Gold 'Game Changer' as UK New Regulation Favours Gold

Commodities / Gold and Silver 2012 Jul 18, 2012 - 12:02 PM GMTBy: GoldCore

Today's AM fix was USD 1,579.50, EUR 1,288.65, and GBP 1,012.57 per ounce.

Today's AM fix was USD 1,579.50, EUR 1,288.65, and GBP 1,012.57 per ounce.

Yesterday’s AM fix was USD 1,595.00, EUR 1,296.85 and GBP 1,020.47 per ounce.

Silver is trading at $27.09/oz, €22.23/oz and £17.43/oz. Platinum is trading at $1,415.75/oz, palladium at $574.18/oz and rhodium at $1,190/oz.

Gold fell $7.80 or 0.49% in New York yesterday and closed at $1,581.70/oz. Gold dropped off in later trading in Asia and then recovered losses for the open in European trading prior to further weakness where it is trading just below $1,580/oz.

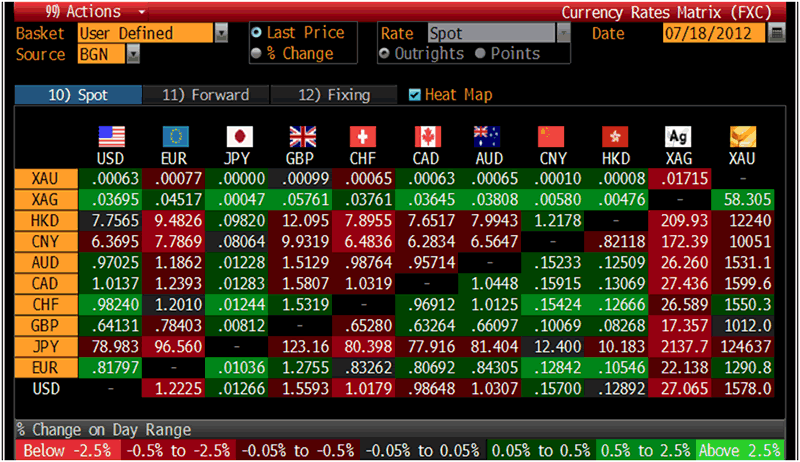

Cross Currency Table – (Bloomberg)

Gold hovered near $1,580/oz today after dropping marginally the previous session when U.S. Federal Reserve Chairman Ben Bernanke gave no clues of any monetary stimulus measures.

However the trading action was positive with gold falling sharply prior to seeing a v shaped bounce back to go positive on the day prior to weakness at the close.

Bernanke reiterated once again the stance that the Fed is prepared to take further action should the economic conditions worsen, but offered no clue on the timing of such action.

We have long said that the conditions would worsen and QE3 was inevitable.

Market participants and traders will wait for Bernanke’s testimony at 1400 today for more clues but those with a more long term horizon will again diversify on the dip.

Bullish for gold was the Fed chairman’s admission that policy makers are studying options for further easing that could be deployed. Tools available include further purchases of assets, reducing the interest rate on bank reserves kept at the Fed and altering its communications on the outlook for rates.

The Dollar Index, a gauge against six counterparts, fell for a fourth day.

Gold may also receive safe haven buying from the LIBOR scandal and crisis which deepened yesterday when Bernanke’s testimony conflicted with the Bank of England’s King and Bernanke appeared to admit that Fed employees were involved in the manipulation of Libor.

Bernanke said yesterday that “[In 2008] there was active effort to report to all relevant policy makers.” While King had said that “the first I knew of alleged wrongdoing ... was two weeks ago”.

Citi, Bank Of America, and JPMorgan appear to be set to be dragged into ‘Lieborgate’ as Congress is expanding the Libor probe to the big three U.S. domestic banks.

Also extremely bullish for gold was Bernanke’s admission that Libor is “structurally flawed” and an international effort would be needed to restore the rate’s credibility as the leading benchmark for mortgages, derivatives and corporate lending around the world.

The Libor scandal is further eroding confidence in the global financial system and will lead to safe haven gold demand.

While official inflation statistics continue to show inflation as benign, inflationary pressures continue to build – especially with regard to the essential that is food.

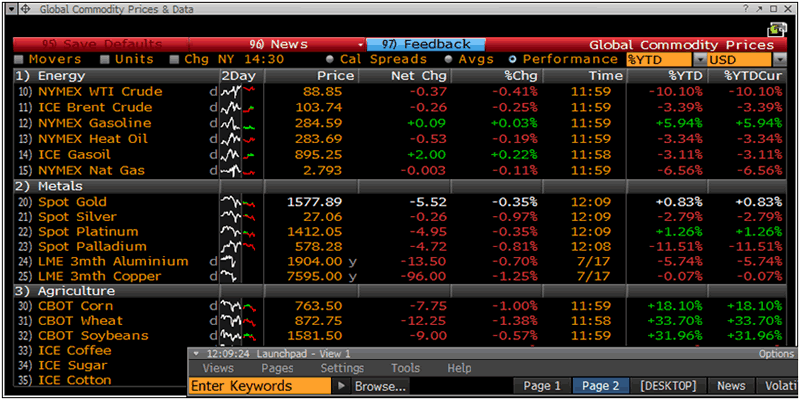

Global Commodity Prices & Data – (Bloomberg)

Year to date, food staples such as corn have risen by 18%. Soybeans have surged 32%.

Bread is set to get even more expensive in the coming months as wheat prices have surged 34% year to date. It is worth remembering that soaring food and especially food prices led to the ‘Arab spring’ and the various popular revolutions in the Middle East and North Africa.

Hungry people do not stay hungry for long. People suffering from inflation and receiving very low yields on deposits in unsound banks will continue to turn to gold as a store of value.

'Game Changer' For Gold In UK As New Regulation Favours Gold

Gold as an investment or savings mechanism has been frowned upon by the financial services industry in the UK and internationally for many years.

This was due to the bursting of the gold bubble in 1980 (when Volker increased interest rates to nearly 20%), the poor performance of gold in the 1980’s and 1990’s and the superior performance of cash, bonds and equities in that 20 year period.

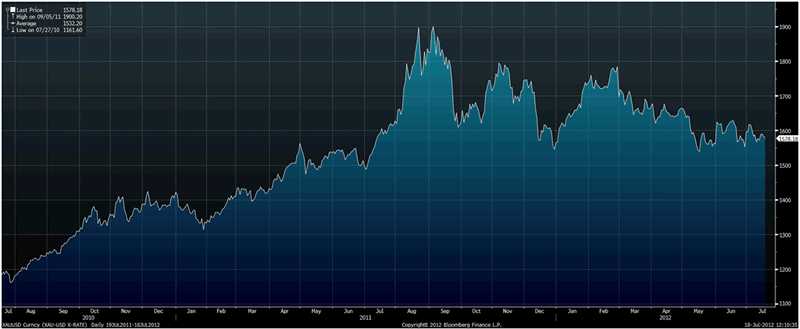

XAU/USD Rate – (Bloomberg)

It was also due to the fact that gold bullion was not lucrative for financial advisers and financial institutions such as stockbrokers and banks. Gold bullion is bought as a long term investment or store of value and as financial insurance. It is normally bought and kept and owned by the owner for a long time – even passing it onto children.

This means that financial institutions do not make continuing commissions which is their stock and trade. Gold bullion is also a very low margin business when compared to structured products and the many investment products with non transparent and often very high charges and fees.

However, the poor performance of the financial services industry with a series of misspelling and other scandals and the abject failure of much of the industry to have the fiduciary interest of their clients at heart means that the UK’s FSA is set to bring in legislation that will protect the retail investment public.

The Financial Services Authority (FSA) primary role is to make retail markets for financial products and services work more effectively, and so help retail consumers to get a fair deal.

In June 2006, the FSA created its Retail Distribution Review (RDR) programme which they are enacting in order to enhance consumer confidence in the retail investment market. The RDR has a target for full-implementation of 31 December 2012.

The RDR is expected to have a significant impact on the way in which financial services are delivered to retail investors in the UK. The primary delivery mechanism of financial services to retail customers is via approximately 30,000 Independent Financial Advisers (IFAs) who are authorised and regulated by the FSA. They are expected to bear the brunt of the force of the RDR.

Gold bullion is set to benefit from the axing of commission for IFAs and the implementation of the RDR “should be regarded as a game changer” for gold as an investment in the UK, according to the World Gold Council.

In its latest report ‘Gold as a strategic asset for UK investors’, the World Gold Council rightly points out that the current commission structure in the UK narrowed the range of products recommended “which has been suboptimal for clients’ risk preferences and diversification prospects”.

The World Gold Council backs the new regulation, arguing that it will lead to a broader range of assets including gold being recommended by advisers.

“Re-focusing the advisory community and the clients it serves on the importance of asset allocation decisions, not just product selection, sits at the heart of wealth protection” it correctly says.

“Encouraging a broader approach to investing across a wider range of asset classes, based on an understanding of the long-term increase in cross correlations within global investment assets, will be a positive development.”

Much financial academic literature has shown how gold can serve as a portfolio diversifier, preserver of wealth and a risk management vehicle.

“During most market crises over the last 25 years, gold has consistently increased portfolio gains or reduced its losses,” according to the report.

Managing director of investment Marcus Grubb, says: “These extremely challenging times mean it’s impossible to quantify the risks for UK investors. They are facing an unprecedented combination of threats to their assets including extreme and unexpected market shocks that can trigger widespread value destruction.”

“As UK investors reduce allocations to traditional investments such as equities and bonds and increasingly dash to cash, they face a double whammy, with the potential for stagnation of capital due to the lack of returns from cash and the increased possibility of inflation as a result of ongoing monetary stimulation.”

“In this context, an urgent reappraisal of how to protect and create wealth is required and our latest research reinforces gold’s credentials as a core portfolio asset which reduces losses and preserves wealth.”

The RDR regulation is another step in gold slowly going from the fringe - with a small minority of people having any allocation to gold - to the mainstream.

The developments in the UK are likely to be seen in other countries with similar financial regulations and will further help position gold as a primary asset – alongside equities, bonds and cash.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.