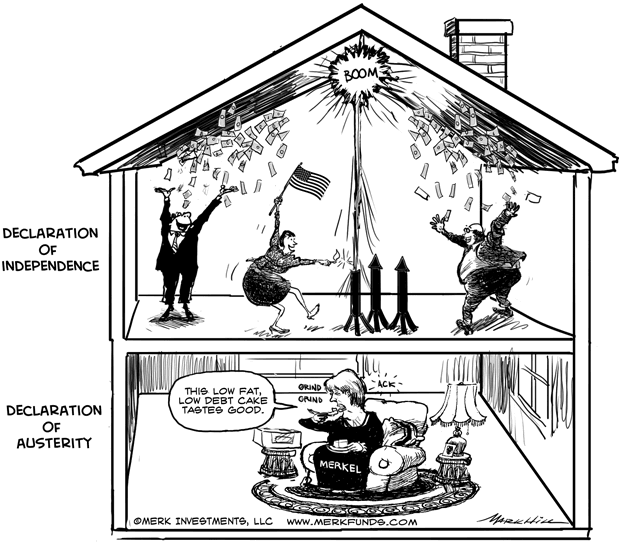

Angela Merkel Celebrates Declaration of Austerity

Politics / Eurozone Debt Crisis Jul 04, 2012 - 04:38 AM GMTBy: Axel_Merk

Spain may have the best soccer team, but it lost control of its banking system. That's good news: the success of the Eurozone summit is not about money, but about process. For the first time in months, it appears there's a sensible path forward. For the budding euro rally to continue, actions must follow words; regardless, however, there will be investment opportunities, but don't count on the U.S. dollar to carry the day.

Spain may have the best soccer team, but it lost control of its banking system. That's good news: the success of the Eurozone summit is not about money, but about process. For the first time in months, it appears there's a sensible path forward. For the budding euro rally to continue, actions must follow words; regardless, however, there will be investment opportunities, but don't count on the U.S. dollar to carry the day.

As for the "winner," German Chancellor Merkel achieved what she set out to do:

- The European Stability Mechanism (ESM) does not receive a banking license;

- No Eurozone bonds have been announced;

- No Eurozone wide bank guarantees have been announced.

Lip service was provided to potentially allow the ESM to buy bonds. But that theoretical possibility has been in place before. In our view, if the ESM were to be deployed to buy peripheral bonds, it would be a waste of ESM resources, depriving the ESM of its ability to inject capital into banks or national governments. As such, the Netherlands and Finland are absolutely right to have come out again in public against deploying the ESM to buy bonds.

With all the talk about winners and losers, let's not get too carried away. It would be great if we had leaders such as former British Prime Minister Thatcher or former U.S. President Ronald Reagan able to articulate a vision, be a straight shooter and sell their message to the public at large. Instead, the world we live in is saturated with politicians that have perfected the art of tailoring their messages. Back at home, even technocrat Mario Monti has learned to give flamboyant anti-Merkel speeches; similarly, German Chancellor Merkel tells her domestic audience "no Eurobonds while I'm alive." However, after spending an overnight marathon session together, the more pragmatic sides prevail.

While most focus on who gets how much money, the only relevant question is whether the Eurozone is heading towards a sustainable path, both politically and fiscally. To get there, European Central Bank (ECB) President Draghi recently stipulated the Eurozone requires roles, deadlines and conditions to be set. In our assessment, the fireworks in the markets were justified because of progress made in a key area: the banking sector.

National regulators have proven ill-suited in supervising their domestic banks - the inherent conflicts of interest to promote sovereign debt of their own governments is simply too great. Further, the political will to liquidate / consolidate lenders has not been strong enough, as the political establishment has long had too cozy a relationship with the local lenders. By agreeing to a Eurozone wide regulator, we have a chance to actually move to a United States of Europe. The devil may well be in the detail - there will be plenty of opportunities for the markets to be disappointed. However, taking the U.S. FDIC model as an example, it has two key components:

- A deposit guarantee;

- A resolution authority

Too much emphasis has been put on the deposit guarantee. Merkel has been absolutely right that it is inappropriate to throw good money after bad in guaranteeing Spanish deposits - without seizing control of Spanish bank regulations. The Spanish banking sector is too large; many of its banks must be liquidated. The political will at home is simply not there (with Prime Minister Rajoy enjoying an absolute majority in his parliament, that's a disgrace). But fear not, financial necessities "encourage" Spain to cede control of its banking system. Merkel has argued all along that if someone wants money, they must give up control - be that over national budgets or national banks.

It remains to be seen how willing Merkel will be to apply the same principle to the German banking system. We have yet to see anything useful come out of the German bank regulator BaFin. As some may recall, BaFin did not play along last summer when the European Banking Authority (EBA) had banks publish their sovereign holdings. There too, luckily, the market provided the appropriate encouragement: German banks hiding behind BaFin had their bonds and stocks sell off in the market; within 24 hours, banks obliged to market pressure, opting for full disclosure. If BaFin were to cede control to the EBA on key regulatory powers, it would be a good day for European banking.

We expect the EBA to take on the role of such a Eurozone bank regulator. The above referenced stress test orchestrated by the EBA was great in allowing the market to assess which financial institutions were strong and which were weak. What wasn't good - ECB President Draghi has been rather vocal about this shortcoming in the past - was that there was no plan available for those that failed. In contrast, we may not have liked the bank bailout, but once a bank was determined to be in need of capital (and a bunch that were not, but that's another story), capital was made available. In the Eurozone, in contrast, weak banks were properly identified; but then, they were left on their own - not exactly a recipe to avoid a panic. Importantly, the summit agreement should lead to the EBA receiving the appropriate tools to clean up the banking system. In addition, the European Stability Mechanism (ESM) will be made available to inject capital.

Is it time to buy the euro? At the very least, there has been an amazing short covering. But the rally may reflect more. We have argued for some time that euro weakness is a result of a lack of process more than anything else. Bad news is better than no news. What we are looking for is that the process announced is actually being implemented - or, at least, that key components of the agreements survive. The most important one being that Spain does indeed cede control of its banking regulation. In the meantime, however, central bankers continue to hope for the best, but plan for the worst. That is, negative real interest rates may well be around for some time in major economies. It may be no coincidence that expectations for future monetary policy moves lean towards tightening for central banks of smaller countries, whereas towards easing for central banks of larger countries. With regard to the euro, we had moved our euro exposure to Singapore in our flagship strategy, for a number of reasons that include the comparatively prudent monetary policy, but also favorable statistical characteristics that make the Singapore Dollar a good substitute for the euro without some of the tail risks. We may be willing to revisit the euro as the process takes shape. In the meantime, however, we are very comfortable being outside of the U.S. dollar while continuing to mitigate the tail risks of the Eurozone.

Please sign up to our newsletter to be informed as we discuss global dynamics and their impact on currencies. Please also register for our upcoming Webinar on July 19, 2012. Please also follow me on Twitter to receive real-time updates on the economy, currencies, and global dynamics.

By Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.