Fall in New Home Sales Casts a Shadow on U.S. Housing Market

Housing-Market / US Housing Jul 26, 2012 - 02:41 AM GMTBy: Asha_Bangalore

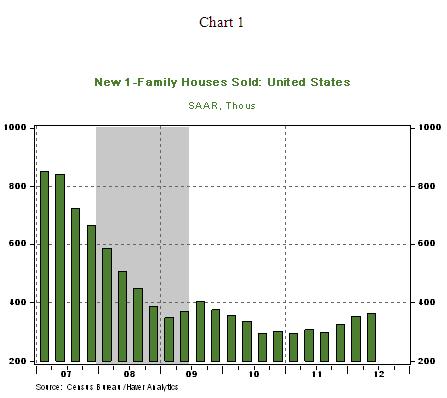

Sales of new single-family homes fell 8.4% to an annual rate of 350,000 in June following upward revisions to both April and May sales numbers. The level of new home sales in the second quarter (363,000) is above the first quarter mark (352,000) mainly due to the sharp increase in sales recorded in May.

Sales of new single-family homes fell 8.4% to an annual rate of 350,000 in June following upward revisions to both April and May sales numbers. The level of new home sales in the second quarter (363,000) is above the first quarter mark (352,000) mainly due to the sharp increase in sales recorded in May.

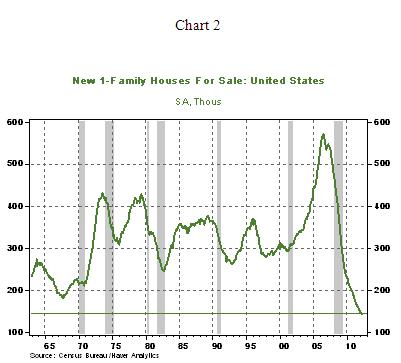

Regionally, sales of new homes dropped in the Northeast (-60%) and South (-8.6%) but advanced in the Midwest (+14.6%) and West (+2.1%). The median price of new single-family declined 1.9% to $232,000 from a year ago, but prices of new homes are hard to assess because of frequent wide swings. Although the inventory-sales ratio edged up slightly in June (4.9 months) from the May reading (4.5 months) , the number of homes for sales is at a record low of 144,000 (see Chart 2). This record low inventory is a big plus as homebuilders will have to consider expanding activity in the event of improvements in the economy.

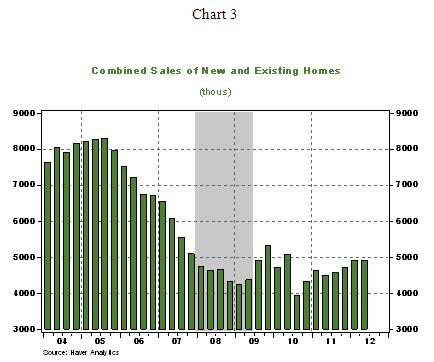

Sales of existing homes slipped 5.4% in June to an annual rate of 4.37 million units and are down 2.6% in the second quarter (4.537 million units). Combined sales of new and existing homes fell 0.4% to an annualized rate of 4.9 million homes, following three consecutive quarterly gains.

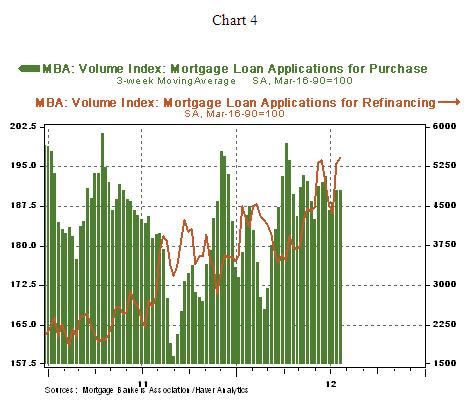

The 5.9% increase in Pending Home Sales Index in May is a bright spot of the housing sector, which bodes positively to an increase in homes sales in the near term. This optimism is dampened to some extent by the nearly flat reading of the Mortgage Purchase Index in the first three weeks of July. The upward trend of the Mortgage Refinance Index (see Chart 4) implies that lower mortgage costs enables households to increase consumer spending. Pulling the mixed news from the housing sector together, the disappointing home sales numbers in the second quarter overwhelms other positive developments and strengthens the case for additional monetary accommodation from the Fed at the July 31-August 1 FOMC meeting.

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2012 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.