Stock and Financial Market Forecasts 2008 - Currencies - Part 3

Currencies / Global Financial System Jan 30, 2008 - 01:34 AM GMTBy: Ty_Andros

Introduction

Introduction

This is the master thread to which all economic analysis must be held up due to the fiat monetary systems practiced UNIVERSALLY around the world. Just like a game of musical chairs, or rearranging the deck chairs on the titanic everyone will go down sooner or later. The central reality is that Currencies don't float, they just sink at different rates .

Currencies are no longer backed by gold or silver and are no one else's liability; they are all now IOU's and are the liability of the central bank and country that issues them. The principle reserves of the world's central banks consist of other country's promises to pay (currency and bonds). As we all know, public servants rarely deliver on their promises, and their “promises to pay” are made of the same timber.

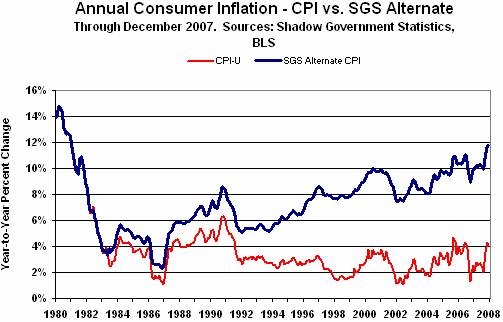

The people who have accepted fiat currency as money expect them to serve the functions of money as a medium of exchange and store of value. Today's money meets only one of these definitions. When a currency holder is paid money they expect it to have equal value as that which they accepted the money for. This is impossible in today's monetary systems. When you see REAL inflation running at ten percent or more, you are seeing the public servants, and central banks they control, RENEGING on their promise to pay! When you see G7 public servants talk about sovereign wealth funds acting SOCIALLY responsible, you are seeing public servants RENEGING on their promise to pay.

As we outlined in Part II of the 2008 outlook, the monetary systems are breaking down as we enter the early innings of a Global “Crack up Boom”. Let's renew our thoughts concerning the two dominant considerations in determining what is unfolding in 2008.

First let's renew our definition of money from part II:

Money/currency has four purposes:

• A Medium of exchange

• A store of value

• A Measure of value

• A Method of accumulating wealth, building upon it and moving it into the future

G7 currencies now fail three out of four of these definitions and are about to accelerate their losses in the last three of these definitions in 2008! YOU MUST UNDERSTAND THIS and adjust your investment plans accordingly. If you are holding cash or bonds then you LOST 20 to 30% of purchasing power and wealth that was stored in them in 2007! The monetary systems in the world are breaking down and people will be scrambling for shelter in the coming year and decade!

Money has been abused for so long by central bankers and G7 public servants that people have forgotten the definition of it. Money is the source of so much of their distress as it has lost the ability to perform its functions. As its value melts in bank accounts and paper investments investors are searching desperately to prevent the loss of their living standards. They will fail for the most part; readers of this letter will be in a position to turn these considerations into enormous OPPORTUNITIES if they properly understand what is in process and adjust their investment plans accordingly. Let's take a look at a quote from that progenitor of Keynesian Economics – something we will be seeing in the coming year:

" By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens... There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.“ -- John Maynard Keynes

This destruction is set to accelerate as the G7 financial authorities battle the dominant pattern of the year through currency debasement by printing press.

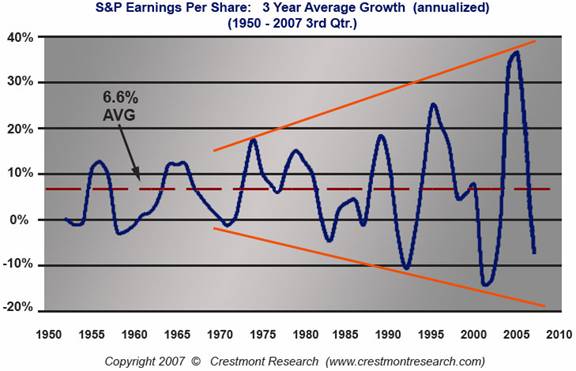

Now we will review the dominant pattern for 2008, courtesy of John Mauldin! I have updated this chart from when it was originally published in March of 2007 and included my commentary at the time (in italics) as it is now CRUNCH TIME for this 50-year chart pattern:

We are looking at a Wolf Wave and the amplification of each wave up or down is expanding. A chart of a Wolf Wave looks like a mega phone, small on one end and amplifying out. Wolves attack and eat things and it is no different with economies and asset markets, they are eaten when a wolf appears. A good example of a Wolf Wave is from John Maudlin's latest letter (and by extension Crestmont Research) where he shows corporate profits since 1950; John can be reached at john@frontlinethoughts.com

(This chart has been updated to reflect through the 3rd quarter 2007)

See the mega phone formation? It is called a wolf wave. We are at a fairly good level of profits now, but it projects a nuclear winter in corporate profits dead ahead (see chart below). From Record highs never seen in fifty years, to record lows also not seen in the same period, below the lows of 2001-2002. This chart is a testament to how fiat money and credit creation has made steady growth and economic stewardship become more and more unmanageable over a long period of time. It is clear that monetary policy is also following this wolf wave pattern, either too hot or too cold. Politicians (and their “something for nothing” constituents) in the western world see these enormous profits and are set to attack the creators and holders of this wealth. They want the money and they will put in place new taxes and entitlement mandates to claw back this gusher of wealth, thereby accelerating the downside of this wave. We all want business cycles that cleanse past excesses, but the up and downs are now out of control. There is no consistency, no orderly form to the business and economic cycles, everything now is either booming or busting.

As this pattern approaches what it is prophesizing we can look at 4 th quarter 2007 profits -- which are now projected to have clocked in at a year over year LOSS of approximately (-19%) extending its slide from the 3 rd quarters NEGATIVE (- 9%). This Wolf Wave is afoot throughout the G7, it is not limited to the US and it is set to EAT these economies and asset markets for lunch. As this earnings collapse unfolds so do incomes and tax receipts in Washington , Brussels , Paris , Berlin , Rome , etc., as well as statehouses, municipalities and the incomes of individuals.

As this profit debacle unfolds you will be given a great opportunity to find MORE VALUE for your paper currencies. A recent example of this is when gold fell about 10% when stocks swooned 10 to 20% since the first of the year. You then saw smart money step in and exchange their paper PROMISES TO PAY for something that is no one else's liability, aka GOLD. Now gold is back at new highs and targets another 70 dollar move from the breakout point, but stocks are still on their lows. There is a lesson here that you must learn, take these FINGERS OF INSTABILITY and use them to find value by exchanging your PROMISES TO PAY, aka Money, for real things that the monetary authorities cannot debase.

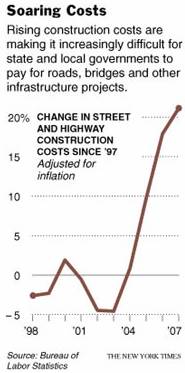

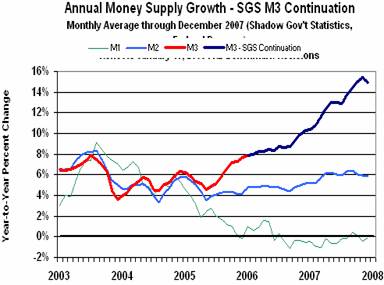

Enormous cost pressures are unfolding. as well as the need for individuals, private enterprises, sovereign governments, states and municipalities to deal with a cost push of epic proportions, as illustrated by this chart from a recent article in the New York Times ( www.newyorktimes.com ) Next to it is a chart of reconstructed M3 money supply growth from John Williams at www.shadowstats.com :

Do you see any resemblance in these charts, shades of Milton Friedman? As this has unfolded so has REAL inflation. Here's another REFLECTION of these previous two realities, courtesy of www.shadowstats.com :

As workers DEMAND wage increases which reflect the REAL losses in purchasing power and standards of living, the central bank printing presses are heating up to cushion the blow to government revenues. Just this week, record deficits were disclosed in the UK and in much of the G7! As we mentioned in a previous missive, M3 is growing at a pace not seen since NIXON was in the latter stages of his presidency. Globally, money supplies are growing at an average rate of 16% COMPOUNDED ANNUALLY! Public Servants are making promises to electorates throughout the G7 to attack the private sectors in exchange for the electoral support of the weakest constituents in their economies.

They are feeding the wealth-creating private sectors to the wealth consuming and weakest amongst them, which now constitute firm electoral majorities in the G7. The “something for nothing” elements of the G7 are eating and consuming the most productive elements among them. This is a recipe for even less wealth creation and income. Wealth creation and income will then have to be supplied by the Keynesian economists in charge of the G7 through more government stimulus, deficit spending and fiat money creation.

The policies which accompanied that period in the early 1970's are being repeated at this time so we can expect a repeat of much of what we saw in that era, such as increasing regulation, confiscatory taxes of the most productive elements of society, substitution of government deficit spending and FIAT currency creation. This era was known for everything government represents: which is the promise that you will pay MORE FOR LESS of everything.

Capitalism's promise that you will pay LESS FOR MORE will continue to be eroded. Paying “more for less” of everything is firmly in place for the foreseeable future, more for food, more for healthcare, more for government, more for everything. This reflects the collapse of Capitalism, wealth creation, job creation and capital investment by the private sector. It will no longer PAY to start a company, take a risk, or create a job. You will get increasingly LESS of it as this reality sinks into every entrepreneur in the G7.

Additionally, the Federal Reserve has lost control of monetary policy to Wall Street and the markets. Now Federal Reserve policy must support STOCK prices as well as fight inflation and support full employment. Pavlov's dog comes to mind, the markets ring the bell and hysterically call for easier money and the fed pushes the Ease Button. Bernanke is completely in the Keynesian mode and has NO understanding of Austrian economics and the source of wealth creation . He is a creature of the Washington beltway and an appeaser of the first order . Bernanke's toughest challenge before coming to the Fed was a college classroom.

This week's Federal Reserve rate cut in response to stock market weakness, Bernanke's absolute misunderstanding of capitalism, incentives to produce and wealth creation are creating enormous opportunities for you to unload your paper currencies in exchange for real assets at better value. Trade your fake currencies and store of value into real ones as asset values REVERT to the mean.

Bernanke is holding the second most powerful job in the world behind that of the US presidency and is absolutely in the grip of WALL STREET and the banking industry. He is seeing the most powerful FINANCIAL constituencies run to Washington DC and the Federal Reserve with FEAR in their eyes to be rescued from their own poor management decisions; rather then suffer from them as is the bedrock of capitalism and creative destruction. Bernanke will do whatever they ask of him, you can bank and invest on that reality. The ownership of those companies NEEDS to flow out the weak hands that now hold them into strong hands.

Bernanke is reacting to events rather than understanding them and prescribing good medicine, as Volker did in the early 1980's. As the mantra from DC is “targeted, temporary and timely”, it shows their absolute incompetence in understanding the difference between permanent income creation and behavior modification through incentives to produce, versus temporary spending and consumption.

Rebates have been tried several times since 1970, not once has it worked or created sustainable recoveries, and they have no excuse for pretending it will now, as detailed analysis of previous failures of these policies is abundant for review. They are banking on their constituent's lack of knowledge of history to FOOL them into thinking this is an answer to the current economic problems. If the economy can't grow how do they expect government revenues to? Maybe they should give that some thought! But growth will come from one area: Fiat currency and credit creation .

However, the G7 economy will grow in NOMINAL, not REAL, terms. Misery will spread in ever widening circles by obese LEVIATHAN government, incompetent public servants and central bankers as they print the money they require to expand their spending and their economies and write CHECKS to the mob with a printing press. This is Keynesian economics! It's an ugly picture don't you think? Recognize these REALITIES, organize your investments properly and turn them into OPPORTUNITIES!

My wife is Mainland Chinese and she and her relatives laugh when confronted with the idea of government handing out checks like Santa Claus or the tooth fairy. They have a firm grip on the reality that “you must produce more then you consume, save your money for a rainy day and that the government is mostly GOOD FOR NOTHING.” These are truisms which served the constituents of the G7 well until they forgot them and were taught other ideas. These beliefs are a recipe for success, the G7 used to have them, now others do.

In the emerging world, capitalism and Austrian economics are delivering REAL wealth creation. Their currency pegs under constant pressure as capital seeks to flow from where it is tortured and punished to where it is best rewarded. When the Federal Reserve lowers rates they are forced to do so and their economies overheat and inflation is exacerbated. As their currencies and wages trudge higher they now are exporters of more inflation to the now de-industrialized G7. Just because the emerging world stock markets stumbled with the developed world doesn't mean decoupling is not evolving, it only signals a period of correction from irrational exuberance. The emerging world has no external deficits to speak of and has enormous amounts of savings. By definition this is a shelter from any storm! Consequently, their currencies will have a natural bid to them in a flight to safety!

The CARRY trade is not over, it is just de-leveraging and going through its regular VISCIOUS unwinding to correct and close out the most foolish activities on the buy side. The dollar is headed lower over the long term ,as Bernanke lowers interest rates to appease his public servant masters and SAVE Wall Street and the US-based Money center and investment banks. The UK is in the early innings of the easing cycle so you can expect the pound to come under pressure, as the socialist welfare States of Central Europe ( Italy , France , Germany , Greece and Spain ) succumb to their own versions of credit and economic contraction. In addition, you can, at some point, expect the ECB (European central bank) to succumb as well, even though ECB Chairman, Trichet, is TRYING to fight inflation by keeping rates higher and providing the credit markets with ample liquidity.

The dollar will increasingly become a FUNDING currency for the CARRY trade, just as the Yen and Swiss Franc are now, creating a steady new stream of DOLLAR SELLERS to fund the trade. Since we can see that no real reform is taking place in regards to the policies of wealth creation in the G7, you can expect steady erosion in the value of their currencies in terms of purchasing power. People who run from the dollar to the Euro or Pound don't understand they are just running from one titanic deck chair to another. All are sinking!

Gold and commodities are increasingly being recognized as what they used to be: REAL MONEY, and they are all on new highs in whatever currency you choose, emerging world or G7.

I travel a lot internationally, meeting with customers and investors around the world and I am going to give you a few anecdotes from my travels:

* I can buy an entrée fish dinner of Salmon for 20 dollars in the US ; a similar meal in London is 23 pounds (23 times $1.96= $45.08 U.S. dollars.)

* I can buy a cab ride to the Chicago Airport from downtown for 40 dollars; a similar cab ride from downtown London costs 50 pounds (50 times $1.96 = $98 dollars.)

* You can buy a nice dress shirt for 70 dollars and a pair of corduroy pants for 50 dollars in the US ; in Zurich the same shirt costs 100 francs (approximately 90 dollars) and the pants are 200 Francs (180 dollars.)

You can do this with any G7 currency, the dollar still holds enormous purchasing power domestically in the US , whereas Pounds, Swiss Francs and Euros hold considerably less purchasing power in their domestic countries. The primary reasons are enormous VAT taxes (social levies for redistribution of incomes, they take a Euro, Pound or Franc, send 10% back in the form of government programs and the government's permanent constituents eat the other 90%), ON TOP of confiscatory personal taxes. So when you run into the G7 currencies, keep these facts firmly in mind as you will pay a stiff price when you spend it; the EU and UK governments eat the additional purchasing power in taxes.

Furthermore, competition and capitalism's creative destruction is not allowed to take place on the European Continent and is regulated AWAY. Costco, Sam's clubs, Wall Mart, Target are unable to set up operations to compete for the customer by bringing lower prices and higher quality goods to them. High prices are a policy of government to shield inefficient domestic suppliers who also happen to support the government in fleecing the consumer. So, at that point your currency ALWAYS can be expected to BUY less.

The higher the yield of the currency the more you can expect it to be RELATIVELY stronger in terms of other currencies, but your purchasing power is eroding in all currencies. The days of the Dollar as the reserve currency to the world will continue to diminish, but don't expect the Euro or Pound to replace it as they are equally flawed.

As the G7 continues to RENEGE on their PROMISES TO PAY to the holders of it's currencies (those who have placed their trust in the G7 public servants, financial industries and central banks) you can expect a natural selling to take place versus emerging world currencies and you can expect this to continue in 2008. The G7 is EXPORTING approximately 2 trillion Dollars, Euros, and Pounds a year to the emerging world and resource suppliers. These are IOU's and promises to pay, not money .

G7 public servants have no intention of paying off these IOU's. To do so would be political suicide and that is one thing you can expect a public servant to avoid at all costs. So, debasement is set to continue and legislative actions are set to confine Sovereign Wealth Fund investments to those that can be confiscated by printing press and FIAT money creation.

This is the G7's definition of SOCIALLY responsible for G7 constituents; it is socially responsible to steal the value of the currency used to pay for goods, services, and energy supplies.

Of course, it is socially irresponsible for the Sovereign Wealth Funds and emerging world central banks to let the value of their currency holdings be debased by their customers to the detriment of their own constituents, so repatriation is set to accelerate.

The UAE's Dirham, Chinese Yuan, Brazilian Real, Indian Rupee, Singapore and Hong Kong Dollars and Russian Ruble, etc. are all set to increase in RELATIVE strength to G7 currencies. Any emerging world currencies that peg to the dollar, or a basket, will be under enormous pressure as the capital flows (out of the G7 and into emerging economies) will be enormously against their desire to peg. Copious quantities of currency sterilization lay directly ahead in these countries, adding to their already enormous piles of G7 currencies and spurring huge amounts of growth, This is the purest form of economic stimulus. But the policies of confiscation through fiat currency creation are firmly in place in the emerging world as well.

In conclusion: Currency values can expect to provide enormous opportunities in 2008 as investors and holders of them race around the world in search of preservation of purchasing power and the ILLUSION of perceived SAFETY and higher yield! There are generational changes in currencies, and in their valuation on the horizon, with respect to one another, as the world transitions to something OTHER than the dollar as the world's RESERVE currency. You can expect emerging world central banks to increasingly substitute REAL reserves, such as gold and silver, in exchange for the ones they are currently using - known as G7 currencies.

The carry trade will continue, only the face and complexion of it will change. Deflation is still firmly in place in the Land of the Rising Sun, aka Japan, as Bernanke succumbs to his weak personal character, poor preparation for the position he holds as Fed chairman (classic demonstration of the Peter Principle), the withering assault from Washington DC, the money center banks and WALL STREET. You can expect him to lower rates and debase the dollar in rapid manner. Also expect the Bank of England and the European central bank to follow in his footsteps as they succumb to the immense pressures so evident in the US today.

In order to thrive you must first STOP and SHORT CURCUIT the loss of the purchasing power of the currency in which you hold your wealth. There will be enormous opportunities as capital flows from one currency to another. Huge moves! Make sure you are on the buy side of any area actually creating wealth (the emerging world and resource economies) and on the short side of those destroying and consuming more of it than they produce (the G7, welfare states and developed world.) The Euro is only a temporary destination as a perception of the ECB (European Central Bank) and Jean Claude “TRICKY” Trichet are at slightly higher levels of esteem then Washington and Bernanke.

The dollar will have inevitable bounces as people run to the perceived safety of it during market routes such as witnessed in the beginning of 2008. Use these episodes of increased value to exit your paper and enter into REAL things. The “Crack up Boom” is unfolding in an increasingly rapid manner.

Keep in mind, as interest rates decline, the funding of the external deficits, “trade and budget”, will cause it ultimately to work lower as assets in the United States will have to be priced LOWER to compensate for the lower yield in the currency. Then, as it transitions to a funding currency for the carry trade additional selling will emerge. Why hold a currency if it yields almost nothing? And, if properly measured against inflation it will yield negative rates of return. In other words, a dollar holder sends money to put into a T-bill; they invest a dollar and get back 90 cents a year later. Increasingly the world will realize this is the case with EUROS, Swiss Francs and British Pounds as well!

There is nothing you can do to change this! These realities are ENORMOUS opportunities! Don't fight them, hide your head in the sand or be despaired, play them for all they are worth! Figure it out, you can do it! VOLATILITY is opportunity and it is going to increase in a vicious manner as I outlined last week. Put yourself in a position to benefit from it!!!

Just as you would duck if a gun was pointed at your head, capital can be expected to have the same “self preservation” instincts. It is the most basic nature of humans to flee and that is what capital will do as well. It is an extension of the humans that control it. On this you can rely! Use this knowledge to protect yourself and capitalize on it!!!!! It is the only sensible thing to do!!!!

Currencies will allow you enormous opportunities in 2008, up and down. RISING Volatility in Stocks and interest rates set the stage for additional volatility in currencies. Market and Economic Perceptions? They are a changing so price adjustments are sure to follow. BIG ONES!

Next week we will wrap up the 2008 Outlook with a look at commodities of all sorts. There is only one haven at this point and that is the world of “real things', hard assets and commodities. However all asset classes and market sectors: stocks, interest rates, exchange rates, metals prices, grains, soft's, and more are set to explode in volatility and opportunity in 2008 . After all, Mises didn't call it a “Crack up Boom” for nothing!

Thank you for reading Tedbits, if you enjoyed it send it to friend and subscribe, its free at www.TraderView.com

Ty Andros & Tedbits LIVE on web TV. Don't miss Ty interviewed live by Michael Yorba from Commodity Classics every week discussing this week's commentary and unfolding news. Catch the show every Wednesday at www.YORBA.tv or www.CommodityClassics.com at 4:15pm Central Standard Time . Archived video casts are available there as well.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.