Spain and The Runaway Euro Bailout Train

Interest-Rates / Credit Crisis Bailouts Jun 11, 2012 - 05:16 AM GMTBy: EconMatters

Spain finally bowed to the rising interest rates and the billions of euros worth of bad loans at Spain's regional governments to ask for a loan. After emergency talks between Euro Zone finance ministers on Saturday, Spain will get up to $125 billion from the European Union (EU) to bail out out its banking system.

Spain finally bowed to the rising interest rates and the billions of euros worth of bad loans at Spain's regional governments to ask for a loan. After emergency talks between Euro Zone finance ministers on Saturday, Spain will get up to $125 billion from the European Union (EU) to bail out out its banking system.

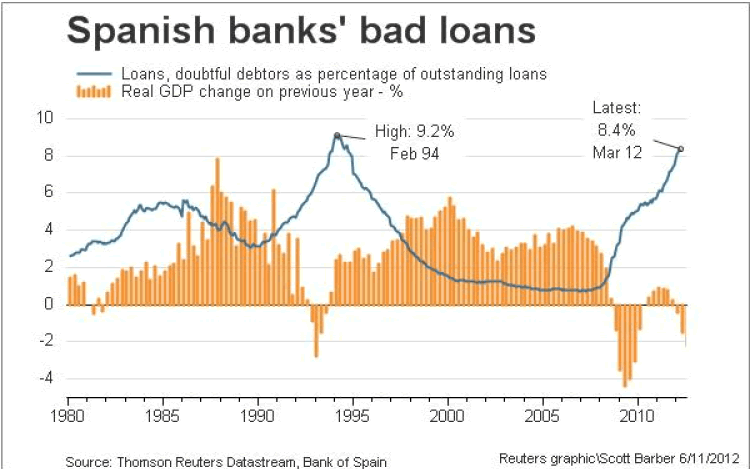

The move came three weeks after Bankia, the nation's fourth largest bank, asked the government for a $24 billion bailout. Spain's economy and financial system are still reeling from the collapse of a massive real estate bubble (house prices have dropped by 25% since 2008) and the subsequent Great Recession. Bank bad loans as a percentage of total lending jumped to 8.4% in March, the highest since August 1994, and a majority of Spain's financial institutions are saddled with debts much greater than their assets.

The $125-billion aid sought by Spain is about 270% of the amount estimated by an IMF study released June 8, but close to the $126 billion projected by a report from Fitch Ratings released on Friday. The aid money will come from two funds - the European Financial Stability Facility (EFSF) and the European Stability Mechanism (ESM).

This bailout may give investors and markets some calming effect, but will not resolve the fundamental debt, deficit and economic problems of Spain. Spain has the highest unemployment rate in the EU at 24.3% (its youth unemployment is at a staggering 51.5%), even worse than Greece, whole GDP is set to shrink 1.8% this year, according to IMF estimates.

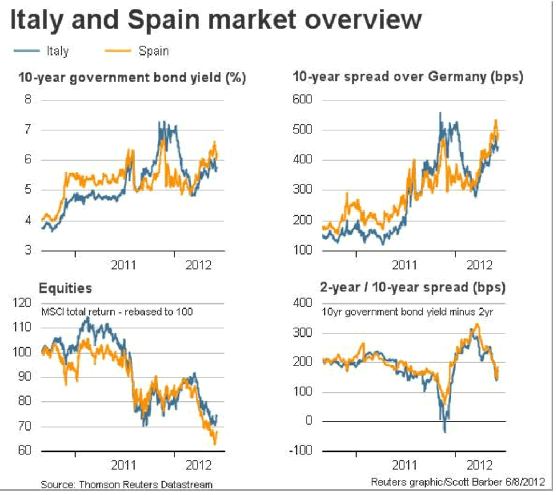

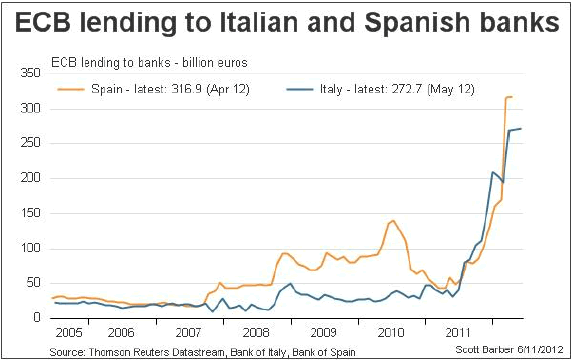

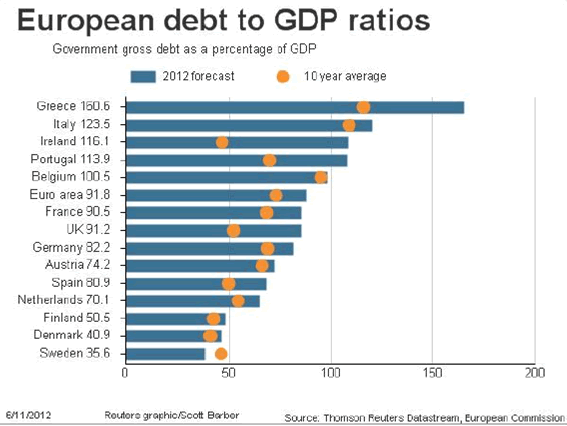

So the odds are very good that Spain may need more bailout down the road. Spain marks the fourth bailout during this Euro Zone debt crisis saga, after Ireland, Portugal and Greece, and may need more aid money, while Italy is looking good to be the fifth bailout candidate. According to BusinessWeek, the bank bailout could add up to 10 percentage points to Spain's debt ratio, which should peak at about 100% of GDP in 2015. But that's still a lot less than Italy, whose debt is over 120% of GDP. Although Italy runs a lower deficit to GDP ratio than Spain, Italy is also facing soaring borrowing costs, and relying on ECB for funds (See 2 Charts Below).

Disclosure: No Positions

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2012 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.