Two Irrefutable Signs of America's New Energy Dominance

Commodities / Energy Resources Aug 24, 2012 - 07:07 AM GMTBy: DailyWealth

Porter Stansberry writes: Yesterday, I showed you how new investments in energy production are now bearing fruit...

Porter Stansberry writes: Yesterday, I showed you how new investments in energy production are now bearing fruit...

U.S. natural-gas production reached a new high last year. U.S. oil production, which had been in decline since the 1970s, will reach a new high in five years.

In a recent report for Harvard University's Kennedy School of Government, global oil expert Leonardo Maugeri explains it is as if the oil capacity of several Persian Gulfs has been discovered in the United States.

The natural endowment of the initial American shale play, Bakken/Three Forks (a tight oil formation) in North Dakota and Montana, could become a big Persian Gulf producing country within the United States. But the country has more than twenty big shale oil formations...

That's why we expect the U.S. to become the world's leading and most reliable source of hydrocarbons – both oil and natural gas. And that's what makes us so unabashedly bullish on the prospects for the U.S. oil and natural-gas industry.

There are two signs we urge you to watch, which validate our predictions...

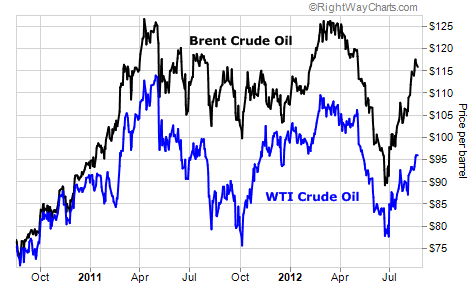

1) The ongoing discount between domestic oil prices (West Texas Intermediate) and the global oil price (Brent). As long as America continues to produce more oil than it needs domestically, it will enjoy a large and growing glut of oil. This will create a discount to world oil prices.

Until recently, there had never been a substantial discount to U.S. crude. If we're right about our prediction, this discount will remain until the U.S. changes its policies regarding oil exports. (Currently, it is against the law to export crude outside the U.S.)

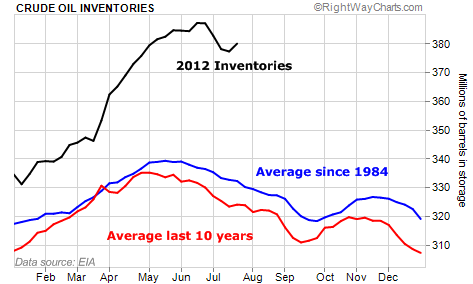

2) The huge growth in oil storage in the U.S. The chart below shows how the amount of oil in storage is now setting new records. This is a sure sign that the price of oil will continue to fall.

I also expect the coming decline in oil prices to cause a short-term wipeout in oil producers that carry large amounts of debt. Investors will be able to step in during these tough times and pick up valuable energy assets for pennies on the dollar.

I'm looking for high-quality assets, where it doesn't cost much to get the oil out of the ground... at a price that gives me the biggest possible discount to the value of the assets. Sooner or later, the price of energy will rebound and/or the company's rates of production and the size of the reserves will increase. At that point, the value of the company's stocks and bonds will soar.

Falling oil prices will spook most investors in the short term. But in the long term, it's a sign that America will become the world's leading oil-producing country.

This new energy boom is good news for our country... It's good news for your family... And it might be the investment breakthrough you need to finally achieve your financial goals.

Good investing,

Porter Stansberry

P.S. I've spent the last year working on an extremely thorough presentation that tells you everything you need to know about the energy boom going on right now in America. In this video, you'll learn a tremendous amount about this situation, for free. And if you're interested in making the right energy investments over the coming years, we are offering a 100% money back guarantee on our research. You'll learn how to take advantage in the video.

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2011 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.