How to Ride the Gold Wave and Minimize Risk

Commodities / Articles Sep 04, 2012 - 03:07 AM GMTBy: Submissions

GoldSilverWorlds writes: Now that GLD has taken off like a rocket the last few days the question arises “how does one manage the risks?”. That being the risks of chasing a stock and sitting through a pullback right after one buys?

GoldSilverWorlds writes: Now that GLD has taken off like a rocket the last few days the question arises “how does one manage the risks?”. That being the risks of chasing a stock and sitting through a pullback right after one buys?

Ever get caught up in the moment only to see shortly thereafter the stock pulls back after you are in? Isn’t it at those times you wished you had just remained calm, cool and collected to enable you to get a better fill?

That’s called chasing a bus here at All About Trends and every day we hammer the point home — do NOT chase buses, but instead wait for stocks to come to you via orderly pullbacks where you are buying a lower, risk adverse entry point.

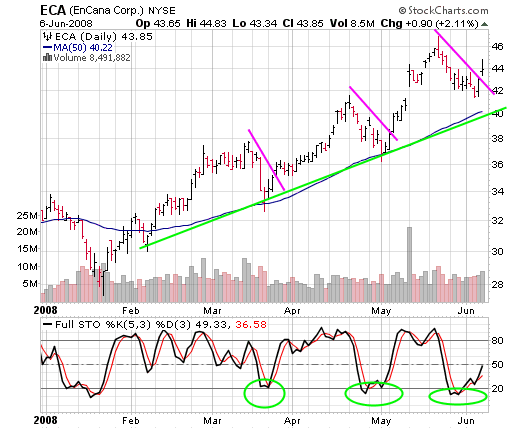

One way that you can start to apply that type of thinking is to implement a disciplined method to the madness vs. getting caught up in the moment. The way we do that is via chart and employ the use of basic chart reading skills.

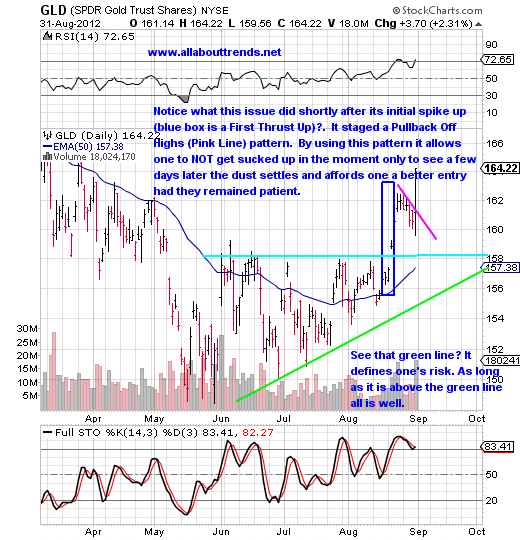

We use two types of chart patterns a lot to help us not get sucked up in the hoopla. The two best patterns that we have found to do this are called POH’s, which stands for Pullbacks Off Highs, and another pattern we call First Thrusts Up.

Below is an example of what we are talking about as applied to a daily chart.

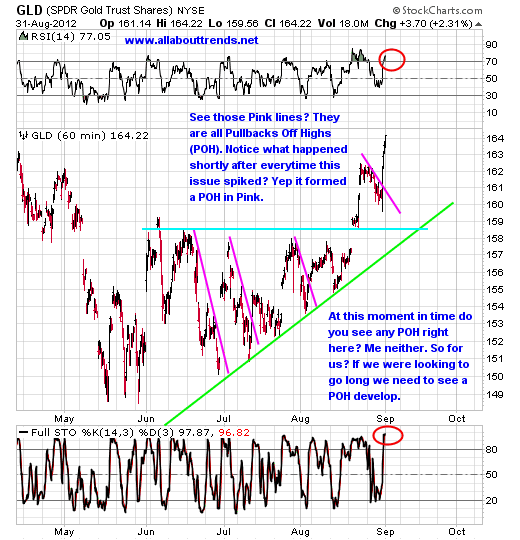

Now let’s zoom in to GLD via a 60 minute time frequency chart for a moment.

The other way we avoid trading errors is by the use of risk management techniques. By controlling your trade size and the use of charts allows one to minimize their risk. We can’t stress how important this is because we all know that at times stocks go south on us. This is just a fact of trading and nobody on the planet ever hits 18 holes in one. However when you do get that big score it really gives a boost to your golf game / equity curve and through a proper trading plan these hole in ones are inevitable.

By allocating no more than 5-7% of one’s portfolio to any one stock, should a stock go to zero (which won’t ever happen, but we say this for illustration purposes), we lose just 5-7% of our portfolio. If you have a balance of $25,000, at 5% you are only investing $1,250 in any one trade. If the stock gets chopped in half, big deal, you lose $625, but still have $24,375. Hardly worth getting emotional over. The same goes for a portfolio of $100,000 where you are investing $5,000 in a position. Should it get cut in half, you lose $2,500 and have $97,500 left for other trades.

These are extreme examples, but it shows you that even if something extreme were to occur by practicing proper risk management, it take your emotions out of the equation and allows you to make objective buy and sell decisions based on what the charts are telling you vs. operating from a chicken little the sky is falling mentality.

In stocks, your most important asset is YOUR MIND SET. You have to protect that and operate from a non-emotional, trade what I see mindset to truly enjoy success in the market. You truly are a product of your last three trades.

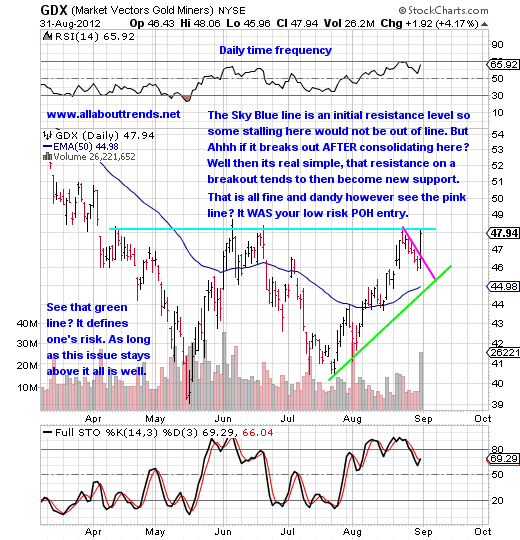

So now that we covered a bit of GLD here let’s take a look at GDX for a moment in multiple time frames and chart frequencies.

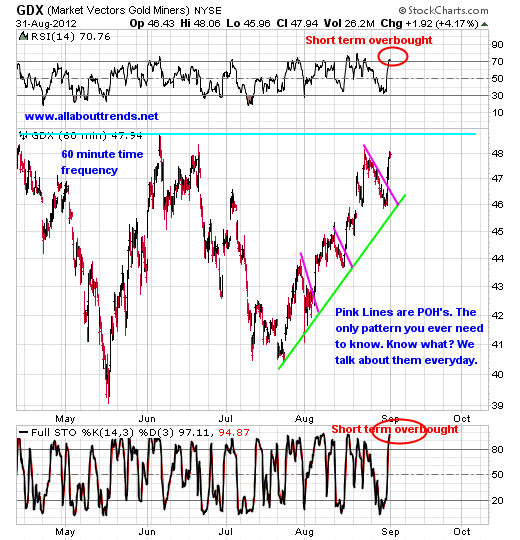

As you can see when you compare GDX to GLD we see that GDX looks like GLD just before it broke out to the upside (sky blue lines). This is why GDX looks more appealing to us here vs. GLD which has already broken out. Both have made short term thrusts higher out of POH’s, so they are both overbought in the short term.

So what do we do about that? Simplly allow them pullback off current highs and come to you. Now some will, some won’t (most do if you are patient enough) but you have to have a method to the madness, otherwise you will be privy to every little whim that shows up in your trading world — it’s all about discipline.

These are the things we talk about every day at All About Trends. Not only do we touch upon the metals, we cover this same type of style on the indexes and individual stocks every day because we know opportunities exist in alternative markets. Proper portfolio risk management also demands to diversify into non correlating sectors.

So now let’s apply that to an individual stock shall we? Below is an outstanding example of what we are talking about that we hone in on daily.

Now you know why we say in uptrending markets the POH trade pattern is the only pattern you’ll ever need to know.

Visit out website to learn more, we currently have 12 names of individual stocks that are currently sporting Pullback Off Highs (POH) patterns that are in clearly defined uptrends that are POHing right here.

Don’t forget there are three types of people out there.

- Those who make things happen (by being prepared in advance)

- Those who watch things happen

- Those who wonder what just happened (usually without them being there)

Ask yourself which one are you. We already know the answer and that is Those Who Make Things Happen.

THESE ARE NOT BUY RECOMMENDATIONS! Comments contained in the body of this report are technical opinions only. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed.

Source - http://goldsilverworlds.com/gold-silver-insights/how-to-ride-the-gold-wave-and-minimize-risk/

© 2012 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.