Obama’s Post-Bubble Job-Surge Still on Track: But Will it Get Teachers Back to Work?

Politics / Employment Sep 11, 2012 - 12:11 PM GMTBy: Andrew_Butter

The idea is that an economy can be over-stimulated by what Mises called mal-investment, and investment and the bounce in spending, whether that was stupid or not, creates jobs…until the bubble pops. Then you have to grind through what Mises called…the slow process of recovery.

The idea is that an economy can be over-stimulated by what Mises called mal-investment, and investment and the bounce in spending, whether that was stupid or not, creates jobs…until the bubble pops. Then you have to grind through what Mises called…the slow process of recovery.

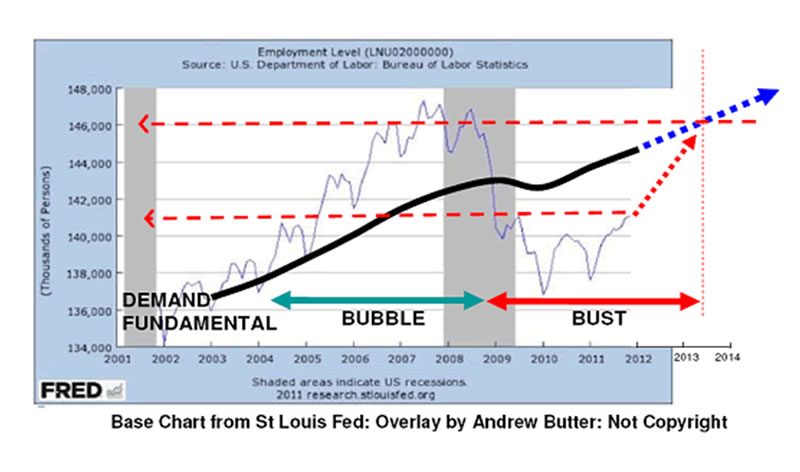

This is a chart put out a year ago:

The black line there which I call the fundamental line, comes simply from GDP (nominal) divided by average wages (nominal), which is a pretty crude number since many jobs involve long term costs (pensions, end of service gratuity…etc), which aren’t captured in wage-data.

So there was a bubble from 2004 to 2008, which is not news. A lot of jobs were created building buildings no one needs, or more to the point can pay for, plus providing goods and services to the house-as-an-ATM brigade, who thought paradise, had arrived, when sadly it hadn’t.

Here is what happened:

So, depending on your political affiliations, you can read that chart two ways, either (a) Obama did a good job…in the circumstances; and brought America back from the brink, or (b) it was going to happen anyway, and he was just in the right place at the right time.

By the way at the time I got the mental arithmetic wrong, but the chart was right, the prediction on the chart was 5-Million jobs by 2014, I actually wrote 15…dyslexia wins again.

The point is that the way employment is arranged in America, and the way the economy is arranged, either (a) wages (in nominal dollars) are going to have to go down, or (b) total jobs will level off at about 146 million, which means unemployment will stay high, now that the population which wants to work has gone up.

Unless there is change; specifically to the way that American corporations and foreign corporations which sell goods (and services) in USA, are incentivized by the tax code and other road-blocks, to locate the job-creating value added parts of their supply chain, inside America rather than outside.

Romney knows all about that, he spent half his life showing companies how to outsource; perhaps the electorate will decide to hire the fox as the gamekeeper?

Meanwhile, the insanity of getting trapped by unions into a position where a utility the government has elected to provide…however inefficiently…can be hi-jacked; is being played out in glorious Technicolor, by the teachers in Chicago.

Socialism is great, but you need either a big pot of someone else’s money to keep that show on the road, or you need to be able to ship people off to Siberia if they get greedy, it’s called having the cake and eating it.

By Andrew Butter

Twenty years doing market analysis and valuations for investors in the Middle East, USA, and Europe. Ex-Toxic-Asset assembly-line worker; lives in Dubai.

© 2012 Copyright Andrew Butter- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Andrew Butter Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.