Schumpeter's Creative Destruction and Nokia's 41 Megapixel Camera Innovation

Companies / Telecoms May 24, 2012 - 04:16 AM GMT In Capitalism, Socialism and Democracy, Joseph Schumpeter coined the term "Creative Destruction" to explain the capitalist process of innovation. Innovation is continually disrupting and transforming companies, industries and entire global economies built on the demands, risks and rewards of international free market capitalism. Innovation and creative destruction is an integral part of economic and financial market cycles, large and small, and therefore in the rise and fall of company fortunes and their shareholders.

In Capitalism, Socialism and Democracy, Joseph Schumpeter coined the term "Creative Destruction" to explain the capitalist process of innovation. Innovation is continually disrupting and transforming companies, industries and entire global economies built on the demands, risks and rewards of international free market capitalism. Innovation and creative destruction is an integral part of economic and financial market cycles, large and small, and therefore in the rise and fall of company fortunes and their shareholders.

Apple (AAPL) has out innovated its peers over the past few years. The creative genius and marketing prowess of Steve Jobs caught many technology companies flatfooted. The iPhone and the iPad have sent competitors reeling, and sent many hurtling toward bankruptcy. Nokia (NOK) is one of the companies shaken to its foundations by Apple innovation and competition that has unleashed creative destruction. Nokia management and the company got too comfortable with their success. Apple has executed almost flawlessly of late with innovation that has dazzled customers and captured market share.

If a company does not have innovative management, or is not free to innovate due to the constraints of excessive regulation and taxation, it is handicapped for failure. The forces of creative destruction decree that if a company does not innovate, it does not survive. This is especially true in the technology industry, where global competition is fierce, and product life cycles are shorter than in many other industries. One reason the U.S. economy is now on the ropes is that excessive regulation and taxation have seriously reduced the ability of companies to innovate, but even in the anti-business climate, innovation is occurring.

Schumpeter also penned the two-volume Business Cycles. He was an expert on the Kondratieff long wave and smaller business cycles and saw innovation and creative destruction as playing an integral role in the rise and fall of both the business cycle and the global economic long wave cycle of global boom and bust. Schumpeter penned the following on the role of innovation and creative destruction in the capitalist process.

Capitalism [...] is by nature a form or method of economic change and not only never is but never can be stationary. The fundamental impulse that sets and keeps the capitalist engine in motion comes from the new consumers' goods, the new methods of production or transportation, the new markets, the new forms of industrial organization that capitalist enterprise creates. [...] The opening up of new markets, foreign or domestic, and the organizational development from the craft shop and factory to such concerns as U.S. Steel illustrate the same process of industrial mutation [...] that incessantly revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one. This process of Creative Destruction is the essential fact about capitalism. It is what capitalism consists in and what every capitalist concern has got to live in.

These macro facts on capitalist innovation and creative destruction are lived out day in and day out in the lives and work of the research and development teams of companies. Apple is drubbing the completion at present. The innovation of Apple has played a role in undermining the market dominance of Nokia, forcing them to do some serious corporate soul searching and sending them back to the drawing board.

Nokia is now striking back with some dazzling innovation of their own. Nowhere is this more evident than in the Nokia 808 PureView, armed with a 41 mega pixel camera that is sending cell phone aficionados and photographers over borders to get their hands one. It remains to be seen if and how this new Nokia technology is going to team up with Microsoft (MSFT).

A new video available on YouTube from Nokia documents the 5 years of work and innovation by the Nokia team that went into the 41 megapixel camera of the Nokia 808 Purview: http://www.youtube.com/watch?v=8g7wct1hTRo. What is cool about this video covering the process of innovation on a product is that it introduces you to the Nokia team members pursuing their purpose of innovation and new technology products. The results of their pursuit of purpose is amazing innovation that is sure to trigger some creative destruction in the global cell phone and tablet market. Additional information on the Nokia 808 PureView is available on the Nokia website.

Game changing innovation in companies like Nokia that have seen their share prices hammered is where it starts getting interesting for investors. Schumpeter's interest in capitalist innovation at companies went hand-in-hand with his study of business and market cycles. The ebb and flow of the global long wave cycle of boom and bust is produced by the creative destruction of individual companies multiplied over the entire economy. Schumpeter believed the Kondratieff long wave, aka The K Wave, is the most important tool for economic prognostication.

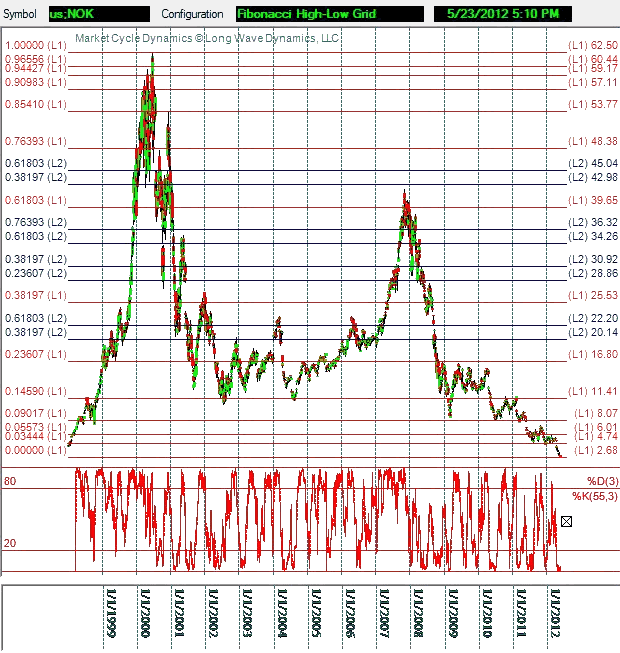

The large and small cycles can be tracked over the entire global economy in major market indexes, or in individual companies like Nokia (NOK), or Apple (AAPL). The chart below is the Level 1 Fibonacci Grid of Nokia, covering the 2000 high to the low at 2.68 on 5/23/12. Nokia has made a remarkable roundtrip.

In our cycle tracking work, in addition to the long wave, we track the Wall cycle, aka known as the 20-week trader's cycle. This cycle has an ideal length, but they run long and short in Fibonacci ratios in time to the ideal cycle. By tracking the Wall cycle in price, time and sentiment, using Fibonacci and stochastics, investors and traders can identify buying opportunities. The bottom of a Wall cycle is where you find real values in large cap global franchise companies. The indexes are at a high probability Wall cycle low.

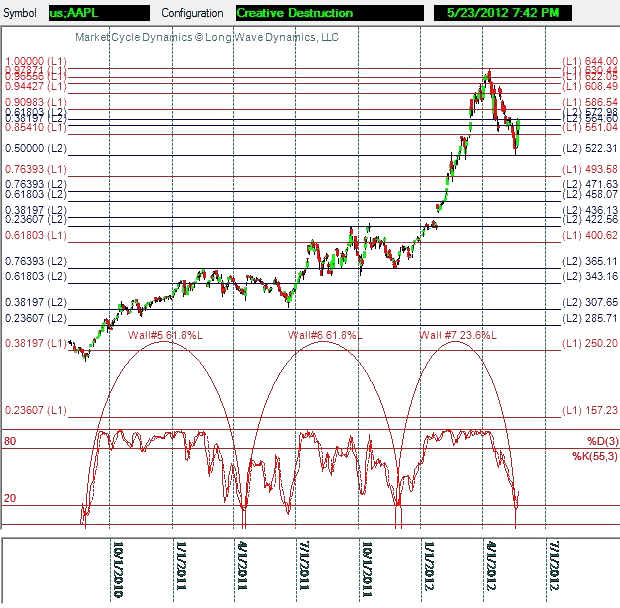

Apple (AAPL) was briefly oversold on the 55-daily slow stochastics and made a Wall cycle turn. The Level 1 Fibonacci grid on the Apple chart below uses the December 200 low at 6.8125 and the 2012 high at 644. Notice that Apple turned on a Level 2 50% target. Apple is in no immediate danger from Nokia. Many tech stocks are one Wall cycle ahead of the indexes. They are benefiting from emerging market demand far more than the average stock in the indexes.

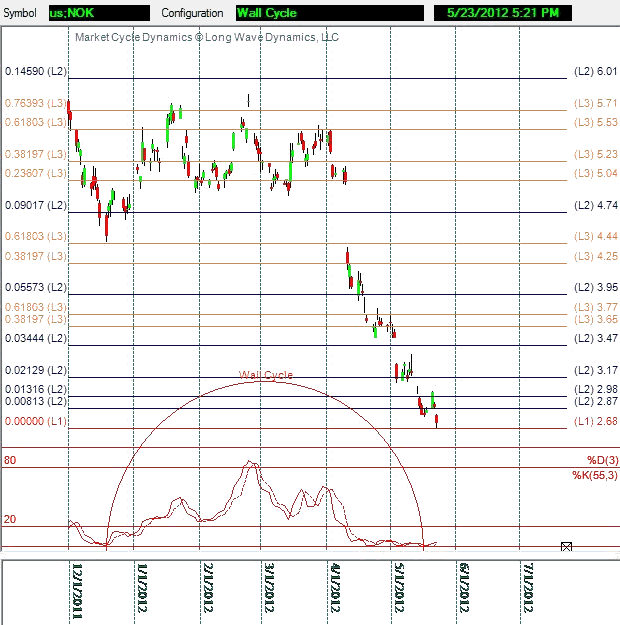

The Nokia chart below reveals the current Wall cycle, which appears to be approaching a low in price, time and sentiment. Nokia clearly has its work cut out to challenge Apple. The drill-down Fibonacci grid method using the important highs and lows as the Level 1 grid in any index or security is a method of price analysis that helps detect the algorithms generating turns of high frequency traders (HFTs). A hot grid, with many hits on key grid targets, can identify important turns in any market index or individual security.

Benjamin Graham, the father of value investing advocated the use of formula timing plans as methods to identify when to buy value and sell it when it gets dearer in price. Tracking the Wall cycle is a formula timing plan to determine when to buy value. The final Wall cycles of this long wave winter season will offer some great discounted value in global franchise companies like Nokia, and others with more solid financials and fundamentals.

The Wall cycle that began last fall has bottomed, or is close to bottoming in the indexes and individual securities presently, and is generating buying opportunities for aggressive investors and traders in the hunt for discounted value. A company like Nokia (NOK) that has really taken a beating from the creative destruction delivered by the Apple iPhone, is now responding with its own innovation, a counter to the creative destruction delivered by Apple.

It will be interesting to see how the new Nokia innovation and Microsoft (MSFT) partnership unfolds when Windows 8 is released later this year. Nokia has reportedly eaten into Apples market share in China in recent months. The word is that Nokia is working on a tablet computer that will be running Windows 8, to be released in the fourth quarter. Maybe the 808 PureView is a red herring, and that 41 megapixel camera is going into an iPad killer tablet from Nokia running Windows 8 and the next generation of Windows Office, and keyboard accessory. The 808 in the name of the PureView may be a Freudian slip.

Of course, Google (GOOG) with their recent closing of their Motorola acquisition and the next generation of the Xoom tablets running the Android OS will attempt to deliver its own creative destruction in the global cell phone and tablet marketplace. Schumpeter would have recognized creative destruction taken to a completely new global level of innovation and competition by these global franchise enterprises. He would also recognize a key piece of the innovation that will drive the next K wave spring season that is just around the corner for international free market capitalism.

Nokia is certainly not a classical value play, since the company is currently losing money and is facing major challenges operationally and competitively. However, Nokia has a nice patent portfolio. The company has approximately $15 billion in cash and pays a 9% dividend. Nokia is making progress in restructuring. Innovation can turn even lumbering failing giants around. Not long ago Apple was also behind the curve and innovation brought it back to life in a remarkable way.

Nokia is not for the faint of heart. It should not be a core holding, and I would keep the position limited, but Nokia may just parley its history of innovation into a new round of successful competition in the tablet wars. That spirit of innovation is still alive and well, as evidenced by the PureView 808 41 megapixel camera.

In conclusion, the K wave is accelerating the current phase of creative destruction in the global economy. Nokia may have what it takes to survive the current Kondratieff wave decline and blossom in the next advance of a new K wave spring season in coming years. Nokia has been hammered into the bottom of the current Wall cycle, which is where great value and deals are to be had. A number of large cap global franchise stocks with yields represent discounted value are close to Wall cycle bottoms. Nokia innovation, along with price, time and sentiment are suggesting Nokia is worth a look.

David Knox Barker is a long wave analyst, technical market analyst, world-systems analyst and author of Jubilee on Wall Street; An Optimistic Look at the Global Financial Crash, Updated and Expanded Edition (2009). He is the founder of LongWaveDynamics.com, and the publisher and editor of The Long Wave Dynamics Letter and the LWD Weekly Update Blog. Barker has studied and researched the Kondratieff long wave “Jubilee” cycle for over 25 years. He is one of the world’s foremost experts on the economic long wave. Barker was also founder and CEO for ten years from 1997 to 2007 of a successful life sciences research and marketing services company, serving a majority of the top 20 global life science companies. Barker holds a bachelor’s degree in finance and a master’s degree in political science. He enjoys reading, running and discussing big ideas with family and friends.

© 2012 Copyright David Knox Barker - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.