Commodities, Natural Resources and Precious Metals Forecasts 2008 - Part IV

Commodities / Resources Investing Feb 05, 2008 - 02:12 AM GMTBy: Ty_Andros

This sector holds the most promise for those who practice simple “Buy and Hold” strategies. The wind is at the back of these markets for the next decade or more as the “Crack up Boom” combines forces with the Austrian economies of the emerging world. Three billion people are emerging into broad new middle classes, on the bid and are sitting on trillions and trillions of IOU's called G7 currencies. Supply constrained, demand lead bull markets are front and center in these sectors. Combine this with the breakdown in the definition of money as a “store of value” and explosive moves are on the horizon.The emerging world has no external debt to speak of and ton's of savings in the bank. They may not be the mindless consumers of the welfare states but their domestic consumption of all commodities, raw materials and metals is growing and will continue to do so at a decent and sustainable pace.

This sector holds the most promise for those who practice simple “Buy and Hold” strategies. The wind is at the back of these markets for the next decade or more as the “Crack up Boom” combines forces with the Austrian economies of the emerging world. Three billion people are emerging into broad new middle classes, on the bid and are sitting on trillions and trillions of IOU's called G7 currencies. Supply constrained, demand lead bull markets are front and center in these sectors. Combine this with the breakdown in the definition of money as a “store of value” and explosive moves are on the horizon.The emerging world has no external debt to speak of and ton's of savings in the bank. They may not be the mindless consumers of the welfare states but their domestic consumption of all commodities, raw materials and metals is growing and will continue to do so at a decent and sustainable pace.

The price structure of the world's commodities, natural resource and metals markets are about to undergo PERMANENT generational repricing. UPWARD! The prices you remember for the past several decades for these sectors will probably never be seen again and the old highs will now be the new lows in their prices.

The G7, and to a lesser extent emerging world, currencies are about to undergo PERMANENT generational repricing of purchasing power DOWNWARD! They will never buy more in the future then they have in the past, and we are entering the era of the “Crack up Boom” as outlined by Ludvig Von Mises.

The Keynesian economies of the developed world are exporting their wealth at an astonishing pace of almost 2 trillion Yen, Euros, Dollars, Pounds, etc. a year. These are IOU's, not money, and sooner or later those who hold them are going to increasingly demand payment, aka repatriation. Recently the managing director of the IMF, Dominic Strauss Kahn, spoke about how the “industrialized” world was in such good shape, inflation expectations were contained, etc. Somebody forgot to tell him the G7 has DE-INDUSTRIALIZED. Talk about fairy tails: the G7 now has no industry, it all lies in the emerging world were capital is rewarded, labor is competitively priced and inexpensive and taxes are dropping.

The only thing supporting the welfare states of the G7 is FIAT currency and credit creation and asset backed growth. The only policy these G7 LEADERS can conceive of is: “Print the money” and create government programs which take one dollar from the private sector or the printing press and create a program which delivers one dime of production. This is capital destruction on a gargantuan scale, and as they destroy it they destroy their own futures.

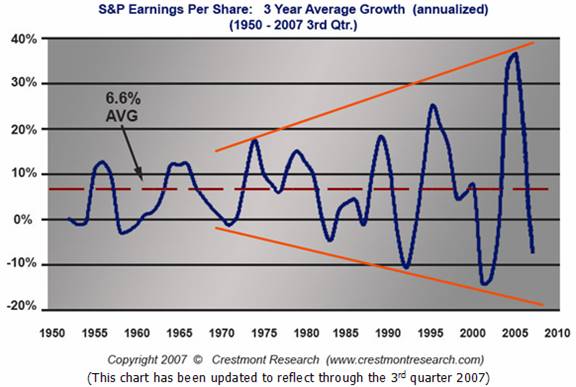

Let's review the dominant pattern of the year, courtesy of John Mauldin ( john@frontlinethoughts.com ) and by extension Crestmont research:

See the mega phone formation? It is called a wolf wave. We are at a fairly good level of profits now, but it projects a nuclear winter in corporate profits dead ahead (see chart below). From Record highs never seen in fifty years, to record lows also not seen in the same period, below the lows of 2001-2002. This chart is a testament to how fiat money and credit creation has made steady growth and economic stewardship become more and more unmanageable over a long period of time. It is clear that monetary policy is also following this wolf wave pattern, either too hot or too cold. Politicians (and their “something for nothing” constituents) in the western world see these enormous profits and are set to attack the creators and holders of this wealth. They want the money and they will put in place new taxes and entitlement mandates to claw back this gusher of wealth, thereby accelerating the downside of this wave. We all want business cycles that cleanse past excesses, but the up and downs are now out of control. There is no consistency, no orderly form to the business and economic cycles, everything now is either booming or busting.

As this pattern approaches what it is prophesizing we can look at 4 th quarter 2007 profits -- which are now projected to have clocked in at a year over year LOSS of approximately (-19%) extending its slide from the 3 rd quarters NEGATIVE (- 9%). This Wolf Wave is afoot throughout the G7, it is not limited to the US and it is set to EAT these economies and asset markets for lunch. As this earnings collapse unfolds so do incomes and tax receipts in Washington , Brussels , Paris , Berlin , Rome , etc., as well as statehouses, municipalities and the incomes of individuals.

In order to support this loss of income they will continue to debase the currency bases providing a natural buoyancy to prices of materials of all types as they reprice to reflect the lowering purchasing power of the paper currency in which they are denominated.

This wolf wave is afoot throughout the G7 and as incomes collapse you can expect the printing presses to pick up the slack. As globalization unfolds, the most powerful constituencies in the G7, the government, financial/banking sectors and corporatists, are rapidly losing their ability to control their own fates. The corporatists are playing both sides of the street as they always do, hedging their bets. They maintain their G7 offices and existing production, while placing most if not all their future capital expenditures in the emerging world. This is destined to continue for the foreseeable future.

But as it unfolds “public servant” policy responses to the crisis will exacerbate their ultimate demise. Rather then set the table for wealth creation they are attacking it at every level with higher taxes (global warming and bio-fuels are the taxman in disguise), and destructive mandates and regulations. These activities are the definition of less for more and inflation.

They are replacing the policies of wealth creation with their Keynesian solutions of government as master and provider of all. In this case, government is the problem not the solution . Socialism has never worked and it will not work today, tomorrow, next week, next year or decade. It is an idea that has been thoroughly PROVEN to FAIL. Unfortunately, it is front and center in the G7, but they call it capitalism to FOOL their constituents, manipulate their FEARS (False Evidence Appearing Real) and gather their electoral support! The majority in the G7 believe it's the wealthiest society in the world, but in actuality it is on its way to being the poorest. If you look at the ledgers, it already is.

In virtually every corner of the commodity, natural resource and metals world supplies are constrained, capacity to produce more is not in place, it takes years or decades to develop and demand is moving higher. As the emerging world and the BRIC's (Brazil, Russia, India, and China) build the infrastructure, roads, cars, appliances, power plants, factories and homes necessary to support their emerging middle classes, enormous amounts of raw materials will be required to do so. As their incomes rise so will their caloric intake as well. Foodstuffs are up 22% or more, year over year, putting additional bids into grains, meats, etc.

In the G7 the infrastructure is aging and decrepit, having been sacrificed on the altar of social welfare programs. Power plants, bridges, refineries, roads, sewers and infrastructure have either been neglected and not maintained or built for decades to feed the “something for nothing” constituents and ever rising ENTITLEMENT programs. Tremendous amounts of resources will be required to bring these areas to the levels required to meet future needs of current G7 residents. As these areas fail and become impaired, G7 public servants will be confronted with the choice of maintenance and rebuilding or feeding the impossible to meet obligations they have created with entitlement programs. They will attempt to do BOTH through fiat currency and credit creation.

The money in the Social Security, Medicare, highway trust funds and general maintenance budgets has been borrowed and redirected into CONSUMPTION and subsidies which create PERMANENT constituencies such as ethanol. Why are these constituencies permanent you might ask?

Because none of them have an economic reason to be, they cost more then they produce and the people employed in these industries must ALWAYS vote for and and make large campaign contributions to the public servants who support, expand and authorize them. Conversely, they are OUT OF A JOB. The more government that creates industries by subsidies and mandates the more they capture permanent supporters. Bio-fuels are turning out to be a scourge on mankind, they hold no economic reason to exist at this point, and they are mandated here and in Europe at ever increasing levels. They also destroy the water tables, so you can invest in water companies as water will become more and more scarce, a sure recipe for higher prices.

The G7 public servants have been eating the savings and seed corn required to meet the needs of present and future generations. At some point it will come down to the decision whether to keep the trains running and cities working or paying it out into entitlements. Ever wonder why there is no one in charge of managing and investing Social Security and Medicare TRUST funds? Because there are no dollars there to be managed, they are gone. Public servants will make the easy choice, “they will print the money” just as a banana republic does. When the bills come due they will always pay a higher price as the currency is ALWAYS worth less then YESTERDAY!

The World is creating FIAT currencies 13 times faster then gold is being mined. Take a look at this chart of global liquidity versus the price of gold, courtesy of RAB capital:

Gold, commodities, natural resources and metals are just going to accelerate higher to reflect the GLUT of liquidity illustrated here! The wolf wave means this move higher in liquidity is set to continue as they print the money to rescue the banks and financial sectors!

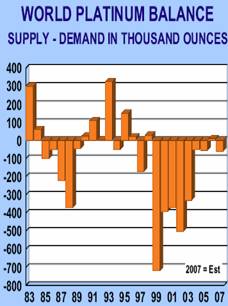

Silver is in constant deficit (we use more then is mined), platinum consumption is projected to be 500,000 ounces in excess of production in 2008. The second highest deficit EVER!

|

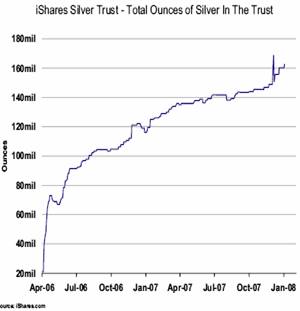

Gold and silver ETFs are constantly reducing the physical supply available as SMART investors seek shelter from the printing press creating additional shortages of all precious, semi-precious and industrial metals. Look closely at the huge base built in silver in the iShares Silver Trust since April of 2007. That is not at a spike high, it is just moving out of a yearlong base building; this move up is in its infancy. Take a look at this MASSIVE pennant that silver has just BROKEN out of on the monthly charts:

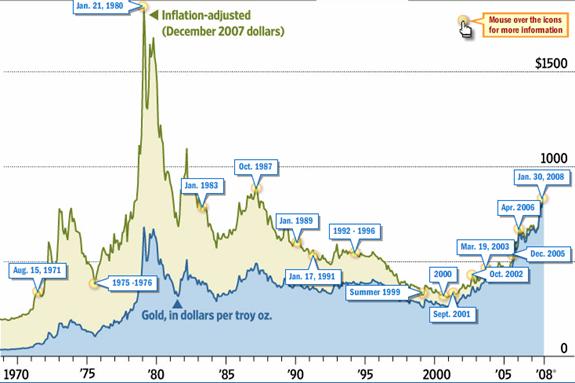

That pattern has been building for TWO YEARS. Wow, talk about an emerging explosion higher in price and volatility. This pattern projects silver to over $22 dollars. Gold has broken above its ALL TIME highs set in the 1980s, and finished there on a quarterly and yearly basis on the charts (projecting a $6oo dollar move higher from the old highs), recent action in short term point and figure charts project $1,125 near term, long term inflation adjusted highs would appear to be a reasonable prospect. Take a look at this recent illustration for the WSJ.com:

Once we get by those inflation adjusted peaks in 1987 and 1983 it's back to the inflation adjusted new highs just as OIL has ALREADY done. Emerging world central bank reserves of precious metals are only set to RISE in exchange to for those pesky G7 IOU's, er currencies. Take a look at this chart illustrating “ Currencies don't float; they just sink at different rates” :

This chart doe not reflect January price moves which moved GOLD to new highs

measured in all the currencies outlined in this chart.

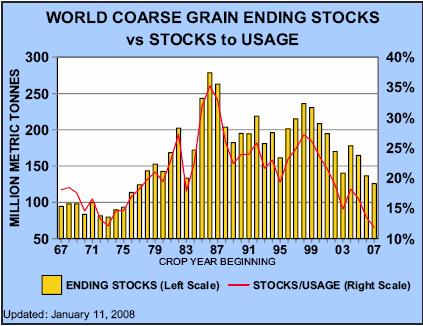

More grains (corn, wheat and soybeans) have been consumed then produced for 7 out of the last 8 years. Global grain stocks are plummeting.

More grains (corn, wheat and soybeans) have been consumed then produced for 7 out of the last 8 years. Global grain stocks are plummeting.

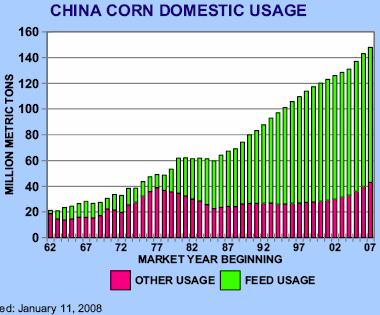

As grain reserves dwindle and production fails to keep pace you can expect “JUST IN TIME” inventory techniques to go the way of the DODO bird as hoarding and inventory building becomes necessary to avoid supply disruptions. Can you say “HIGHER prices as the FOOD FIGHT emerges?” Bio-fuels and expanding consumption are creating acreage shortages for all the major grains: wheat, corn, soybeans, and all the minor crops are left with inadequate supplies as well. Cotton and other grains are in emerging shortages as acreage that used to go to them is now diverted into the higher paying mainstays. Take a look at China 's corn usage profile:

Do you think this trend is going to end anytime soon? Grain and meat shortages are in the headlines throughout China , India and Asia . The emerging world has more money to consume commodities then ever before. As Marie Antoinette once said “Let them eat cake” and they will. They will be spending it, because if they don't they will always get less of everything the longer they hold it. Food prices are set to move much higher, buy pullbacks.

Do you think this trend is going to end anytime soon? Grain and meat shortages are in the headlines throughout China , India and Asia . The emerging world has more money to consume commodities then ever before. As Marie Antoinette once said “Let them eat cake” and they will. They will be spending it, because if they don't they will always get less of everything the longer they hold it. Food prices are set to move much higher, buy pullbacks.

The new Tata, $2,500 dollar automobile is set to roll out in India and China ; the first rung on the ladder for first time car buyers. In a year, when you see gas up $1 dollar a gallon keep this in mind. Commodities can go up because of other factors as well, lack of refineries, poor field maintenance by NOC (Nationalized Oil companies) and many other factors can cause shortages. Additionally, there are many factors, such as these, providing additional support to a wide array of other commodities, natural resource, and metals markets.

The Government run oil companies of Russia, Iran, Venezuela, Mexico, and Iraq are RAPING their oil resources by not properly maintaining or investing in them adequately, thereby considerably shortening their productive futures. If you can't get it out of the ground or turn it into something usable this creates upward price pressure as well. Output is falling in Venezuela , Mexico and Iran precipitously as fields are poorly maintained, underinvested in and milked for short-term gain and long-term pain. Russia is flaring more natural gas then the United States uses in a year, as it has NO ability to capture or transport it from the oil fields. Consequently, shortages are set to increase in these vital areas.

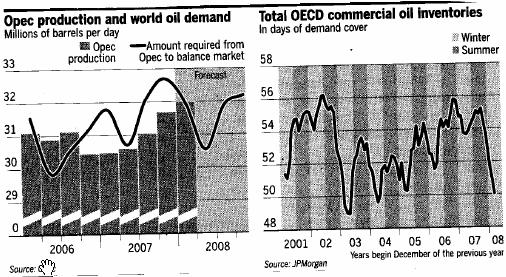

OECD oil inventories are approaching 4 year lows, global oil production is about 75 million barrels a day, usage is about 85 million barrels (bio-fuels and substitutes account for the difference) Opec's production is maxed out and bio-fuels cannot expand fast enough to meet additional demand. Bio-fuels have already caused widespread FOOD shortages, environmental destruction and exploding prices. Politically mandated expansion of this abomination of a political industry will roll into your grocery bills in a vicious manner this next year as well.

Source OECD

China is running on a knife's edge in terms of oil and coal inventories due to price controls. As anyone knows when they are imposed availability of the price-controlled commodity it virtually disappears from availability. Although demand in China and the emerging world is advancing, as you saw in the grain charts, their reserve positions in oil and coal are at perilous levels. Energy inventories are low around the world, in the developed economies and emerging ones. Ipso facto: More demand, less supply, plummeting purchasing power of fiat currencies equals HIGHER PRICES!

|

Ask Hugo Chavez, or the former Soviet Union ; price controls were virtual guarantees of scarcity. Everyone in the mainstream investment community keeps calling a top in oil to FOOL you, a pullback to the old breakout point of 75 or 80 dollars a barrel is called an INTERMEDIATE term correction in a blazing BULL market, NOTHING MORE! This is done to shake you off the trade, and allow your positions to fall into the strong hands of their proprietary trading operations.

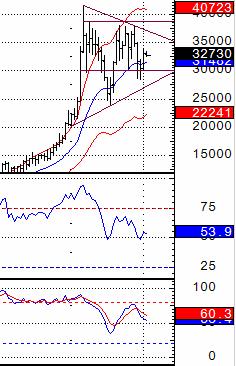

Everyone bemoans the state of the US housing and automobile industries and their prospect of collapsing, but you wouldn't think global growth is collapsing by taking a visit to Dr. COPPER who has a PHD in economic prognostications. They have not broken down and are closer to their highs than lows; take a look at this monthly chart going back to 2004:

Time to be a buyer very soon. Notice how the RSI (relative strength index) has just pulled back to NEUTRAL setting the table for the next BIG advance which will be signaled when the stochastic's cross back to the upside? You are looking at a TWO YEAR base! If it breaks out of the top of the pennant, it projects approximately $1.60 higher from the point of the breakout. I believe it goes out the top! Just as gold, silver and oil do over and over again!

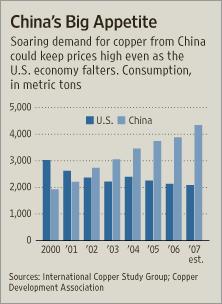

Why isn't copper breaking down based on unfolding G7 economic weakness? Look no further then this chart of Chinese consumption reflecting what was illustrated in the corn chart:

According to the International Copper Study Group, the US consumes just 12.4% of global production, down form 21.4% in 2000 (talk about de industrialization) while China consumes 22.7% of global production, up from 12.8% eight years ago. Infrastructure build outs are going to continue to support increased consumption in the emerging new capitalist economies. As middle classes emerge in the Austrian economic areas copper will be needed for cars, homes, appliances, power plants, etc. These trends are set to continue as the emerging world grows and the G7 production bases shrink from over regulation, high and rising corporate taxes and government mandates which render them increasingly uncompetitive in the global marketplace.

There is virtually no place I can find a commodity, natural resource or metals market which looks BEARISH in the MACRO sense; supposedly there is a liquidity crisis and a US recession unfolding but the CRB index (commodity research bureau index of commodities) finished at new highs in January. I can't find evidence of a slowdown in any charts, but can see corrective action in a few. The emerging world is doing what its name implies, EMERGING, and it is impacting demand and is a permanent incremental demand in all sectors we are covering today.

The only liquidity crisis is in the financial sector BALANCE SHEETS (they will fix this by doing what else: Printing the money). There is no liquidity crisis in the amount of IOU's, er currencies, sitting in bank accounts around the world. In fact, they are topped up and ready to roll out into the unfolding “Crack up Boom”. They are getting ready to move to avoid having their purchasing power and value confiscated at night by the global FIAT monetary systems, central banks and public servants.

FIAT currency and credit creation are rolling right along and, since the previous destinations in London and New York's over the counter sausage factories known as CDO's, CMO's MBS, CLO's are closed due to lack of confidence, this money must now seek new destinations as it is created and accumulated.

In the case of commodities, metals and natural resources there is a shortage of places to land; compared in size to the financial and currency markets they are dwarves! It's going to be like a city the size of New York trying to fit inside a compact car. Can you say: $10 dollar corn, $20 dollar Soybeans, $20 dollar wheat, $2200 gold, $25 dollar silver, $150 dollar OIL, $5 to 6 dollar copper, $1 dollar cotton, etc. ad infinitum?

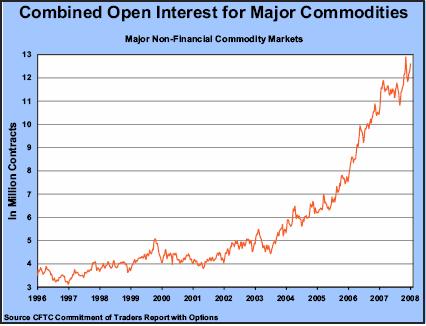

Now we are going to look at the data that says it all: OPEN INTEREST. Anybody who is involved in trading markets KNOWS that open interest is the TREND fuel of all markets. As people open positions and hold them it signifies healthy demand and investment growth; this, along with users accumulating hedges to LOCK in lower prices in anticipation of FUTURE USAGE. You don't want to be on the wrong side of this FRIEGHT Train!

Now we are going to look at the data that says it all: OPEN INTEREST. Anybody who is involved in trading markets KNOWS that open interest is the TREND fuel of all markets. As people open positions and hold them it signifies healthy demand and investment growth; this, along with users accumulating hedges to LOCK in lower prices in anticipation of FUTURE USAGE. You don't want to be on the wrong side of this FRIEGHT Train!

This is not the picture of a bubble; it is a picture of an orderly BULL MARKET in all major physical commodities. Individual markets may back, fill, consolidate gains and correct as supplies ebb and flow during the various production and use cycles during the year. Providing excellent opportunities to find value for your fiat currency for very brief periods. Notice the pullback, correction and consolidation of open interest in late 2006 and 2007? Providing a SOLID long term base for the next move higher in terms of TIME and PRICE!

The reason High energy and commodity prices have caused recessions in the past is because money supply growth is SLOWER than price growth during supply constrained BULL markets! This time that is not the case as GLOBAL money supplies are growing as fast or FASTER then commodity prices. Money supplies have grown far faster than prices for years and years and it is set to continue. This is why the recession has not materialized yet. Globally fiat currency creation is running about 16% per annum, Nothing REALLY bad can happen when they are creating money as fast as they are in the globe today. It's when they quit creating it at that pace that the problems start.

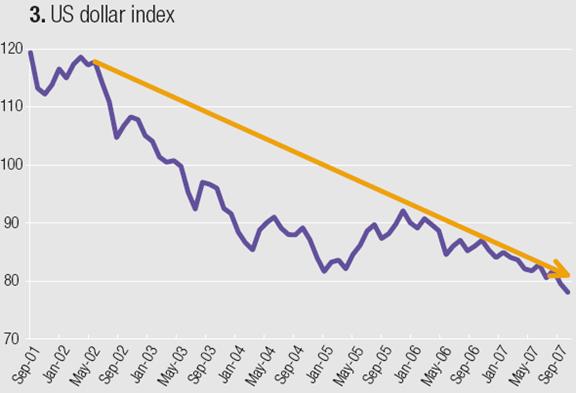

Now let's look at a long term chart of the dollar and the ORDERLY pace of decline:

Do you really think this well established trend is going to change soon? Those are multi generational LOWS in the value of the dollar since August. Of course the world will want more of them because of the booming economy, responsible central bank, high yields on interest rates, low taxes and prospects for capital to earn returns in the United States right? WRONG! Laugh out loud!!!! Bernanke has signaled clearly that they will print money to support leviathan government spending and deficits, stock markets, the economy, over indebted consumers, and financial system bailouts in whatever quantities are required to do so. This IS NOT a recipe for INCREASING PURCHASING POWER! It is a recipe for decreasing purchasing power! Hope is not a strategy! Seek financial shelter! Learn how to capitalize on this unfolding gargantuan OPPORTUNITY !

In conclusion , to anybody who tells you that commodities, raw materials and precious metals are in a bubble: Laugh in their faces. There is NO evidence to support their conclusions. Of virtually everything, demand is accelerating and supply is declining. All markets go though rotation and correction as they work higher in zigzag fashion. Do not be FOOLED by mainstream media HEADLINES. As “just in time” supply plans begin to break down, hoarding inventory will increasingly occur in many commodity markets . This is going to be a market for the record books as Austrian economics in the emerging world, supply constrained, demand lead bull markets combine with: incompetent PUBLIC SERVANTS, Keynesian economics, Fiat currency and credit creation and the “Crack up Boom” as the monetary system of the G7 melts away over the next decade.

2008 stands out in my mind in respect to outstanding opportunities in all the markets covered in the past 4 weeks of the outlook. I do not think this is going to be a short process; it will take years as the world economies and financial systems evolve according to Darwin and the laws of nature. Up, down and sideways moves are set to materialize in many markets (stocks, bonds, currencies, commodities, raw materials, metals, everything is going to change price in dramatic manners) as the future and globalization sorts itself out. Think nuclear bombs exploding, nitro glycerin exploding, the perfect storm, stampeding herds of animals (in this case HUMANS), and VOLATILITY GALOR! It is going to be GLORIOUS! “Volatility is Opportunity ” learn to capture it! IMF chair, Dominic Strauss Kahn, talks about inflation expectations being “well contained and anchored” and recommends STIMULUS! Well, here it comes, Anchors Away as they say, Dom!

Here's a cautionary tale for you: This week I spoke with a very bright woman in Ohio . She was extremely well informed about the issues investors are confronted with at this time. Her portfolio was SHORT THE DOLLAR, LONG A COMMODITIES FUND, and in GLD gold ETF, sounds about perfect doesn't it? All sectors have had major moves since June. Well, Guess what? SHE LOST MONEY! She had purchased some products from Charles Schwab, that paragon of investing prowess. Those mainstream investment houses sell JUNK. Be CAREFUL how you choose your investment vehicles and methodologies as you can be in the right place, at the right time, and still “Miss the Boat”. If your investments are failing like these are its not because the markets haven't performed, it's the provider of your investment vehicles that haven't. If you are in this boat, switch boats! She has the makings of a sophisticated investor and I am going to work hard to assist her in becoming one. She is doing her homework and you must do so also!

Gigantic “Fingers of Instability” are deflating the G7 financial, banking and housing sectors! Public servants, G7 central bankers and Keynesian economists will meet these challenges by “deflating” the yield, purchasing power and value out of their currencies and transferring the money to their special interest constituents in those sectors to SAVE them and their financial/banking systems. Driving more stakes into the hearts of the middle classes who have elected them in ignorance of history, the policies of solvency and wealth creation. The re-flation required to combat the WOLF wave and meet the outstanding obligations of entitlements, and maintenance of the G7 infrastructures is going to boggle the mind. The commodity, natural resource and metals sectors are increasingly going to substitute for money as a store of value . The IOU's, er money, is going to bulge out into the rest of the world driving the “Crack up Boom”. It is going to push ALL markets all over the place. Sounds like fun doesn't it!

Thank you for reading Tedbits 2008 Outlook part IV, if you enjoyed it send it to friend and subscribe, its free at www.TraderView.com . Don't miss the next edition of Tedbits!

Ty Andros & Tedbits LIVE on web TV. Don't miss Ty interviewed live by Michael Yorba from Commodity Classics every week discussing this week's commentary and unfolding news. Catch the show every Wednesday at www.YORBA.tv or www.CommodityClassics.com at 4:15pm Central Standard Time . Archived video casts are available there as well.

By Ty Andros

TraderView

Copyright © 2008 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.