Gold Optimism Reality Check

Commodities / Gold and Silver 2012 Sep 27, 2012 - 06:58 AM GMTBy: Brian_Bloom

History shows that one cannot “manipulate” a primary trend (and maybe not even a secondary trend)

History shows that one cannot “manipulate” a primary trend (and maybe not even a secondary trend)

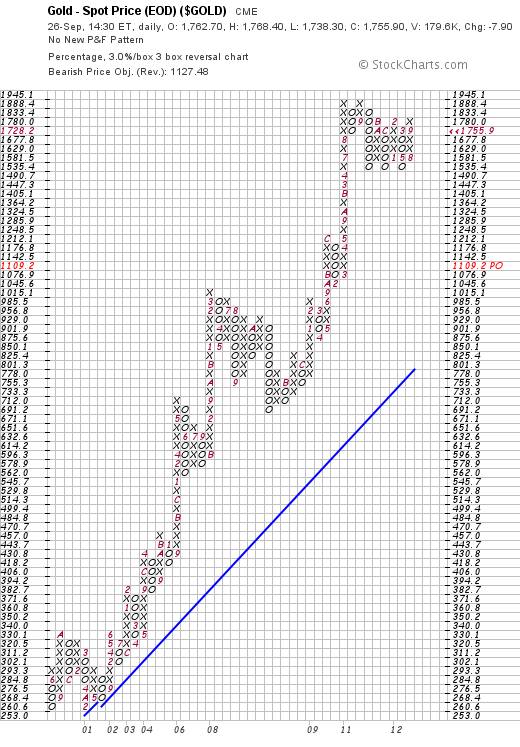

Despite all the optimistic noises regarding recent movements of the gold price, the chart below (3% X 3 box reversal Point & Figure chart, courtesy stockcharts.com) is still showing $1109 as the prevailing target price. The gold price will need to rise to $1833 for that target to be negated.

Chart #1 – 3% X 3 Box reversal Point & Figure chart of Gold

Note that the recent volume levels on the weekly bar chart of gold are lower than the volume levels leading gold’s price peak in August 2011. One needs to be dispassionately objective here: Was it “buying pressure” that caused the gold price to break up out of the descending right-angled triangle six weeks ago, or was it speculative trading? There is no place for ego in the markets. It doesn’t matter what I or any other commentator thinks. The question is: What does the market think?

The cold, harsh reality is that the gold price is technically overbought and needs to pull back for the market in gold to remain functionally healthy. If the gold price breaks up to a new high then those who are calling for a price $3,500 an ounce might be proved right. Unfortunately, this will not be good news because it will likely be symptomatic of the world’s financial markets beginning to spiral out of control. Buying gold now is therefore tantamount to taking a bet that the world’s financial markets will spiral out of control. That behaviour is appropriate if one views gold as an insurance policy. Arguably, it is nothing short of gambling if the reason one is buying gold is that one is hoping to make a killing.

Chart #2 – Weekly bar chart of gold

Below, courtesy Google is the S&P Global 1200 Industrial Chart up to September 26th 2012 (Source: http://www.google.com/finance?cid=10264130 )

This chart does not look like it wants to break “up” – notwithstanding the monetary policy decisions of the US Federal Reserve and the European Central Bank. Arguably, we might be witnessing the emergence of the right hand shoulder of a head and shoulders pattern. If that pattern breaks down (likely delayed until after the US Presidential inauguration or at least the US Presidential elections) this will not be a harbinger of the price inflation that gold investors are anticipating. By contrast, it will be a sign that the velocity of money can be expected to slow and that economic activity can be expected to contract across the planet.

(Note: The S&P Global 1200 Index is a free-float weighted stock market index of global equities from Standard & Poor's. The index covers 31 countries and approximately 70 percent of global stock market capitalization. It is composed of six regional indices: (source: http://en.wikipedia.org/wiki/S%26P_Global_1200 )

Chart #3

Will price inflation prevail? Unfortunately, no one alive can make the call with confidence at this stage. We have to wait for the market to vote with its feet. But an early warning will be if the S&P Global index falls below the rising trend line. Of course, it might break up above the falling trend line. Unfortunately, because this is a global index, it can’t be as easily influenced by vested interests.

Finally, here’s the really important question: Against a background of rioting in Greece and Spain (and elsewhere) in response to austerity measures, what evidence is there that the authorities and decision-makers are actively moving to stimulate the worlds’ economy as opposed to stimulating the world’s financial markets? At the end of the day, prices are determined by underlying value, not by the wishes and hopes of speculators. It is not “money” that drives the world economy. It is entrepreneurial activity facilitated by the emergence of new technologies that hang off newly emerging energy paradigms – the same energy paradigms, the emergence of which, vested interests in the coal and oil industries moved to block when they failed to ratify the Kyoto protocols in 1998.

The flip side of this coin is that the news is not all bad: There is an enormous amount of good news that is not yet seeing the light of day (see my website at http://www.beyondneanderthal.com/mission-overview/ ) . The challenge is to get the political decision makers to understand that their role needs to be to encourage the emergence of these employment generating industries, as opposed to protect vested interests. Also, as I argue in my two factional novels, it will be necessary to restructure the way society manages itself so that the Rule of Law is reconnected to the foundation of ethics on which it was originally constructed.

Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2012 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.