My Best Investment Advice - Watch Your Fellow Investors Then Do The Opposite

Companies / Corporate Earnings Jun 01, 2012 - 04:07 PM GMT In my opinion, the recent selloff in stocks defies commonsense and logic, but in truth and fact it usually does. In other words, it's not uncommon to see investors selling at precisely the time they should be buying and vice versa. Moreover, when investor pessimism is at a high, like it is today, stocks become cheap causing people to panic and sell. Of course, the more people sell the worse it gets and simultaneously the cheaper stocks get.

In my opinion, the recent selloff in stocks defies commonsense and logic, but in truth and fact it usually does. In other words, it's not uncommon to see investors selling at precisely the time they should be buying and vice versa. Moreover, when investor pessimism is at a high, like it is today, stocks become cheap causing people to panic and sell. Of course, the more people sell the worse it gets and simultaneously the cheaper stocks get.

When investors are in this negative state of mind, it amazes me how even good news can become bad news. For example, one of the common arguments for a pending market collapse is based on the notion that corporate margins are high, and therefore must get worse. Therefore, the pessimist takes really good news and immediately wants to turn it into a negative.

The following is a summary of the S&P 500's Q1 earnings results taken directly from Standard & Poor's website:

"With 98% of 1st Quarter 2012 EPS Reported, numbers remain good. Q1 operating EPS coming in as 3rd best; margins remain high (9.07%, average 7.19%) Q1 as reported EPS maintaining slight edge as the best in index history - but could be close as reported margins also very high, 8.56%, with historical average 6.11%. Q2 2012 operating estimated to set a new record high."

The same Standard & Poor's document provides additional detail on what I can only describe as an excellent first quarter for the S&P 500 companies. Of the 493 (98.6%) of the S&P 500 already reporting, 66.73% beat estimates, 23.33% missed estimates and 9.94% met estimates. In other words, over 73% of the S&P 500 companies are showing very healthy operating results.

Now when I review the above data, I get optimistic and the sage advice of legendary investor Warren Buffett immediately comes to mind. "be fearful when others are greedy and greedy when others are fearful." In other words, I immediately began to suspect that all this pessimism is creating a great long-term opportunity for investors with a more optimistic view of the future.

Matt Ridley, author of the best-selling book The Rational Optimist, had his work summarized by the Reader's Digest on March 21, 2012, and updated on Saturday, April 14, 2012 in an article titled 17 Reasons to be Cheerful. I would like to share reason number 17 that stated Optimists are right, because it corroborates my thesis:

"For 200 years, pessimists have had all the headlines-even though optimists have far more often been right. There is immense vested interest in pessimism. No charity ever raised money by saying things are getting better. No journalist ever got the front page writing a story about how disaster was now less likely. Pressure groups and their customers in the media search even the most cheerful statistics for glimmers of doom. Don't be browbeaten-Dare to be an optimist!"

In addition to the continuous dual between optimism and pessimism that has now raged on for many centuries, there is another aspect regarding stock market behavior that I believe worthy of discussion. Stock market volatility is an inevitability that will never subside. However, all stock market drops have been temporary in nature, and of course the same can be said of stock market rises.

On the other hand, it is also true that the long-term trend and direction of stock values has been up. Therefore, even if the pessimists are right, and we end up getting a self-fulfilling prophecy of a stock market drop, I would strongly argue that like all others it will only be temporary. Moreover, it is also historically true that the best time to buy equities is during the periods where market pessimism is at a peak. This has even been true after the great recession of 2008 that has traumatized investors so badly.

The S&P 500 - Undervalued Based On Fundamentals

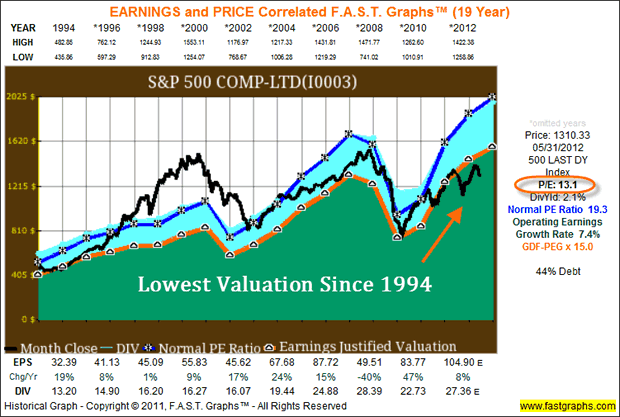

The following F.A.S.T. Graphs™ reviews the S&P 500 since 1994 and correlates earnings and stock prices. The orange line on the graph represents S&P 500 earnings-per-share multiplied at the historical average PE ratio of 15. As is clearly evident from this graph, Mr. Market has valued the S&P 500 at a premium to its long-term average PE of 15 over this 18-plus year's period of time. Until most recently that is.

I believe this graphic is enlightening because it shows that when an actual measurement is based on real earnings, the S&P 500 is cheaper than it has been in two decades. This is not statistical mumbo-jumbo, but actual earnings and actual market valuations based on those earnings. The only estimate on this graph is for calendar year 2012 earnings of $104.90 (Note that this number could have been rounded to $105, but I kept it at $104.90 on the graph for conservative expression).

The S&P 500 Estimated Future Earnings

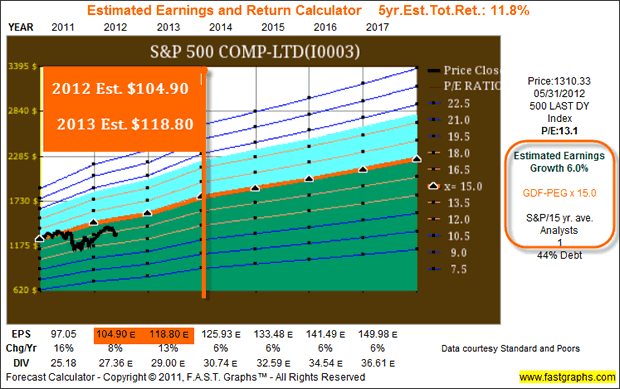

The following estimated earnings and return calculator reviews current earnings estimates on the S&P 500. The earnings estimates for 2012 and 2013 are taken directly from Standard & Poor's Corp.'s website, and are the most important earnings that I suggest readers focus on. The 2012 estimate is most likely to be the most accurate estimate, followed by calendar year 2013 being the second most accurate estimate. The estimates for 2014-2017 are based on the 15-year average earnings growth rate of the S&P 500 of 6%. (Note on the above graph that the average growth since 1994 has been even higher at 7.4%.)

Moreover, based on the most current, and I believe reasonable earnings estimates for the S&P 500 over the short to midterm timeframe (2012-2013) indicates the index is undervalued with a PE of 13.1 versus a fair value PE of 15. Once again, it is also clear from the above historical graph that this is the cheapest the S&P 500 has been on an absolute basis since 1994. There is no conjecture on that last statement, only a factual representation of what has occurred.

Summary & Conclusions

I would like to summarize this article by sharing some comments from John Bodnar, a New Jersey-based financial planner that I have a great deal of respect for. Here is a link to John's website. Of course, I readily admit that John not only shares many of my frustrations with the stock market and investor behavior in general, but my views on optimism as well. The following excerpt from a recent correspondence that John sent to his clients puts things into perspective, at least in my opinion:

"Compare the long sweep of stock market history with the performance of the average investor and what do you see? A tremendous disconnect. Why do investors underperform on a consistent basis? After 30-years as a personal financial advisor, I propose it is "headline risk," which manifests itself into fear and paranoia. ICI data confirms fund flows as a counter-indicator to market tops and bottoms. Short form to success for investors: watch your fellow investors, and DO THE OPPOSITE!"

In that same correspondence, John also offered his clients some additional wisdom and hypotheses that he and I share regarding equities versus bonds (fixed income):

"So what are investors doing today? After listening to the so called "experts" on TV, radio and the internet they are pouring dollars into "safe" investments. Investments that Oppenheimer CIO Art Steinmetz says "...will guarantee that you lose money, albeit slowly." Warren Buffett was recently quoted: "Bonds today should come with a warning label." Personally I don't know when rates will finally go up, but it will probably happen faster than any of us expect and will trap investors and portfolio managers alike."

Personally, I believe that the best definition of an investment advisor that I ever heard goes something like this. To paraphrase: The best investment advisor is one that displays the courage and integrity to insist that his clients do what they ought to do, rather than what they want to do. John Bodnar meets that definition as evidenced by this next and final excerpt from his client letter:

"As a personal financial advisor it is a challenge to get clients to "do nothing." The first year or two working with a new client I need to remind them that they should be tilted toward savings, inaction, patience, and analysis. Thus keeping trading costs down. And eventually buying on the cheap, usually when others are completely freaking out due to M.I.F. (media-induced frenzy)."

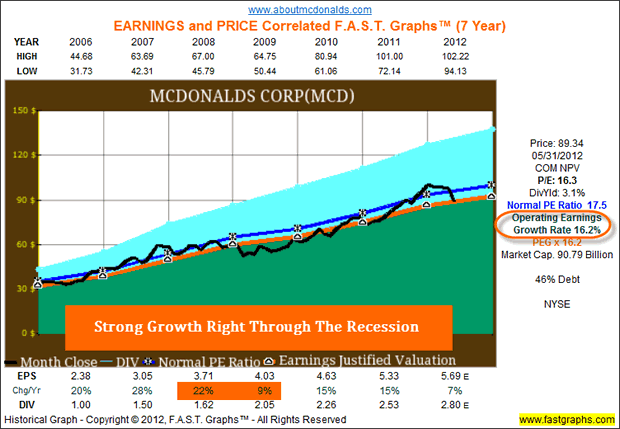

Based on real numbers, I believe that the S&P 500 appears reasonably priced today. However, as I've often written before, I really don't believe in predicting markets. Instead, I believe in building portfolios one company at a time because I believe it is easier and more accurate to analyze one company and the near-term prospects of its business, than it is to try to analyze a large universe like the S&P 500. What many investors fail to realize is that even during the great recession of 2008 many companies continued to prosper and grow. McDonald's (MCD) is just one name that immediately comes to mind.

McDonald's Grew During the Recession of 2008

McDonald's is just one example of a company that increased its earnings in 2008, 2009 and beyond. Likewise, they provided a generous increase in their dividend each year as well. Consequently, McDonald's represents undeniable evidence that it is a market of stocks, not a stock market.

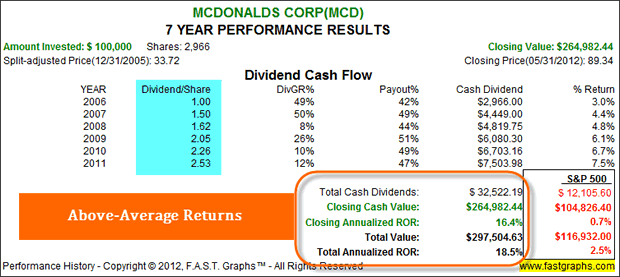

McDonald's produced exceptional returns on their shareholder's behalf since 2006. This had nothing to do with macroeconomic events, and everything to do with the individual performance of this exceptional company.

In closing, the only reason I write articles like this one is as an attempt to try and counteract the numerous other articles that are forecasting the next great market collapse. The naked truth is that neither I, nor anyone else really knows what the market might or might not do in the near term. On the other hand, I believe that the evidence supporting a long-term bright future is compelling. Even if we do experience a downdraft, whether it's self-induced or not, as it always has before, I believe it will be temporary and represent a great buying opportunity.

Disclosure: Long MCD at the time of writing.

By Chuck Carnevale

Charles (Chuck) C. Carnevale is the creator of F.A.S.T. Graphs™. Chuck is also co-founder of an investment management firm. He has been working in the securities industry since 1970: he has been a partner with a private NYSE member firm, the President of a NASD firm, Vice President and Regional Marketing Director for a major AMEX listed company, and an Associate Vice President and Investment Consulting Services Coordinator for a major NYSE member firm.

Prior to forming his own investment firm, he was a partner in a 30-year-old established registered investment advisory in Tampa, Florida. Chuck holds a Bachelor of Science in Economics and Finance from the University of Tampa. Chuck is a sought-after public speaker who is very passionate about spreading the critical message of prudence in money management. Chuck is a Veteran of the Vietnam War and was awarded both the Bronze Star and the Vietnam Honor Medal.

© 2012 Copyright Charles (Chuck) C. Carnevale - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.