The Stock Market - FTSE Bull or Bear?

Stock-Markets / UK Stock Market Feb 02, 2008 - 03:38 AM GMTBy: Fat_Prophets

So far, 2008 has been an extraordinary year for investors. Sharp falls in December and January, which culminated in last Tuesday morning's panic selling, saw the FTSE100 down more than 20 percent from October highs. This supposed magic 20 percent figure sparked widespread talk of an 'official bear market'. But for the remainder of the week, the market rallied, thus pulling us out of bear market territory. Does this mean we're back in a bull market?

So far, 2008 has been an extraordinary year for investors. Sharp falls in December and January, which culminated in last Tuesday morning's panic selling, saw the FTSE100 down more than 20 percent from October highs. This supposed magic 20 percent figure sparked widespread talk of an 'official bear market'. But for the remainder of the week, the market rallied, thus pulling us out of bear market territory. Does this mean we're back in a bull market?

"On the one hand we have a contracting global credit bubble and on the other we have the US authorities manning the liquidity pumps to stimulate a flagging economy. "

We raise this rather useless point to illustrate the difficulty of broadly defining market trends. The conventional wisdom is that a 10 percent fall represents a correction while a 20 percent fall represents a bear market. We don't support these simplistic methods.

As Members know, we use technical analysis to assist with our fundamental research. There is nothing in the field of technical analysis that states that a fall of 10 percent signals a correction, or that a fall of 20 percent signals a bear market.

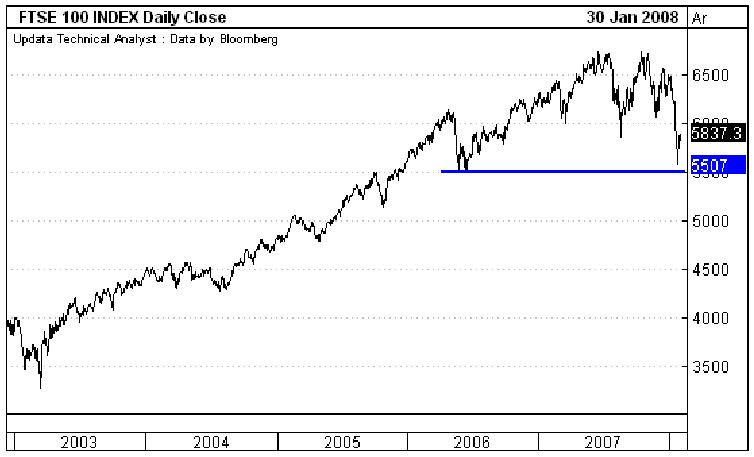

In our opinion, the jury is still out on the bull/bear market story. From a short term perspective, last week's sell-off was not good. As shown on the daily chart below, the FTSE100 went perilously close to August lows.

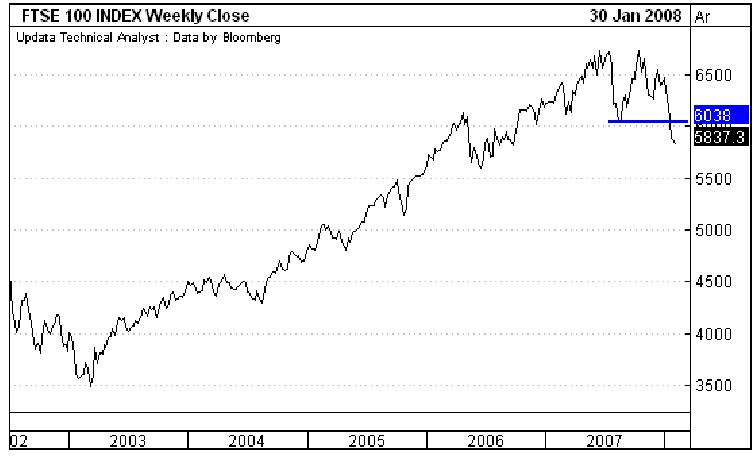

But if we look at a weekly chart, which provides a longer term perspective on market direction, the picture is mixed. The chart below shows the weekly close on the FTSE100.

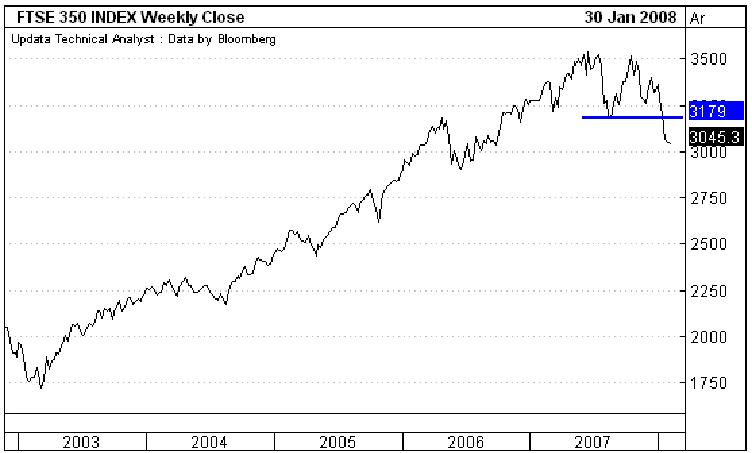

The recent break and close below the August low of 6038 satisfies the Dow Theory criteria for a bear trend. However, falls in the region of 1200 points during January have seen technical indicators become considerably oversold. In our opinion, this indicates further downside risks are limited in the near-term.

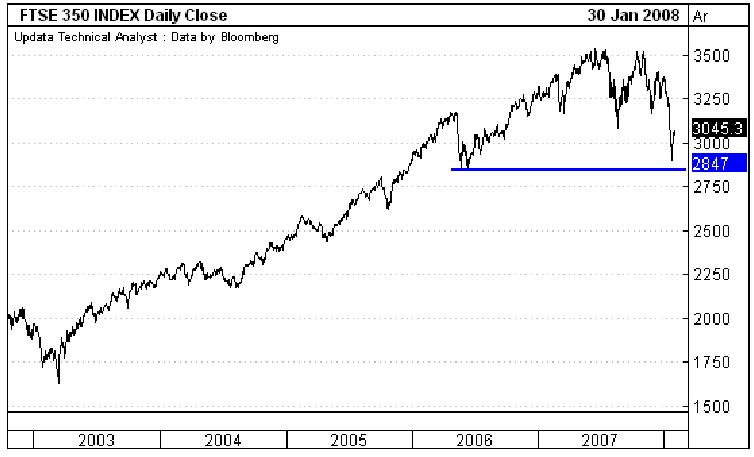

The story is similar for the FTSE350.

While we cannot rule out further volatility in the months ahead, it is encouraging to note that the index currently remains above the low close of June 2006 at 5507. So we cannot say with great certainty that the bear is waking from his long period of hibernation.

This tug-of-war between the bull and bear viewpoint as discussed above is hardly surprising. On the one hand we have a contracting global credit bubble and on the other we have the US authorities manning the liquidity pumps to stimulate a flagging economy.

Last week, the US Federal Reserve provided Wall Street with an unprecedented emergency rate cut of 75 basis points to offset an impending stock market meltdown. And yesterday they took a further 50 basis points off, taking rates to 3 percent.

On top of this, George Bush is prompting Congress to pass a US$150 billion fiscal stimulus package. The package is designed - unbelievably - to get consumers to spend more.

If the consequences of such action weren't so serious, it would be funny. Lower interest rates and abundant credit are the cause of the current market problems, so how lower interest rates and more credit will change things is anyone's guess.

Yet the Fed really has no choice but to lower interest rates and try and contain the fallout from the deflating credit bubble. Wall Street and Washington are too powerful for the Fed and would not stand for a responsible, long term monetary policy.

These recent events simply reinforce our bigger picture views. The big winners out of all this will be the precious metals, and probably to a lesser extent oil and the base metals, given their more economically sensitive fundamentals. So a portfolio overweight in 'real' assets should continue to outperform other sectors.

The other major winners will be Asian nations and oil producers, who will undoubtedly continue to use their large foreign exchange reserves to buy up US assets. These countries collectively have huge holdings of US debt. Debt is a claim on assets, and there will be increasing claims on US assets as the credit crises continues to unfold, as debt is swapped for equity.

With US cutting interest rates as fast as possible, the Bank of England is also facing similar pressures to loosen. However the Bank is in a difficult bind.

The UK housing market is creaking and there are clear signs that a weak consumer and struggling financial sector may have a large impact on economic growth.

Then there is inflation. Already above the Bank of England's 2 percent target and expectations are even higher. A YouGov survey released this week pinned these at 3.3 percent over the next 12 months, with higher food and energy prices the key drivers. The Bank's concern would be that if not dampened these expectations could herald a wage price spiral.

Perversely, despite predictions by many of a cut next week, the textbook decision would be to increase rates to combat rising inflationary pressures. This would also provide the Bank with inflation fighting credibility. Remaining on hold, and adopting a 'wait and see' on the other hand, is for the moment probably the easiest (in the short term) decision. However the Bank will have to put their cards on the table sooner or later.

In summary, given the high level of uncertainty investors are experiencing (witness the huge recent daily market moves) our strategy is to remain cautious in terms of investing additional capital in the market.

We advocate buying on panic days like last Tuesday (hence our mid-week buy alert) and continuing to accumulate gold and gold stocks. Gold is clearly in a bull market and although we expect continuing volatility, the outlook remains extremely solid. So we will continue to recommend opportunities as they arise.

And while on the subject of gold, the charts are painting an extremely bullish picture. After breaking out of a triangle formation in late December, the gold price marched through the old nominal high of US$850/oz with ease. The following pullback was notable as it ended abruptly at the US$850 level, before again resuming higher.

While US officials continue to think they can print their way to wealth, we'll continue to stick with our bullish views on gold. Furthermore, we'll continue to recommend gold and gold stocks on any short term corrections.

In terms of other sectors, as we have mentioned, value is returning to the market but we see no need to rush in. If this does turn out to be a bear market, cheap stocks can get cheaper. Similarly, cheap stocks can become expensive if earnings miss expectations. Given that many stocks are still in a downtrend, we feel we have plenty of time to investigate opportunities.

For a FREE sample of Fat Prophets research please call 02079369357 or email peter.lomas@fatprophets.co.uk.

About Us - Fat Prophets provides independent advice on the financial markets where our objective is to be transparent, accountable, objective and ethical. We believe that integrity is the central characteristic of every successful investor. Our independence in financial markets is derived from the fact that Fat Prophets does not execute transactions or provide investment banking services.

Fat Prophets principal focus is to deliver a quality service to Members by discovering and identifying quality stock recommendations on the London Stock Exchange. The launch of our UK service follows the successful establishment of Fat Prophets in Australasia.

Founded in June 2000, Fat Prophets is owned and operated by financial markets professionals. Having become Australia's leading independent stock market advisors, our horizons were broadened during 2003 through the addition of Fat Prophets United Kingdom. Our service offering also includes Fat Prophets Mining & Resources, Fat Prophets USA, and Fat Prophets Funds Management.

Fat Prophets UK was launched in 2003. As one of the world's largest stock markets, the UK offers an expansive array of investment opportunities. Within this environment our value-based strategy has proven highly successful, and fattened our Members' portfolios.

Fat Prophets Australasia focuses on delivering a quality service to Members by identifying and recommending undervalued companies on the Australian and New Zealand stock exchanges.

Fat Prophets Mining & Resources coverage extends to companies involved in mining, exploration, precious metals, diversified resources, energy, mineral sands, bulk ores, diamonds, as well as mining and energy infrastructure services.

Fat Prophets USA has an international focus, recommending a broad range of US based and foreign companies trading on the US exchanges.

Fat Prophets Funds Management In 2005 the company diversified into funds management when the Fat Prophets Australia Share Fund (Fat Fund) was successfully listed on the Australian Stock Exchange after $33 million was raised.

Disclaimer : Mint Financial (UK) Ltd, trading as Fat Prophets United Kingdom, has made every effort to ensure the reliability of the views and recommendations expressed in this report. Fat Prophets United Kingdom research is based upon information known to us or which was obtained from sources which we believed to be reliable and accurate at time of publication. However, like the markets, we are not perfect.

This report is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Individuals should therefore discuss, with their financial planner or advisor, the merits of each recommendation for their own specific circumstances and realise that not all investments will be appropriate for all subscribers.

To the extent permitted by law, Fat Prophets United Kingdom and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special or consequential loss or damage) arising from the use of, or reliance on, any information within the report whether or not caused by any negligent act or omission. If the law prohibits the exclusion of such liability, Fat Prophets United Kingdom hereby limits its liability, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Fat Prophets Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.