FTSE - A rose between two thorns - MAP Analysis

Stock-Markets / UK Stock Market May 21, 2012 - 12:17 PM GMTBy: Marc_Horn

In MAP Analysis Part 1... I said the FTSE is showing some anomalies and needs further analysis!

In MAP Analysis Part 1... I said the FTSE is showing some anomalies and needs further analysis!

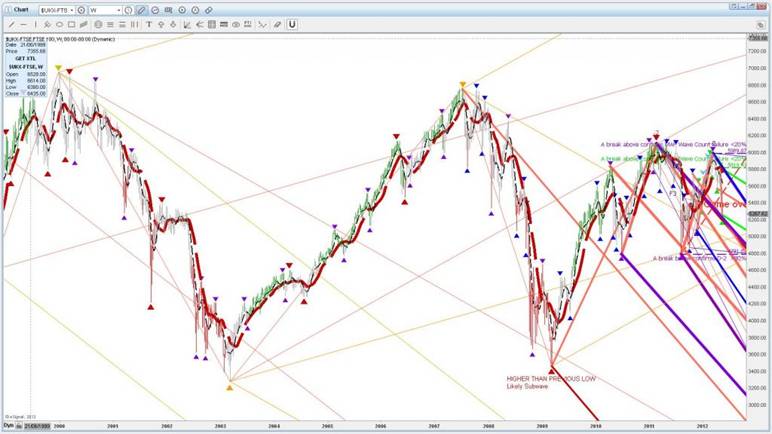

The reason stated was that it appears that there was a subwave build up and having analysed it further using the principles described in parts 1 through 5 the picture is indeed one of subwaves and is not rosy! I have zoomed in on the big picture so you can see the waves within waves.

You can clearly see the wedge formation and from MAP Analysis Part 2.... know that this is an pattern that indicates the presence of subwaves, and when it breaks out of this pattern expect big moves! MAP Analysis shows you the direction of that move!

Wave formation and count from 2000 top.

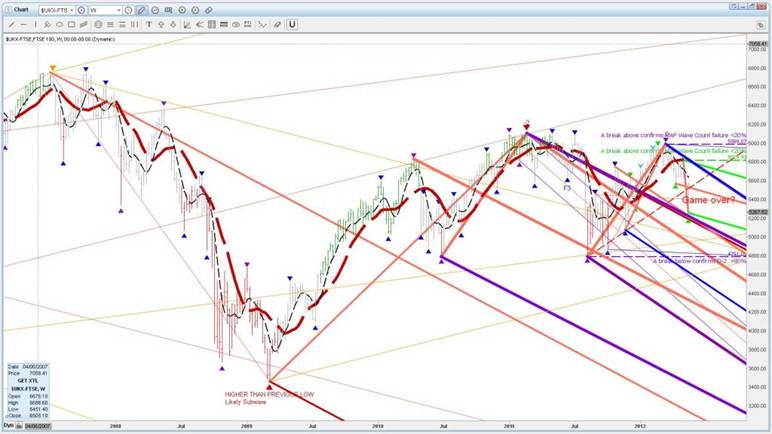

Wave formation and count from 2007 top. Note all MAP Analysis cycle forks are pointing down!

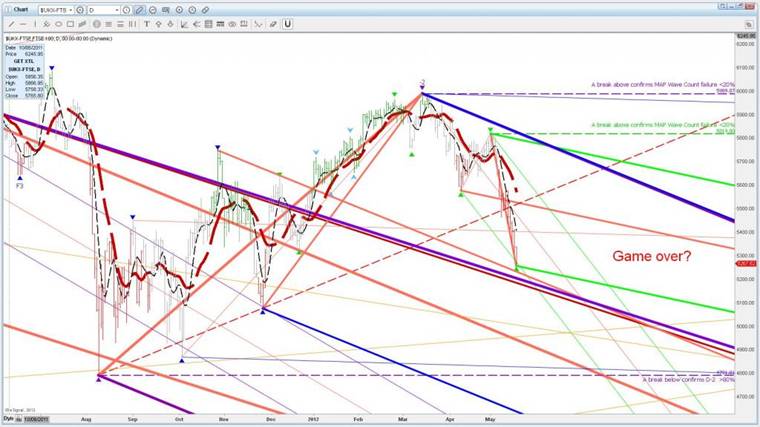

Last weeks price action broke the 04 bear break line and hit the H012MLL. Prices should bounce with a possible retest of the bear break line at the intersection with the H, 4H and Daily MLU here before resuming the down trend to the 4H345ML, D0-1-2ML, weekly 0-1-2ML and monthly 345ML.

This is a very negative setup.

For the first time I will add some substantiation which reinforces this outlook:

Money printing has not worked and the UK is officially back in recession.

Unemployment is not showing any signs of downtrend.

Budget deficits and total debt is growing despite propaganda to make the public think austerity is being implemented with cut backs.

Inflation with the exception of the drop in late 2009 has been above the government’s target of 2% since early 2008. It has been above the maximum mandate of 3% since January 2010 (these are the fudged government figures!)! Inflation is the result mis-allocation of capital and is the governments stealth tax on the savers as Nadeem has pointed out in his many articles. Even on the Bank of England website it clearly states in its first 2 lines A principal objective of any central bank is to safeguard the value of the currency in terms of what it will purchase. Rising prices – inflation – reduces the value of money.

Unless we start to change our behaviour which drives these cycles as explained in MAP Analysis Part 3 ... the future is bleak!

Click here to follow your duty of care:

Probabilities are derived from the methodology described therein,

Use and copyright is described therein.

For more information of how I do what I do http://mapportunity.wordpress.com/ . Comments and discussions very welcome!

The statements, opinions and analyses presented in this site are provided as educational and general information only. Opinions, estimates, buy and sell signals, and probabilities expressed herein constitute the judgment of the author as of the date indicated and are subject to change without notice.

Nothing contained in this site is intended to be, nor shall it be construed as, investment advice, nor is it to be relied upon in making any investment or other decision.

Prior to making any investment decision, you are advised to consult with your broker, investment advisor or other appropriate tax or financial professional to determine the suitability of any investment.

© 2012 Copyright Marc Horn - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.