Investors Learn to Think Nonlinearly

InvestorEducation / Learning to Invest Jul 10, 2012 - 03:15 PM GMTBy: Frank_Holmes

Is your portfolio limited by linear thinking? We believe so.

Is your portfolio limited by linear thinking? We believe so.

Many linear thinkers believe that to solve a problem, you need to follow a simple, logical path, a step-by-step sequence involving two variables. One and one is always two. Here's a diagram depicting the progression.

When it comes to solving today's social, political and economic ills, linear thinkers believe the solution is more regulation and government intervention. To wit: the thousands of pages piling up from the solutions of Sarbanes-Oxley, the Volcker Rule and Dodd-Frank.

There's a danger with this line of thinking because life is much more complex. Government policies are necessary for a level playing field for businesses, but they require a nonlinear way of thinking. Consider how scientists, mathematicians, psychologists and meteorologists have had tremendous success when they step outside the stiff boundaries required by linear thinking. Nonlinear math equations and systems have been used to explain weight loss, the spread of happiness, strength of metals and hurricanes. Millions of Americans' lives have been improved by a deeper level of understanding of these issues.

This nonlinear line of thinking needs to be adopted by policymakers. As we enter a critical period in the U.S. election cycle, Americans deserve thoughtful regulations that maintain the spirit found within the Declaration of Independence. These are lofty, but attainable goals, as long as we have leaders who are brave enough to fully consider how their actions affect job creation, social stability, economic prosperity, trust, and free markets.

Prohibition is an obvious example of extreme regulation in American history. With all the good intentions of improving the lives of Americans by eliminating the perceived source of corruption, crime and poverty, politicians outlawed the making, transporting and selling of alcohol. Politicians did not anticipate the extent of unintended consequences, as the illegal commodity only encouraged bootlegging, speakeasies and the mafia.

If you're older than 21, raise your glass to the repeal in 1933 and the more practical and balanced approach that followed, as states chose their own drinking ages until the 1980s, when the need to reduce drunk driving fatalities led to the National Minimum Drinking Age Act of 1984.

Investors today are the unintended victims of the linear thinking that has permeated through today's government policies. A friend of mine shared his parents' experience with me that many retired workers can relate to. After years of working hard and prudently saving for retirement, my friend's parents felt that their nest egg was large enough to retire and live off the interest. At the time, their accumulated savings of $500,000 was invested in long-term Treasury bonds yielding roughly 6 percent. The annual interest of $30,000 satisfied their needs.

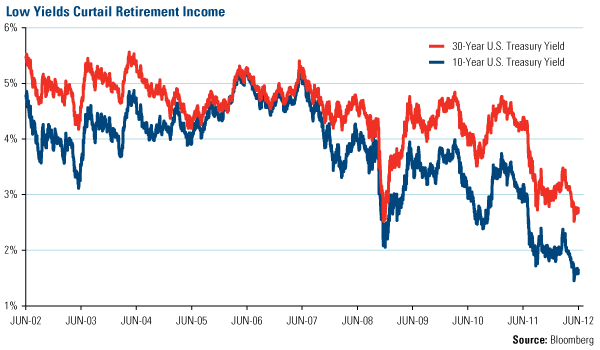

Fast forward to this year, when 30-year and 10-year government yields have been so manipulated by the Federal Reserve that the rates have been reduced to near-record lows. This knocks the interest income on the retirees' half a million dollar nest egg to only $5,000 per year.

By regulating yields, the Fed had the good intention of allowing people to borrow money at low cost to stimulate the economy, but the unintended consequence was a huge tax on retired people, forcing many to go back to work to supplement today's meager earnings.

Think Nonlinearly: A Time to be Resourceful

Don't be limited by linear thinking in your portfolio. As an alternative to low yielding Treasury bonds, consider resources stocks that pay dividends. We've found that most materials, utilities and energy stocks in the S&P 500 Index pay a dividend higher than the 10-year Treasury: Materials and utilities companies yield an average of 2.3 percent and 4.1 percent, respectively, while energy stocks pay an average yield of 2.2 percent.

Nonlinear thinkers have historically benefitted from the inclusion of natural resources as part of a balanced portfolio. Financial Planning found that, when included in a diversified portfolio and rebalanced annually, of natural resources funds with 10 year returns, the Global Resources Fund added the most return.

For more updates on global investing from Frank and the rest of the U.S. Global Investors team, follow us on Twitter at www.twitter.com/USFunds or like us on Facebook at www.facebook.com/USFunds. You can also watch exclusive videos on what our research overseas has turned up on our YouTube channel at www.youtube.com/USFunds.

By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

U.S. Global Investors, Inc. is an investment management firm specializing in gold, natural resources, emerging markets and global infrastructure opportunities around the world. The company, headquartered in San Antonio, Texas, manages 13 no-load mutual funds in the U.S. Global Investors fund family, as well as funds for international clients.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Standard deviation is a measure of the dispersion of a set of data from its mean. The more spread apart the data, the higher the deviation. Standard deviation is also known as historical volatility. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies. The NYSE Arca Gold BUGS (Basket of Unhedged Gold Stocks) Index (HUI) is a modified equal dollar weighted index of companies involved in gold mining. The HUI Index was designed to provide significant exposure to near term movements in gold prices by including companies that do not hedge their gold production beyond 1.5 years. The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.