The Gold Standard: A Panacea or More Malaise?

Commodities / Gold and Silver 2012 Sep 21, 2012 - 05:16 AM GMTBy: Submissions

Kira McCaffrey writes: The debt clock keeps on ticking. The U.S. federal debt recently surpassed the $16 trillion level and is still rising. The Republicans ushered the idea of a return to the gold standard to the center stage at their Tampa convention last month. Some see a return to the gold standard as a panacea to instill fiscal responsibility by our elected officials. While there are no easy answers or simple solutions to the massive debt crisis America faces, could a return to the gold standard be the answer? Let's take a look.

Kira McCaffrey writes: The debt clock keeps on ticking. The U.S. federal debt recently surpassed the $16 trillion level and is still rising. The Republicans ushered the idea of a return to the gold standard to the center stage at their Tampa convention last month. Some see a return to the gold standard as a panacea to instill fiscal responsibility by our elected officials. While there are no easy answers or simple solutions to the massive debt crisis America faces, could a return to the gold standard be the answer? Let's take a look.

A LITTLE HISTORY

The U.S. went off the gold standard under President Nixon in 1971. What may not be widely known is that the classic gold standard that the U.S. was utilizing (and that Britain and France had followed before) included a 40% cover ratio.

What does that mean? "The government will only print money if it has gold in its Treasury equivalent to 40% of the currency in circulation," said Jeffrey Christian, managing director at the CPM Group. "That means if you have $10 billion of money in circulation, you have to have $4 billion of gold in the Treasury. A lot of gold bulls don't realize it was a 40% cover." Christian noted.

HOW MUCH GOLD IS IN FORT KNOX?

Given that the current U.S. federal debt stands at $16 trillion, it begs the question, how much gold does the United States own? Currently, the U.S. does have the largest gold reserves in the world at 8133.5 tons, according to the World Gold Council. Just for comparison, Germany is a distant second with 3,395.5 tons and the IMF in third place at 2,814 tons.

So, the U.S. has a lot of gold, but is it enough to back all our debt? Not even close.

COMING UP SHORT

David Beahm, vice president at Blanchard & Co., a New Orleans based precious metals investment firm, did some quick back of the envelope math. "One ton equals 2000 pounds. One pound equals 16 ounces. 2000 times sixteen equals 32,000 ounces. With spot gold about $1,760, one ton equals about $56 million," he said. That equals about $456 billion at current market value or roughly half a trillion in gold, he said.

"Even if we liquidated our gold we could only bring our debt down to $15.5 trillion. That's a lot of shortfall," Beahm noted. "The next step [for the gold standard] is for them to revalue gold. It would make it go up by 400-500%," Beahm noted.

BIG WINDFALL

David Hargreaves, a widely watched mining consultant, has actually calculated a figure at $40,000 per ounce, based on world GDP figures (roughly 100 trillion), versus the 30,000 tons held by global central banks and came up with that balance.

Others have estimated a $10,000 per figure per ounce. But, again even that could be high as CPM Group's Christian notes that most gold bulls are assuming a 100% cover rate, while historic gold standards have only boasted a 40% cover.

BOTH SIDES OF THE COIN

While gold bulls are frothing at the mouth at the thought of cashing in the gold coins buried in their backyard for a government mandated standard, let's take a look at both sides of the coin. What are the positives of a gold standard for the economy and what are the negatives?

PROS

Simply put, the big positive of a return to the gold standard "would give us the fiscal discipline for governments, businesses and individuals. It would force all of us to be more fiscally responsible," said Ken Goldstein, economist at the New York-based Conference Board.

While that may sound enticing given the $16 trillion price tag Washington D.C. has currently placed on our future, the gold standard comes with some costs too.

CONS

On the negative side of the column, Goldstein explains "our jobs, incomes and the overall economy would grow at a much slower pace." How come?

MONEY SUPPLY

The answer comes down to money supply. That simply means the total money in circulation and that is a dynamic and growing figure.

"Modern finance has growing money. Money supply grows in reaction to the growth of the real economy. As an economy grows, more wealth is generated," said CPM Group's Christian. "Post industrial growth for the last 160 years has averaged 2-3% and the gold supply hasn't risen at the same pace."

Put another way, today's global economy stands at a rough $100 trillion GDP figure, and has been growing at 3-4% per year. "Finding that much more gold per year is just not going to happen. That's why going back to the gold standard is a pipe dream," said Goldstein.

CHOKE OFF GROWTH

Bottom line? A gold standard would result in a relatively fixed money supply. Money supply couldn't grow faster than the supply in gold, which would ultimately choke off growth. "It would force lending to slow down and the economy to slow down," said Goldstein. Explaining the connection and impact on lending, Goldstein elaborates. "For every dollar a bank has it can loan maybe $10-15 out. But, if those dollars are convertible to gold, that all collapses."

"If you can't borrow it would choke off the jobs growth, businesses can't raise prices, and consumers can't buy at higher prices because they can't borrow. Basically, you put a chokehold on the economy."

Additionally, for anyone who has current debt now, including a mortgage "our ability to pay it back would take us longer and would cause us to do without other things to pay it back," said Goldstein. The gold standard would result in a devaluing of the dollar and it would buy less. That would include bonds issued by cities and towns, and corporate debt as well as consumer debt. "The lenders would benefit, but the people who suffer are people who have to pay back debt."

CPM Group's Christian echoed those thoughts. "If we are going to manage our money supply, the economy cannot grow as rapidly as it wants to grow with periods of deflation, starvation and depravation that simply don't have to occur," he said noting that repeated periods of starvation were seen in the U.S. through the 1870's-1890's "because the money supply could not grow fast enough to grow the economy."

LONGER RECESSIONS

While many gold bugs are known Fed bashers, Christian points to the Bank Panic of 1907, which occurred while the U.S. was on the gold standard and prior to the creation of the U.S. Federal Reserve. "That bank panic threw almost the whole world into depression. The U.S. was in recession in 60 of the 90 following months," he said.

Goldstein agrees that a gold standard would make "the climb out of recession longer [because] you can't create as much debt with a gold standard."

MINERS WILL GET HURT

Another aspect of the gold standard discussion that is not widely talked about is the impact on gold mining companies. "Western gold mining interests will be ill served if we went back to the gold standard," said Christian. He pointed to the 1945-1971 period under the gold standard in the U.S. and said "many mining companies were driven out of business." Why? It's simple math. "As the cost of mining rose and labor costs rose, but the price of gold stayed at $35 an ounce gold miners closed because it wasn't economically feasible," he explained.

STORE OF VALUE

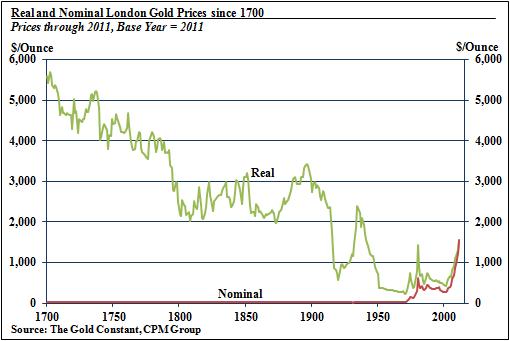

CPM Group's Christian also smashes another widely held myth about gold: that it is a store of value. In inflation-adjusted terms "the price of gold has never been stable," he says. See Figure 1 below, courtesy of the CPM Group. The inflation-adjusted or real price has gone down over the centuries.

"It is a myth. People think that the purchasing power of gold is stable over time and if you hold your wealth in gold that inflation will not hurt your purchasing power. Statistically, that is not true," Christian said. He points to the 1980 to 2001 period as an example. During that period "gold was falling in nominal terms from $800 to $250 and in real inflation adjusted prices it fell even more. In between [that time period] fortunes were lost. It is not a stable asset. It is not a stable store of value," he said.

WHAT'S AHEAD?

So, what are the odds that we will see a gold standard? "Pretty slim," said Pete Grant, chief market analyst at USAGOLD.

Adrian Day, president of Adrian Day Asset Management, highlights the November U.S. presidential elections as key. "If the Republicans win, I suspect a commission could well be set up. But, just because you get a commission doesn't mean they will do it," Day noted. In fact, there was a Gold Commission set up to study the matter in 1981, under President Reagan. At that time, "the majority said that gold had no role," Day said.

Looking around at academia and the Washington bureaucracy, Day added "I don't think there is broad pressure for a return to the gold standard. But, a [new] commission could have a suggestion that gold could play a role."

Looking ahead, however, Day sees potential for the tides to shift. "As time goes on and the financial mess continues to not be solved, and the currency continues to lose its purchasing power, the sentiment that we should have a gold standard will grow stronger and stronger," Day said. Perhaps Day notes "we could have a dollar standard backed by a basket of hard assets including gold."

Christian concedes that "it's possible we could see a gold standard briefly if you had a major world war. But, once you got out of the cataclysmic crisis, we would quickly go off."

IS IT PRACTICAL?

Another stumbling block would be the difficulty in actually organizing a shift back to the gold standard. Some say it would only work if all countries agreed to work off the gold standard. "Suppose we did it and the rest of the world didn't drink the Kool Aid, we've got an economy moving at a snail's pace and we've got the rest of the world growing at a 3.5-4% pace," said Goldstein.

Besides, "it would be unwieldy just to get an [global] agreement. Look at the degree of difficulty just getting 17 member of the European Union to agree," said Goldstein.

Does the Conference Board's Goldstein think we'll see a gold standard anytime soon? "You will hit the lottery before we go back on the gold standard," he concluded.

GOLD MAY HAVE A ROLE

Others are more optimistic. "The odds are remarkably high that we will see gold play an increasing role in the monetary system over the next ten years," said Day. "But, I don't think we will see a return to a pure gold standard," he concluded.

Blanchard & Co's Beahm notes a pure gold standard "doesn't seem feasible or logical because of the dollar amount we are talking about." He saw better odds of a so-called hybrid gold standard in which the government would "peg a portion say 25% of the dollars out there would be tied to gold." The upside of this type of hybrid plan? "To give the dollar some sort of protection that it can only lose this amount, because it is backed by gold. Right now it is backed by a promise," Beahm said.

Blanchard's Beahm advises that "having a small portion of your portfolio in gold protects you and also puts you in a position for a financial windfall if they do move to the gold standard."

Looking for trading ideas? Read out daily Markets section here.

Kira McCaffrey

Kira McCaffrey Brecht is managing editor at www.TraderPlanet.com She has been writing about the financial markets for 20 years and has passed Level 1 and 2 of the MTA's CMT exams. She was previously managing editor at SFO magazine for 10 years. Follow her on Twitter @KiraBrecht

© 2012 Copyright Ian R. Campbell - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.