Stock Market Free fall Crash is Imminent

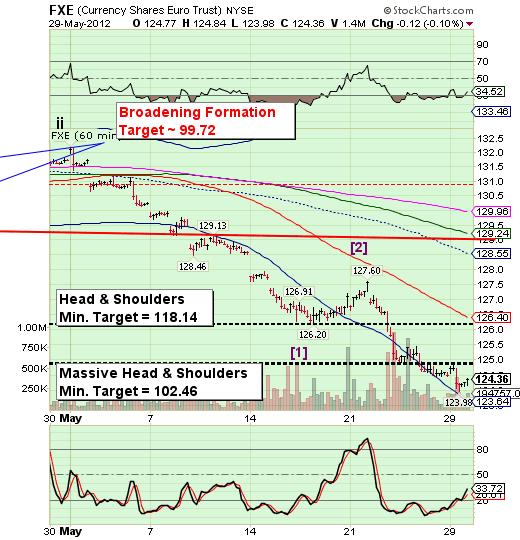

Stock-Markets / Financial Crash May 30, 2012 - 03:28 PM GMT FXE (123.67) is slipping lower. It appears that the retest of the Head & Shoulders neckline is over and FXE is losing what little support there is left. Free-fall lurks below 123.64 and appears to be imminent.

FXE (123.67) is slipping lower. It appears that the retest of the Head & Shoulders neckline is over and FXE is losing what little support there is left. Free-fall lurks below 123.64 and appears to be imminent.

Remember, the Cycles Model suggests that this decline may not be over until June 15-18. The interesting item is that options expiration occurs on June 15, so a decline during that week may provide the catalyst for a crash. Ms. Market was able to control her decline during the last options expiration. It may not be possible this time.

EFA (47.93) is coming dangerously close to its Head & Shoulders neckline. The correction above the neckline sports what appears to be a truncated wave [c], which is very bearish. Note that EFA is also on the “liquidity cycle” that I mentioned last night.

SPY (132.57) has crossed below the Crash Trigger on a Broadening Top formation and short-term trend support at 132.87. Today we may see SPY challenge hourly Cycle Bottom support and a Head & Shoulders neckline at 129.45. At approximately 128.50 is the last Crash Trigger of this complex triple Broadening Top formation and a free-fall zone to last year’s October low at 106.29. The “average” wave iii of (iii) target is 113.53, which may be exceeded.

Hang on to your hats!

GLD (149.78) has surpassed yesterday’s low and is also taking aim for the massive Head & Shoulders neckline at 148.60-148.80. This also follows what appears to be a truncated wave [C]. Not much more to be said.

TLT (125.32) is breaking out again today. While I am not entirely certain about the wave positions noted in the chart, I have incorporated a trendline that we must stay above as the final wave C of (5) rises higher.

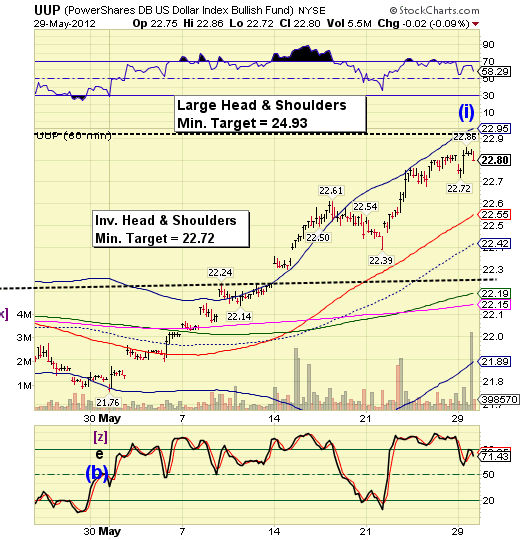

UUP (22.89) is progressing toward its large neckline near 22.93. Crossing it will give UUP practically a new lease on life as its targets expand higher. The correction that bottomed at 22.39 on May 21 may be an early Primary Cycle low, but it might be helpful to anticipate another brief pullback as UUP reaches its next neckline.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.