Russia Accumulates Gold As Price Consolidates Below Resistance At $1,644/oz

Commodities / Gold and Silver 2012 Aug 21, 2012 - 10:19 AM GMTBy: GoldCore

Today's AM fix was USD 1,624.00, EUR 1,308.94, and GBP 1,030.26 per ounce.

Today's AM fix was USD 1,624.00, EUR 1,308.94, and GBP 1,030.26 per ounce.

Yesterday’s AM fix was USD 1,615.25, EUR 1,306.84 and GBP 1,028.04 per ounce.

Silver is trading at $28.95/oz, €22.40/oz and £18.44/oz. Platinum is trading at $1,495.75/oz, palladium at $604.70/oz and rhodium at $1,025/oz.

Gold rose $4.80 or 0.3% in New York yesterday and closed at $1,620.70/oz – its highest level in three months (since June 19). Silver dropped than rallied back to $28.83 ending the day with a gain of 2.64%.

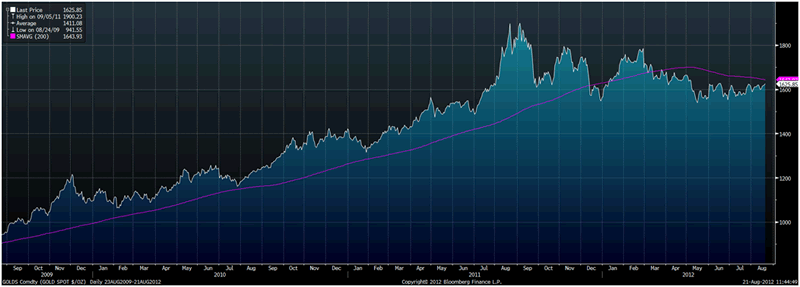

Gold Spot $/oz and 200 Day Moving Average - August 2009 to Today - (Bloomberg)

Gold continues to be supported by the real risk of EMU break up and further weakness in the euro, dollar and other currencies. Gold continues to consolidate below its 200 day moving average at $1,644/oz.

Technically, gold needs to close above the 200 DMA. Should this happen we could see quite significant short covering and more speculative elements on the COMEX may sense blood and come in on the long side in a more aggressive manner thereby propelling gold well above its recent trading range.

Platinum hovered just above the 2 month high hit on Monday over supply concerns from South Africa. Lonmin is the world’s number three producer and accounts for 12% of global platinum output. Industrial unrest has spread to other platinum mines in South Africa which produces between 70% and 85% of the world’s platinum (different estimates).

44 people died after violence and a massacre at Lonmin’s Marikana mine, and the company is now waiting before firing the 3,000 workers as previously planned, as the mine owners realized it would escalate the situation.

Gold bullion prices inched up despite trading volume for US gold futures being on track to hit a 2012 low. Silver surged almost 3% and there was speculation that platinum's rally may have made some of the silver shorts close some of their massive concentrated short positions.

Platinum has surged 7% in the last 3 sessions bringing its year to date gain to 7% outperforming gold and silver so far in 2012.

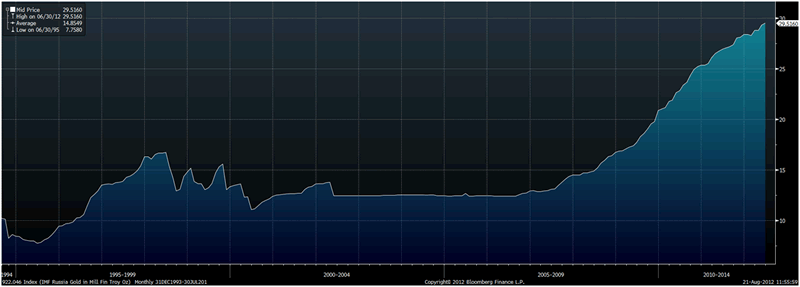

Russia continues to accumulate gold in its large foreign exchange reserves. The reserves include monetary gold, special drawing rights, reserve position at the IMF and foreign exchange.

Russia’s central bank increased its gold holdings to 30.1 million troy ounces as of August 1st, from 29.5 million troy ounces a month earlier, according to a statement published on its website today.

The gold reserves were valued at $48.7 billion at the end of last month, Bank of Russia said in a statement.

Russia's gold and foreign exchange reserves rose to $510.0 billion in the week to August 10 from $507.4 billion a week earlier, central bank data showed last Thursday. Russia's gold and foreign exchange reserves were $498.6 billion at the end of 2011.

This means that Russia now nearly has some 10% of its foreign exchange reserves in gold bullion.

Russia’s Gold Holdings From 1993 to June 2012 - (Bloomberg)

Since 2006, Russia has been gradually accumulating gold in order to diversify and protect from devaluation of their dollar and euro foreign exchange reserves and as part of a long term plan to position the Russian rouble as an international reserve currency

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.