Gold GLD ETF Surges, But No Breakout

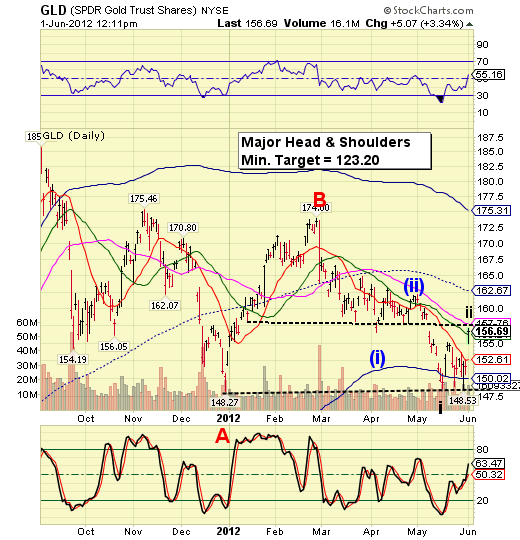

Commodities / Gold and Silver 2012 Jun 01, 2012 - 04:13 PM GMT GLD surged nearly to its former Head & Shoulders neckline and 50-day moving average at 157.76. Normally I would have taken some of our position off the table if GLD had closed above short-term trend support/resistance at 152.61. This case, however, was out of the blue. I think that since Goldman was selling TLT, it decided to try GLD as the new “safe haven.”

GLD surged nearly to its former Head & Shoulders neckline and 50-day moving average at 157.76. Normally I would have taken some of our position off the table if GLD had closed above short-term trend support/resistance at 152.61. This case, however, was out of the blue. I think that since Goldman was selling TLT, it decided to try GLD as the new “safe haven.”

This is an excellent place to add short positions to GLD with a stop loss just above the 50-day moving average (possibly 158.50-159.00).

SPY seems to be testing mid-Cycle support and the lower trendline of the red Orthodox Broadening Top at 129.10. Overhead resistance is at the neckline at 129.55. It appears that the decline isn’t over yet, so we wait for a further breakdown this afternoon.

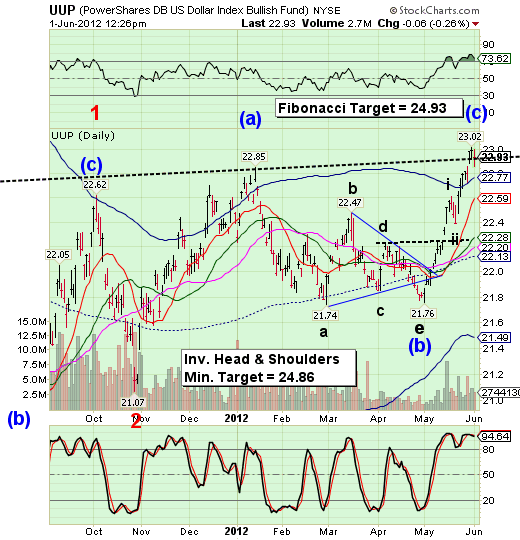

UUP has been retesting its neckline this morning and may be ready to resume its rally. On the opposite end of the scale, FXE is bouncing above its low in a brief correction as well.

USO took a big hit today. It may linger beneath Cycle Bottom resistance for the rest of the day, but the more likely outcome is a resumption of its decline toward its new Head & Shoulders neckline at 29.10. There are two weeks left in this declining cycle, so we may see a huge decline in the price of oil.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.