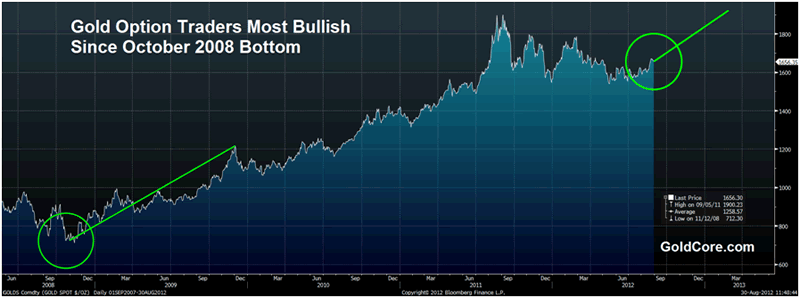

Gold Option Traders Most Bullish Since October 2008 Bottom

Commodities / Gold and Silver 2012 Aug 30, 2012 - 08:01 AM GMTBy: GoldCore

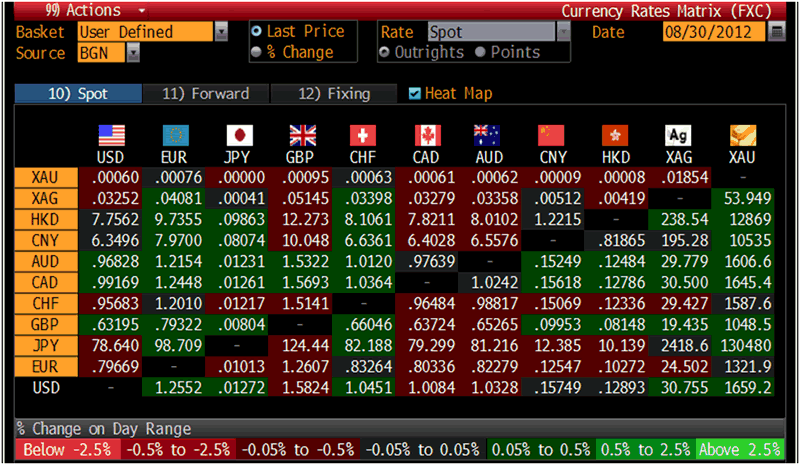

Today’s AM fix was USD 1,657.00, EUR 1,320.21 and GBP 1,046.48 per ounce.

Today’s AM fix was USD 1,657.00, EUR 1,320.21 and GBP 1,046.48 per ounce.

Yesterday’s AM fix was USD 1,664.25, EUR 1,325.04 and GBP 1,051.66 per ounce.

Silver is trading at $30.78/oz, €24.63/oz and £19.50/oz. Platinum is trading at $1,528.25/oz, palladium at $631.80/oz and rhodium at $1,025/oz.

Gold fell $11.10 or 0.67% in New York yesterday and closed at $1,656.10. Silver slipped to a low of $30.55 and rallied back and forth then finished the day with a loss of 0.58%.

Gold Rose 67% Between October 2008 And February 2009

Gold is mostly unchanged as investors gear up for the US Fed chairman, Ben Bernanke’s speech tomorrow.

Market participants are focussed again on the short term and the silly “will he, won't he?” debate re Bernanke at the Jackson Hole symposium.

Bernanke may again obfuscate and not give clear guidance regarding monetary policy and further QE.

However the smart money such as PIMCO's Bill Gross, Jim Rogers, John Paulson and others believe that further QE and money printing remain inevitable. We would concur and advise investors to fade out the short term noise emanating from Jackson Hole and from assorted policy makers on both sides of the Atlantic and focus on the reality that further monetary easing and currency debasement will continue for the foreseeable future.

There are continuing hopes that the ECB will deliver concrete plans next week that will help diminish the borrowing costs in Spain and Italy and an interest rate decrease is also being mooted.

The German Constitutional court decision on September 12th may finally put to bed whether Germany will allow the ECB to print euros in order to bailout periphery nations thereby debasing the euro.

The 6.5 billion euro Italian sovereign bond sale went well today but the auction again spotlights the country's massive debt burden and still high and rising borrowing costs.

A new and important bullish indicator for the gold market is that gold calls are at highs not seen since the October 2008 low as option traders go long gold in the belief that it will go higher.

It suggests that option traders believe that U.S. Federal Reserve Chairman Ben Bernanke will hint at or announce additional money printing and monetary easing at the Jackson Hole, Wyoming, symposium.

Alternatively, it suggests that they are bullish on gold due to the risks posed to the dollar and the risk of inflation taking off.

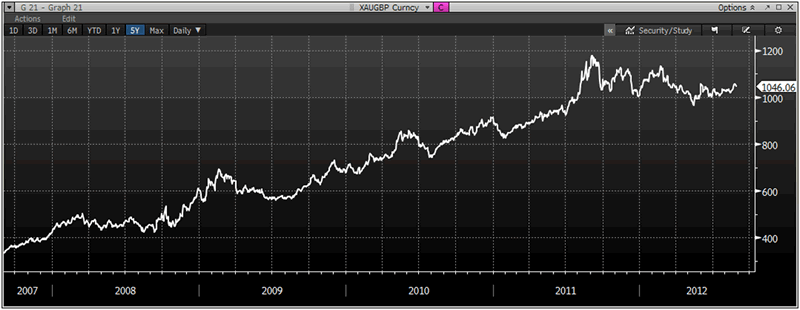

XAU/GBP 5 Year Chart – (Bloomberg)

The ratio of outstanding calls to buy the SPDR Gold Trust versus puts to sell jumped to 2.69 to 1 on August 24th and reached 2.76 earlier this month, the highest level since October 2008, according to data compiled by Bloomberg.

Ownership of calls is up 26% since the July 20th options expiry. Ten of the most owned actively owned ETF option contracts are bullish.

Option traders are regarded as savvier and tend to be more sophisticated then the more speculative futures traders.

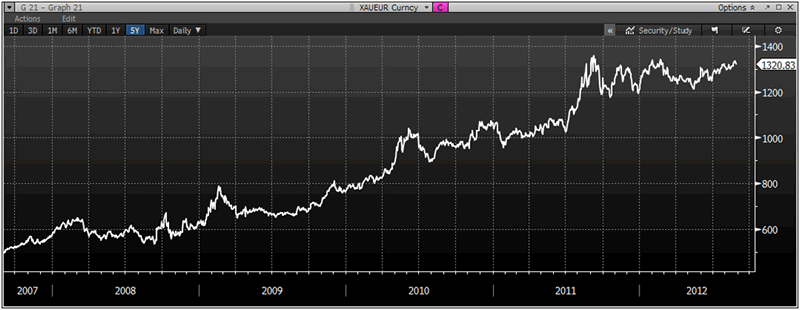

XAU/EUR 5 Year Chart – (Bloomberg)

Gold in October 2008 was trading at below $725/oz (see charts above). In the less than 5 months that followed gold rose 67.8% - from mid October 2008 to the high on February 12th 2009 at $1,215/oz.

A similar move today is quite possible given the long period of consolidation in the last 12 months and the strong fundamentals.

This could see gold rise from below $1,660/oz today to $2,785/oz in the first quarter of 2012 (see chart above).

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.