gold derivatives, of their currency derivatives.

The 1998 LongTerm Capital Mgmt was not permitted to endure liquidations, since the powerful men in suits did not want for gold to rise by $500 more per ounce, exposing the Bank of Italy in its hidden leases to Wall Street hedge funds. So the monetization papering over of the problems will continue on a greater scale.

News items are growing uglier by the day. The second biggest bank in France, Société Générale announced a $7.1 billion loss from a rogue bond trader involved in fraud. Was blame put on one man instead of putting their entire bank management under scrutiny? They join in the Hall of Shame the firms Sumitomo, Barings, and Kidder Peabody in lax trading oversight. Ford Motors announced a 54 thousand job cut, at a time when USGovt officials claim the economy is still expanding. Not to worry! The Qatar government has decided to put $15 billion of cash into twelve ailing US and European banks. Why do they do that? Simply because many US & Euro banks are insolvent, a nice word for bankrupt.

The bond insurers are the big story these days. Ambac was downgraded by the debt rating agencies last Friday. MBIA, ACA Capital and a small gaggle of bond insurers are sitting on a mountain of dead credit default swaps. One day we might awaken to learn that those who thought they had a profit from credit default swaps are actually holding nothing, since the counter-party is dead as a doornail. If only we could arrange counter-party risk holders to reside on the planet Mars, outside our system. A credit default swap is an insurance contract against $10 million in debt securities, such as mortgage bonds or corporate bonds. As distress is felt, the bond loses value while the swap rises in value.

The 50% annual rise in the credit derivative volume of outstanding contracts owes mainly to the burgeoning growth in credit default swaps.

As mortgage loans flooded the banking system, and their bonds flooded the credit market system, some measure of insurance was taken out. Too bad pay days on those insurance claims will be absent. Watch the municipal bonds insured by Ambac and MBIA. They might be forced into sales by institutions soon, or else just permit the munis to run naked without insurance at all. Some cities and towns might order huge budget cuts.

The USDollar money supply is growing at alarming rates, sure to go much higher. The gold price rises with this growing supply, now clocking a 15% annual rate. The biggest story among central bankers right now is how the Euro Central Bank is being coerced to cut rates. We are watching the quintessential ‘Competing Currency Wars' with a series of competitive currency devaluations to ensue. The Canadians relieved their loonie rise by cutting rates. The Bank of Canada will cut more. The British relieved their sterling rise by cutting rates. The Bank of England will cut more. My January Gold & Energy Hat Trick Letter contains a very important forecast on the British banks, sterling currency, and economy. The EuroCB is mired in internal confrontations.

The Germans remain hawks against price inflation, with vivid memories of Weimar times. The French advocate rate cuts, led by Sarkozy. In time, the EuroCB will cave in from the currency war. The US Federal Reserve cut the official interest rate by 75 basis points, a forecasted call made on stage by me on Monday at the Vancouver Gold Show. Now pressure is extreeeeme on the EuroCB to cut also, or else suffer from a euro currency vaulting over 150. Bond yield spreads favor the euro too much. The tougher the Europeans act against price inflation, the more serious damage their economies will suffer from a high currency rendering harm to exporters. Unlike the USEconomy, the Eurozone economy has a hefty trade surplus on the order of $10 billion per month. The USFed remains well behind the curve. With a 2-year TBill yield at 2.2% (it was under 2.0%), and the Fed Funds at 3.5% now, the USFed is still behind the curve. Their rate cuts will not affect the USEconomy for some time, maybe six to nine months. The stock market likes the news, but corporate profits are sure to decline badly.

THE UPSHOT OF THE COMPETITIVE CURRENCY DEVALUATIONS IS THAT GOLD WILL RISE IN EACH ECONOMY WHOSE BANKERS EXECUTE INTEREST RATE CUTS. THAT MEANS ALL OF THEM, WITH THE EUROPEANS BEING THE LAST.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

“You are part of a little community of real contrarians, rather than one of the many educated technical contrarians with mainstream American views. For me and my friends, it is a matter of financial (and perhaps personal) survival in the next 4 to 5 years of financial and political upheavals which again will plunge the world into the abyss. Newsletters like yours are essential to look through the spin and disinformation glut and give some trading directions.” (KarlW in Germany )

“The unfortunate demise of Dr. Kurt Richebacher leaves Jim Willie, Bob Chapman, and Jim Sinclair as the finest financial minds on the scene today.” (DougR in Nevada )

“There are four writers that I MUST READ. You are absolutely one of those favorites!! William Buckler, Ty Andros, Richard Russell, and YOU!!” (BettyS in Missouri )

“Your newsletter caught my attention when the Richebächer report ended. Yours has more depth and is broader in coverage for the difficult topics of relevance today. You pick up where he left off, and take it one level deeper, a tribute.” (JoeS in New York )

“I am currently subscribed to over 60 paid newsletters. Your analysis is by far the most accurate every time. The most impressive characteristic of your thought processes is your ability to think in multi-factorial terms. You are one of the few remaining intellectuals with such capacity intact.” (Gabriel R in Mexico )

By Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 24 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.