Taking Advantage of Canada's (Black) Gold Rush

Companies / Oil Companies Aug 16, 2012 - 03:40 AM GMTBy: Roger_Conrad

Politics is a cynical game, rarely more so than during US presidential election years.

Politics is a cynical game, rarely more so than during US presidential election years.

And there are few better examples than the off-again, on-again treatment by federal regulators of TransCanada Corp’s (TSX: TRP, NYSE: TRP) attempt to build the Keystone XL pipeline.

The 1,179-mile Keystone pipeline would bring large amounts of oil from Canada’s tar sands south to US refineries for the first time.

Opposition has centered around the path the pipeline would take though environmentally sensitive areas of Nebraska as well as what opening Canada’s reserves would unleash in terms of carbon dioxide emissions.

The pipeline is currently officially in limbo, with the Obama administration deferring judgment until almost certainly after the election. The president, however, has allowed TransCanada to begin construction on the southern leg of the pipeline, a segment connecting Oklahoma’s Cushing hub with Gulf Coast refineries. This segment promises to be profitable in its own right, given the bottleneck at Cushing.

That move is a pretty good sign Mr. Obama will eventually approve the entire project if he’s re-elected in November. Meanwhile, his principle opponent Mitt Romney has said repeatedly he’ll OK Keystone.

My colleague, David Dittman, has reported on this controversy in Keystone Cops Create Controversy, TransCanada Builds Wealth. And there’s no doubt this is a tale with much left to tell, and ink to spill telling it.

My view is that the Keystone will eventually win approval and eventually begin shipping oil south in the coming years. That will unlock tar sands oil--as well as Canadian light oil from shale--as never before.

And the result should be an unprecedented wave of investment in the region that will trickle down to companies involved in everything from drilling wells to building schools.

Investment would be accelerated further if TransCanada rival Enbridge Inc (TSX: ENB, NYSE: ENB) succeeds in building is Northern Gateway pipeline, which will take oil sands output to the Pacific Coast.

Meanwhile, a third group of developers is gearing up to develop and export liquefied natural gas from British Columbia.

Suncor Energy Inc (TSX: SU, NYSE: SU) was the first company to develop Canada’s tar sands bounty, opening its Great Canadian Oil Sands mine in 1967. Today the company produces 542,000 barrels of oil equivalent a day; the majority of that total is from tar sands, and Suncor has plans for much more such output. And virtually every other major global oil company has joined it in the region, several of which operate under the Syncrude Partnership.

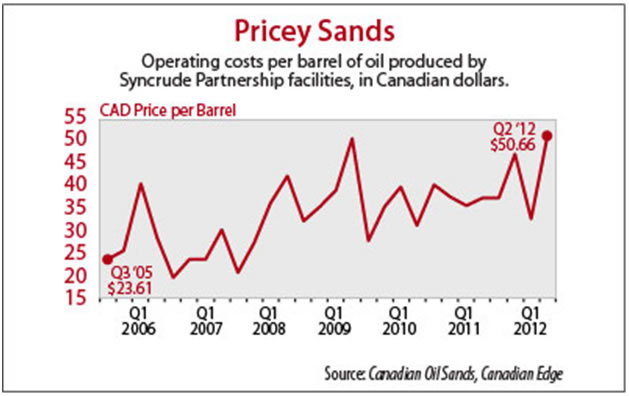

The key challenge is costs. As the graph “Pricey Sands” shows, the cost of producing a barrel of oil equivalent from Syncrude’s facilities has steadily ratcheted higher, even as scale has ramped up.

Syncrude’s average cost in the second quarter of 2012, for example, was over CAD50, more than twice what it was in third quarter of 2005.

That’s the precise opposite of the economics of most other energy sources, and it points to a long-term problem of many major oil sands producers.

Their facilities are simply not economic unless oil and gas prices are at a high enough level.

The exception to the rule is MEG Energy Corp (TSX: MEG, OTC: MEGEF), which uses a method of extraction known as in situ. Rather than mine and refine as Syncrude does, MEG’s method more or less flushes, with the results that costs are far less, production is greater and even environmental disruption is subdued.

The result is MEG’s costs are even lower than those of many conventional oil producers, coming in at a record of CAD7.79 per barrel produced in the second quarter. The company’s projects are backed by the financing power of China National Offshore Oil Corp, known as CNOOC, and judging from its second-quarter conference call output is likely to ramped up substantially if Keystone XL becomes a reality.

The chief drawback of the company’s stock for many investors is the lack of yield. That’s not likely to change anytime soon, given the company’s needs for development capital. If you’re an income hunter, check out my free report, The Top 3 Canadian Income Stocks to Buy Now.

Mr. Conrad has a Bachelor of Arts degree from Emory University, a Master's of International Management degree from the American Graduate School of International Management (Thunderbird), and is the author of numerous books on the subject of investing in essential services, including Power Hungry: Strategic Investing in Telecommunications, Utilities and Other Essential Services

© 2012 Copyright Roger Conrad - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.