Investor Rules for Avoiding Stock Market Bubbles

InvestorEducation / Liquidity Bubble Sep 25, 2012 - 12:55 PM GMTBy: Casey_Research

Dan Steinhart, Casey Research : Warren Buffet's #1 rule of investing is "Don't lose money."

Dan Steinhart, Casey Research : Warren Buffet's #1 rule of investing is "Don't lose money."

It's good advice, though not to be taken literally; all investors lose on occasion. Still, it is a worthy goal for which to aspire. And to have any chance of reaching it, you must learn how identify and avoid bubbles.

Which is easier said than done. We've all seen that seductive sector that just keeps going up…and up… and up… coaxing in more and more unwitting investors along the way. At its peak, even the most strident skeptics concede that sky-high prices are the new industry norm.

And then…POP!

In an effort to avoid such unpleasant situations, here are two rules to help you detect bubbles well before they harm your wallet.

Rule #1: Watch the Sectors

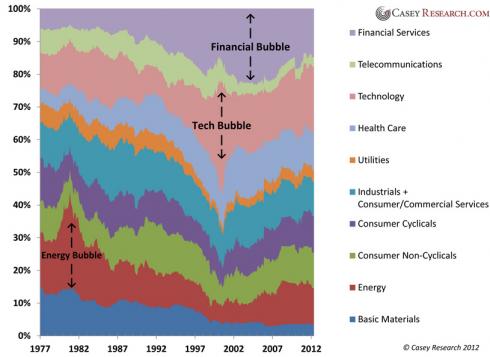

We use the Casey Research Bubble Monitor to sniff out bubbles as they inflate. Essentially, it compares the size of each S&P 500 sector against the others, and we observe the change over time. It's a simple concept with powerful results. Take a look:

The Casey Research Bubble Monitor

The swells and pinches illustrate the various sectors growing or shrinking in relation to one another.

Bubbles are easy to spot – during each, the offending sector expands and encroaches upon the others.

At their peaks, the energy, tech, and financial bubbles all claimed an unsustainably large chunk of the S&P 500. Cue the Bubble.

Our monitor is based on the assertion that no one sector should comprise much more than 20% of a large, diverse economy - and the US economy is as large and diverse as they come.

A case in point: Tech, at its August 2000 peak, comprised 35% of the S&P 500. Predictably, it plummeted to just 15% in the ensuing years.

Indeed, whenever a sector strays too far too quickly from its long-term average, it always gets knocked back into line. The energy and tech bubbles ended with blow off tops, and crashed soon after. The financial bubble persisted longer, but also popped in epic fashion.

Today, the US economy is mostly well balanced. My only concern is that tech is beginning to look a little frothy, as it has climbed above the important 20% threshold in recent months. We'll be keeping a close watch on this situation, and if it starts to look seriously bubbly, will issue an early warning in The Casey Report.

Rule #2: Beware the phrase "This Time is Different"

A bubble begins with a paradigm shift – a totally new way of doing business that forever alters an industry's landscape. It destroys old opportunities and ushers in new ones. That creative destruction is the lifeblood of any healthy economy. But paradigm shifts also have a dark side – they are oft used as justification for why bubbles are not really bubbles.

Think the mass adoption of the internet in the late 1990s. An endless world of possibilities opened up overnight, and investors assumed that all companies connected to this phenomenon would rake in the dough. Stock prices soared as investors anticipated wild profits. The potential seemed limitless.

You know how that story ends.

We now look back at those 2000-ers with puzzlement. How did they not see the bubble? Did they not notice the chart of every dot-com company going parabolic?

Of course they did. But they rationalized it away with the paradigm shift: "Stock prices are booming because there's an entirely new industry! This isn't a bubble, because these high prices are actually justified!

Or, in other words, "This time is different."

Famous last words. In a free(ish) economy, profits can explode temporarily when a new industry is born. But those swollen profits are quickly eroded by entrepreneurs entering the field. They find new, better, and cheaper ways to do things, then lower product prices to compete with each other. Before long, profit margins plummet toward equilibrium with all other industries. And sky-high stock prices can't persist without sky-high profit margins.

Don't join the lemmings in rationalizing ridiculous prices. Sky-high prices = bubble. And all bubbles end the same – with a pop.

Further Reading

So we can spot when individual sectors are overvalued. But how do we know if the stock market as a whole is over- or under-valued?

If that critical question piques your curiosity, I recommend a bit of educational reading in the form of Stocks vs. Bonds, a free report by Bud Conrad, Chief Economist of Casey Research. In it, Bud employs three highly accurate indicators to determine whether US stocks are expensive, cheap, or reasonably priced.

Without spoiling his conclusion, all three indicators strongly point in the same direction today – a fact you'll want to consider when deciding where to invest your money for the rest of 2012 and into 2013.

© 2012 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.