Gold Rises In EUR and CHF in May and Outperforms Stocks Which Fell Sharply

Commodities / Gold and Silver 2012 Jun 01, 2012 - 06:48 AM GMTBy: GoldCore

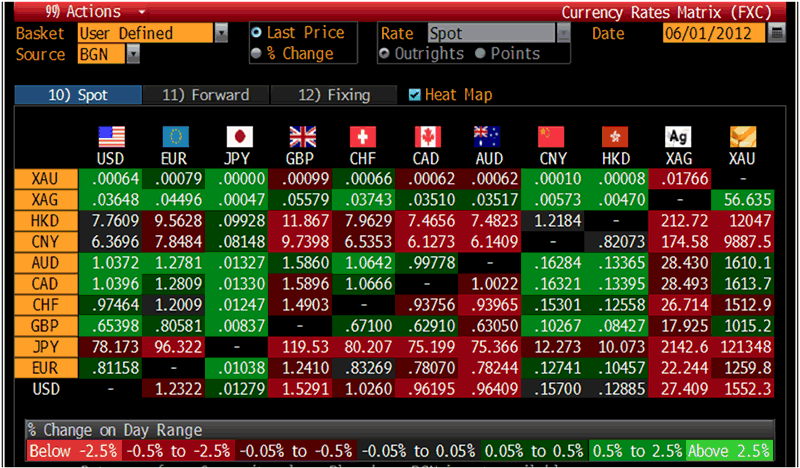

Gold’s London AM fix this morning was USD 1,552.50, EUR 1,259.53, and GBP 1,015.37 per ounce. Yesterday's AM fix was USD 1,567.50, EUR 1,262.08, and GBP 1,010.51 per ounce.

Gold’s London AM fix this morning was USD 1,552.50, EUR 1,259.53, and GBP 1,015.37 per ounce. Yesterday's AM fix was USD 1,567.50, EUR 1,262.08, and GBP 1,010.51 per ounce.

Silver is trading at $27.45/oz, €22.36/oz and £17.99/oz. Platinum is trading at $1,398.00/oz, palladium at $598.10/oz and rhodium at $1,200/oz.

Gold lost 0.17% or $2.70 in New York yesterday and closed at $1,562.10/oz. Gold initially traded sideways in Asia then dipped and began to recover at the open in European trading prior to further slight weakness saw it touch $1,550/oz.

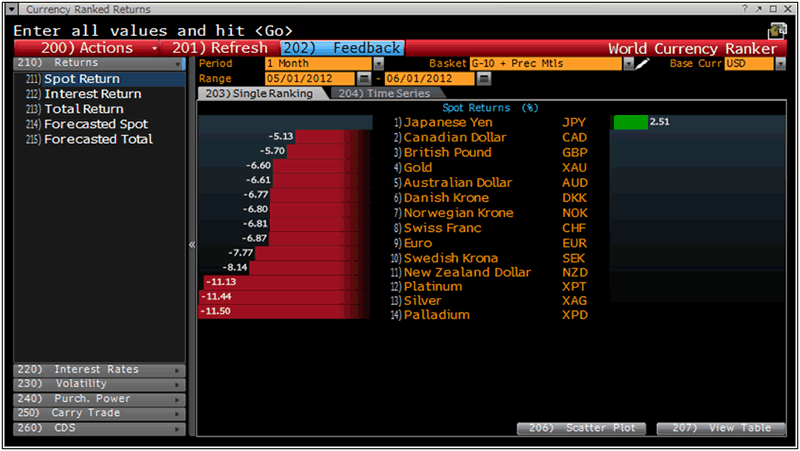

Gold in USD, EUR, CHF and USD in May (Daily)

Gold edged down on Friday heading towards its 2nd week of losses as some investors remain on the sidelines. Traders await clues from US non-farm payrolls data for May at 1230 GMT.

Periphery European bond yields have risen again and unemployment in the Eurozone has risen to a record high. There is a distinct feeling that there is a massive financial volcano that may erupt at any moment.

US data released yesterday showed that economic growth was softer than expected in Q1, with slower factory output and a shrinking job market. The question is when and how will the US Fed react to more negative news on the US economy? The answer we are confident is more QE and currency debasement.

Gold incurred its 4th month of losses in dollar terms which has not been seen in nearly 13 years. However, it is important to put those losses in perspective. It is also important to look at gold’s performance in non dollar terms.

Gold had a gain of 10.2% in 2011 - adding to the 10 years of gains since 2000. Gold then saw a 10.8% gain in January 2012. Since then gold has seen gradual declines in February (-1.5%), March (-5%), April (-.03%)and now the 6% drop in May meaning that gold is now down 0.4% in dollar terms year to date.

Importantly, while gold in dollar terms was down 6% in May, the sharp fall in the euro means that gold has again risen in euro terms and was up 0.4% in euro terms in May – closing over €1,250/oz.

Meanwhile, stocks and commodities had a torrid month with sharp falls seen.

The benchmark S&P500 was one of the best performing stock markets in the world in the month – it fell by 6.3% in May, its largest percentage drop since September.

The Dow's 6.2% drop and Nasdaq's 7.2% loss are their largest monthly declines in two years.

Thus, even gold priced in the strengthening dollar managed to outperform the leading US indices.

Gold's 0.4% gain in euro terms hedged investors exposed to European stock markets which plummeted. The CAC and Dax (Xetra) were down by 6% and 13.5% respectively. The FTSE Eurofirst was down 13.1% and periphery stock markets fell by even more with Spain's Ibex 35 down 19%.

The FTSE fell 7.7% in May while gold priced in sterling was down by just 1%. Therefore, an investor who was overweight UK equities fared far worse than one who had an allocation to gold.

Asian stock markets also saw sharp falls but gold priced in local currency terms was either marginally higher or lower.

Most emerging market equity indices also had a torrid May.

G10 Currencies and Precious Metals Performance in May 2012

While gold's performance in May was good relative to stocks, it is important to focus on the long term and we are confident that gold will again protect investors from market turmoil in the coming years as it has done in recent years.

It will also protect against currency devaluations and from an international monetary crisis - something we have warned of since 2003.

Bill Gross, who runs the world’s biggest bond fund at PIMCO, said yesterday that the lower quality of sovereign debt represents a threat to the global monetary system.

The global monetary system is facing a seismic change in how it operates and major companies and countries could start to shun sovereign debt in favour of real assets, according to Gross.

‘China, for instance, may at the margin shift incremental Treasury holdings to higher returning commodity/real assets which might usher in a gradual or somewhat sudden reconfiguration of our current dollar-based credit system.'

‘Having a reduced incentive to purchase Treasuries and curtail Yuan appreciation, the Chinese and their act-a-likes may look elsewhere for returns.’

Gross’ comments received a degree of confirmation from the Chinese agency tasked with managing their foreign exchange reserves, SAFE, which overnight said that they will create new ways to invest China’s foreign exchange reserves.

For breaking news and commentary on financial markets and gold, follow us on Twitter.

Cross Currency Table – (Bloomberg)

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.