Crude Oil Price Spike on QE3 Expectations Should be a Warning to the Fed

Commodities / Crude Oil Aug 11, 2012 - 12:36 PM GMTBy: EconMatters

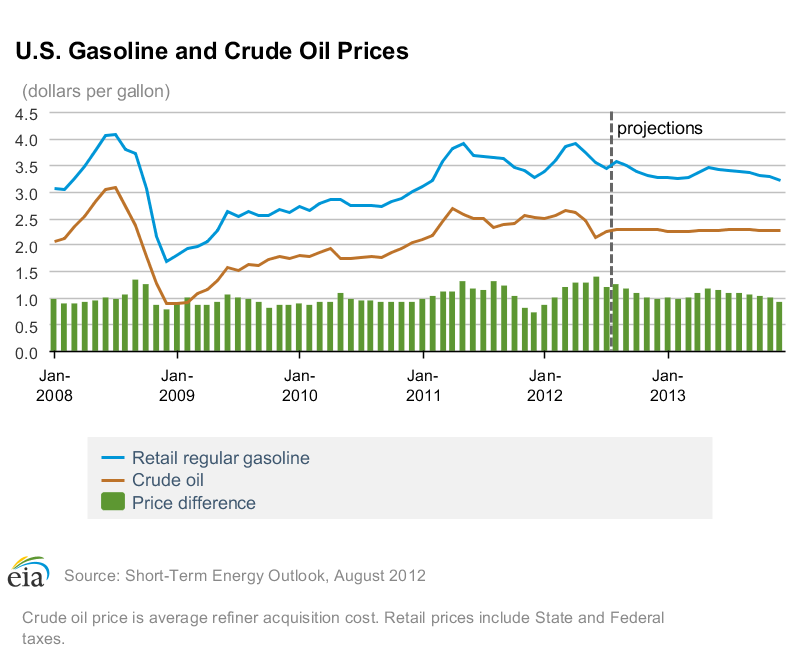

Crude Oil prices for WTI were just $78 dollars in July, a month later they are $93.40 with supplies well above their five year average range, China decelerating at a rate not seen since the financial crisis, and US gasoline demand down 4.2 percent year-on-year and distillates down 2.8 percent.

Crude Oil prices for WTI were just $78 dollars in July, a month later they are $93.40 with supplies well above their five year average range, China decelerating at a rate not seen since the financial crisis, and US gasoline demand down 4.2 percent year-on-year and distillates down 2.8 percent.

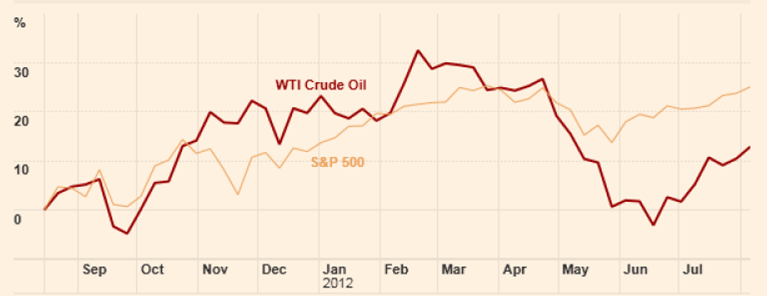

So what the heck is going on in the Oil Markets? Well, just look at the S&P for your answer: Capital has flowed into assets based upon the expectation that Bernanke and his cohorts at the Federal Reserve will print some more money out of thin air in the form of some monetary easing initiative falling under the heading of QE3. (See Chart Below)

Chart Source: FT.com, Aug. 11, 2012

Will the Fed ever learn that they cause more harm than good in the Global and Domestic economy with these QE initiatives that are the proverbial sugar rush to asset classes on one hand, but cause far more structural damage to the economic recovery by adding a huge federal tax premium to gasoline prices in the process. This just is the same old cycle over and over:

1.QE Program

2.Gasoline prices explode upward with the rise in Oil

3.Consumers pull back discretionary spending

4.Economic growth slows down

5.Oil drops because of slower economic growth

6.Politicians lecture about the need to create more jobs

7.The Fed notes slower economic growth

8.Consumers benefit from lower gas prices

9.Just as the economy starts to benefit from more discretionary capital being allocated towards the Retail & Consumer sectors and away from high input costs like Fuel

10.The Federal Reserve hints at QE3 and all asset prices inflate in less than a month with crude gaining $16 a barrel

11.Consumers and the economy start pulling back all over again.

Stop this endless cycle and let the economy slowly work its way out of the deleveraging process in a natural, slow but solid growth trajectory which can actually build momentum upon each previous quarter instead of this push and pullback QE cyclicality that can never get out of its own way.

There are actually market reasons why prices should retreat in a slower growth economy, and this is part of the natural business cycle. But these QE initiatives never give the natural forces of lower input costs which given enough time to work their way through the supply chain can add a lot to stimulate creative and economic growth which is actually sustainable. And when the economy is really humming along market prices will increase just fine on their own accord. But artificially pumping the economy with steroids in the form of another QE3 Initiative is just self-defeating in the long run.

What are the actual benefits anyway? Bond rates have been extremely low; everybody who possibly qualified for a refinance has already done so at bottom basement rates. It doesn`t create any jobs which are based on demand. And oh by the way demand for more goods and services leads to more workers, but companies don`t need more workers if input costs are higher for consumers so they pull back discretionary spending in other areas to cover inflated gas prices that they cannot afford.

The US was built on consuming, and I am afraid the only consumption that will be increased is capital allocated to gasoline purchases, and in case you haven`t noticed there are zero jobs created by higher gas prices in the actual grass roots of the economic growth engine in the consumer and services portion of the economy.

Obviously, QEs in themselves do not work or we wouldn`t have to keep doing another iteration. Will there be a QE4,5,6,………………….100? These are not UFC events, if you have to keep doing another QE Initiative that ought to tell policy makers that there is a problem here with their effectiveness in the first place.

The rise in Oil and Gas prices in the last month based on hopes that the Federal Reserve will boost asset prices some more should be the biggest warning sign that they need to stop this madness, and let the market down for a change. The goal is to improve the economic fundamentals, not push up assets artificially that create no actual jobs in the economy.

The market has screamed loud and clear what the tangible results of the QE3 program are even without ever being implemented. Hello Fed I hope you are watching Oil prices lately because you caused more pain for consumers once again. Do you really need to go down this road again to know how it ends? QE3=Higher Gas Prices=Economic Slowdown. Just say no to QE3!

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2012 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.