Sector Rotation for Recession - Lessons from the Business Cycle

Stock-Markets / Sector Analysis Feb 06, 2008 - 12:40 AM GMTBy: Donald_W_Dony

In their never ending pursuit to uncover the next undervalued company, portfolio managers and investors often forget how equities, as a whole, fit into the stock market and business cycles. Though it is important to focus on the individual issues, it is never wise to forget about the surrounding environment and its positive or negative influences.

In their never ending pursuit to uncover the next undervalued company, portfolio managers and investors often forget how equities, as a whole, fit into the stock market and business cycles. Though it is important to focus on the individual issues, it is never wise to forget about the surrounding environment and its positive or negative influences.

The basic pattern of the business or economic cycle has four steps. These steps, though never exactly unfold the same during each cycle, the basic structure remains firm and should be remembered.

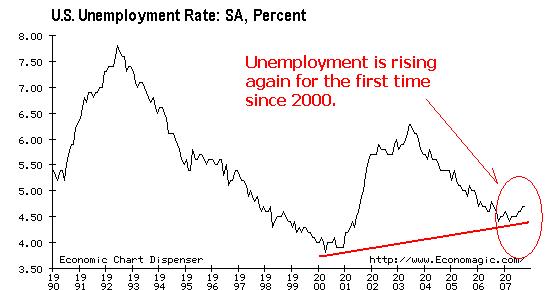

1. Recession. A decline in the real GDP that occurs for at least two or more quarters. Recessions feed on themselves. During a recession, business people spend less than they once did. Because sales are failing, businesses do what they can to reduce their spending. They lay off workers, buy less merchandise, and postpone plans to expand. When this happens, business suppliers do what they can to protect themselves. They too lay off workers and reduce spending. Unemployment starts to rise (Chart 2).

As workers earn less, they spend less, and business income and profits decline still more. Businesses spend even less than before and lay off still more workers. The economy continues to slide.

2. Low Point, or Depression. State of the economy where there are large unemployment rates, a decline in annual income, and overproduction. The time at which the real GDP stops its decline and starts expanding; the lowest point. Sooner or later, the recession will reach the bottom of the business cycle. How long the cycle will remain at this low point varies from a matter of weeks to many months. During some depressions, such as the one in the 1930s, the low point has lasted for years.

3. Expansion and Recovery. A period in which the real GDP grows; recovery from a recession. When business begins to improve a bit, firms will hire a few more workers and increase their orders of materials from their suppliers. Increased orders lead other firms to increase production and rehire workers. More employment leads to more consumer spending, further business activity, and still more jobs. Economists describe this upturn in the business cycle as a period of expansion and recovery.

4. Peak. The point at which the real GDP stops increasing and begins its decline; the highest point. At the top, or peak, of the business cycle, business expansion ends its upward climb. Employment, consumer spending, and production hit their highest levels. A peak, like a depression, can last for a short or long period of time. When the peak lasts for a long time, we are in a period of prosperity.

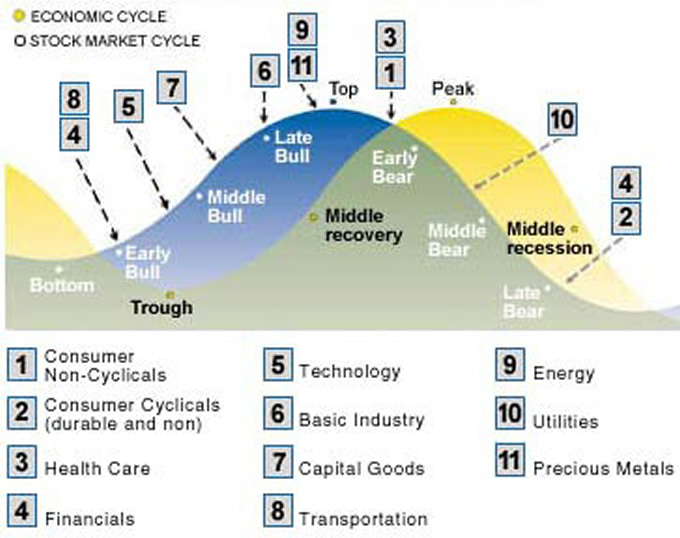

The stock market (Chart 3) is a well proven leading indicated on the business cycle and normally leads by 6-9 months. The rise and fall of sectors within the equity markets provides ample clues to the investor of the correct phase of the business cycle.

For example, if a time slice from the last 2-3 months were examined closely, the following economic and stock sector evidence would be found. Interest rates are now falling (Chart 1). Gold and oil are making all-time highs. Defensive groups such as health care and staples are some of the top performing groups. Financials and discretionaries have started declining months ago (both are leading indicators on the stock market). Basic materials and consumer goods are trading flat. All of this data would suggest a peak in the economy has developed and that the stock market (usually 6-9 months behind the economy) has already topped. Technical models indicate the crest for global markets was in October.

Bottom line: The current fundamentals of a company can be greatly influenced by the surrounding economy. By understanding the basic structure of the business cycle, investors can determine the present position of the cycle and anticipate a weaker or stronger economy in the near future. The business cycle has one of the strongest influences on the present and future earnings of a organization.

Investment approach: Portfolios should be weighted toward sectors that have proven strength in economic contraction periods. This includes defensive groups, utilities and pharmaceuticals. Investors should also consider under weighting transportation, technology, basic industry and capital goods. These last groups usually perform poorly during economic slowdowns.

Additional information about the economy, global equity markets and commodities can be found in the February newsletter.

Your comments are alway welcomed.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2008 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.