Stock Market Top Identified by Business Cycle - Rotate Sectors for Growth

Stock-Markets / Sector Analysis Jan 29, 2008 - 09:08 AM GMTBy: Donald_W_Dony

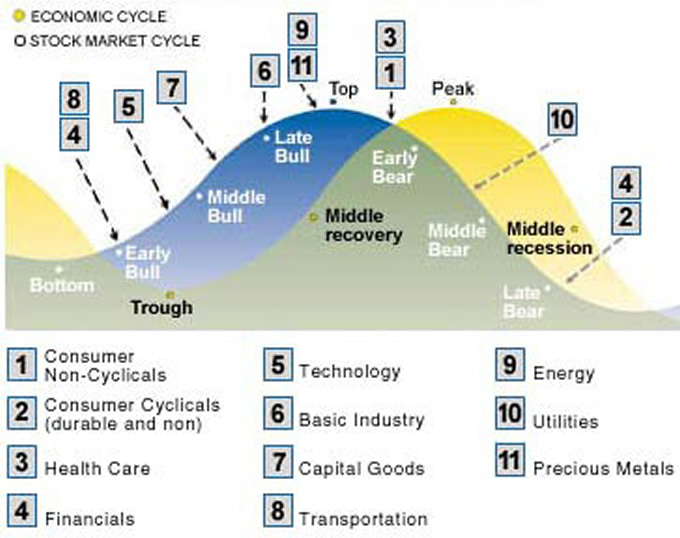

The rhythmic rise and fall of equity sectors throughout the business cycle has told economist, analysts and investors for decades the positions of the economic and stock market cycles. Certain equity sectors typically advance at different phases of the cycles which provide important clues and can dramatically assist in portfolio performance. For example, financial's normally lead the stock market and are one of the first to decline before the market top and one of the first to advance in the late bear phase. The transportation sector is also one of the strongest performing groups in the early bull market but usually rolls over at the top signaling the end of the bull market is near.

The rhythmic rise and fall of equity sectors throughout the business cycle has told economist, analysts and investors for decades the positions of the economic and stock market cycles. Certain equity sectors typically advance at different phases of the cycles which provide important clues and can dramatically assist in portfolio performance. For example, financial's normally lead the stock market and are one of the first to decline before the market top and one of the first to advance in the late bear phase. The transportation sector is also one of the strongest performing groups in the early bull market but usually rolls over at the top signaling the end of the bull market is near.

As the stock market normally leads the economic or business cycle by 6-9 months (Chart 1), weaknesses or strengths within specific stock group can add valuable information that may not be available through standard fundamental or technical analysis. Analysts recognize that through the expansion and eventual contraction of the normal economic cycle, certain equity sectors should be stronger at specific times and overweighted in a portfolio or underweighted or even removed depending on the position of the stock market cycle.

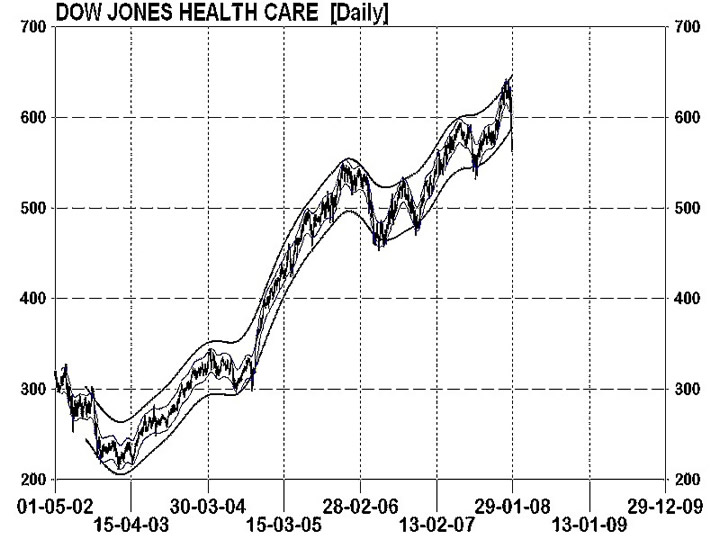

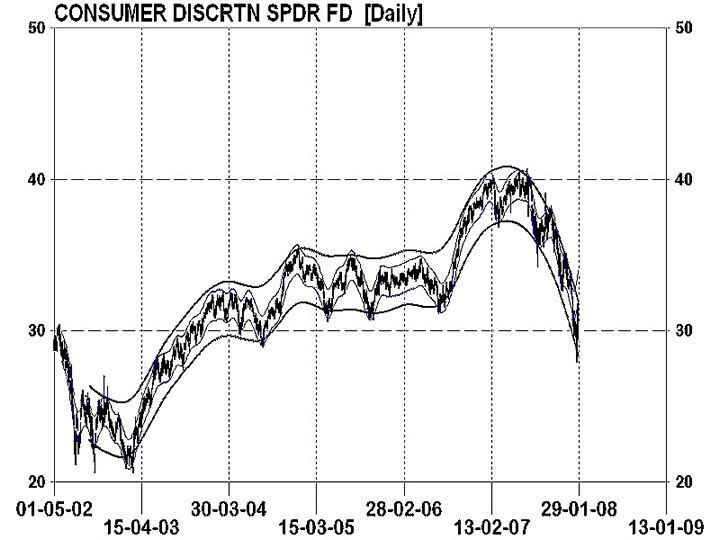

But where is the stock market cycle now? A review of current sector performance provides many answers. U.S. equity groups that have recently rolled over in the second half of 2007 are banks, transportation, discretionary ( Chart 3), retail, insurance and semiconductors. Sectors that are improving in relative performance are food and beverage, health care (Chart 2), consumer staples (Chart 3), medical supplies, tobacco and gold.

This analysis of strengths and weaknesses would suggest a stock market that is near or at a peak. Additional information such as rising unemployment, aggressive Fed rate cuts and a shift out of small cap to safety and defensive stock groups would point to an early contraction phase of the economic or business cycle and that the peak in the stock market may have already passed.

So what lies ahead and where will be the probable strengths in the market?

As Chart 1 indicates, consumer non-cyclicals (staples), health care and defensive equity groups will likely provide the best potential for growth during this bear market phase of the economic cycle.

And when will the bottom of this present bear market develop? Watch the financials and consumer cyclicals. They will very likely be some of the first to herald the beginning of a new bull market.

Bottom line: Fundamental and technical evidence suggests that the stock market peaked in October 2007 and is progressing into a contraction bear phase.

Additional information on the business and stock market cycle will be in the up coming February newsletter. There will also be a section on the best performing equity sectors and exchange traded funds.

Your comments are always welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2008 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.