China Banking Ponzi Crisis, China Will Grow Old Before it Grows Rich

Economics / China Economy Oct 12, 2012 - 10:56 AM GMTBy: Mike_Shedlock

The Ponzi schemes and off-balance sheet loans in China's banking system are in the forefront of today's news. Reuters reports Bank of China executive warns of shadow banking risks

The Ponzi schemes and off-balance sheet loans in China's banking system are in the forefront of today's news. Reuters reports Bank of China executive warns of shadow banking risks

A senior Chinese banking executive has warned against the proliferation of off-book wealth management products, comparing some to a Ponzi scheme in a rare official acknowledgement of the risks they pose to the Chinese banking system.

China must "tackle" shadow banking, particularly the short term investment vehicles known as wealth management products, Xiao Gang, the chairman of the board of Bank of China, one of the top four state-owned banks, wrote in an op-ed in the English-language China Daily on Friday.

He warned of a mismatch between short-term products and the longer underlying projects they fund, adding that in some cases the products are not tied to any specific project and that in others new products may be issued to pay off maturing products and avoid a liquidity squeeze.

"To some extent, this is fundamentally a Ponzi scheme."

Yuan Loans Trail Estimates

Bloomberg reports Yuan Loans Trail Estimates as Wen Struggles for Rebound

China's new lending was below analysts' estimates last month as the government struggles to reverse a slowdown in the world's second-biggest economy.

Banks extended 623.2 billion yuan ($99.5 billion) of local- currency loans, the People's Bank of China said on its website today. That compares with the median estimate of 700 billion yuan in a Bloomberg News survey of economists.

China's central bank has cut interest rates and lenders' reserve requirements to spur lending, with economic growth sinking just as the Communist Party prepares for a once-a-decade leadership transition that starts next month. While local governments are rolling out plans for infrastructure spending, banks are wary of accumulating bad loans and have failed to make use of extra leeway for offering discounts to borrowers.

Premier Wen Jiabao is "risking handing over a sharply slowing economy to the next administration, a blemish to his otherwise great performance over the last ten years," said Liu Li-Gang, an economist in Hong Kong at Australia & New Zealand Banking Group Ltd. (ANZ), who previously worked at the World Bank. Liu said the central bank needs to cut lenders' reserve requirements.

Korea Slashes Interest Rates

Business Insider reports Korea Slashes Interest Rates

SEOUL, South Korea (AP) -- South Korea's central bank trimmed the key interest rate Thursday for a second time this year, as Asia's fourth-largest economy faces mounting threats from the protracted debt crisis in Europe and the slowing growth in the world economy.

Analysts expect that the Bank of Korea, which revised down its outlook for South Korea's economy to 3 percent in July, will further reduce its growth forecast for 2012 and 2013 in its scheduled announcement later in the day.

Singapore Economy Contracts

Business Standard reports Singapore Q3 economic growth slows.

Singapore's economy grew by 1.3 percent in the third quarter, slower than the 2.3 per cent growth in the previous quarter.

"On a quarter-on-quarter seasonally-adjusted annualised basis, the economy contracted by 1.5 per cent, compared to the 0.2 per cent expansion in the second quarter", the Ministry of Trade and Industry (MTI) said while releasing the advance GDP figures.

The Ministry also cautioned that growth could be weighed down by the subdued global economic conditions for the rest of the year.

Hong Kongs's July retail sales growth slows

China Daily reports HK's July retail sales growth slows

Retail sector to remain weak for rest of the year, analysts warn

The city's retail July sales value tumbled drastically as the local retail sales market was weighed by the global economic slowdown and the decrease in mainland tourists' spending. Economic analysts cautioned that the local retail sales will remain weak for the rest of the year.

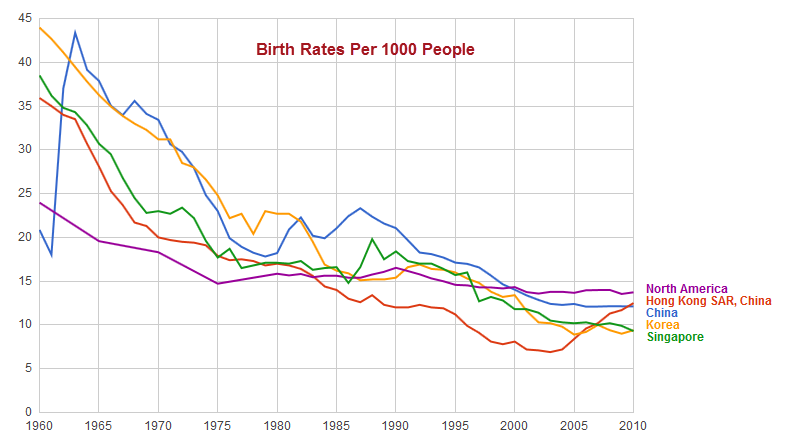

Birth Rates of North America vs. Asia

Chart from Google World Indicators.

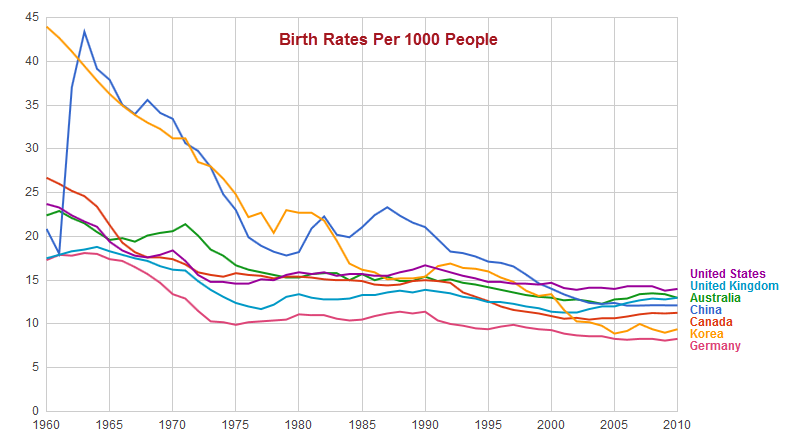

Birth Rates of US, UK, Australia, China, Canada, Korea, Germany

"China Will Grow Old Before Growing Rich"

My friend "BC" emailed the above links along with a few thoughts. "BC" writes.

Developmentally, China is where the US was in the late 1920s and early 1930s, and where Japan was in the late '60s and early '70s, but China does not have the luxury of growing supplies of $10-$15 oil as did Japan.

Banking crises historically occur following demographics-induced credit and unreal estate booms/bubbles. China, Australia, and Canada are next in line for an unreal estate bust and banking crisis.

Demographic drag effects will hereafter begin to occur in China, Korea, and the Asian city-states, especially for China after '14 into the mid- to late '20s. Attempts to increase lending and "stimulus" with a debt overhang will encounter the same structural demographic constraints as in Japan since the mid- to late '90s and the US since '08.

China's growth boom is over, which means that the same for Taiwan, Korea, Singapore, Hong Kong, Thailand, Malaysia, and Vietnam.

China will "grow old before growing rich".

Impact on Commodity Producers

I am in general agreement with the thoughts expressed by "BC".

The impact on commodity exporters like Canada and Australia will be far, far greater than most realize. For further discussion, please see ...

12 Predictions by Michael Pettis on China...

Currency Wars, Commodity Prices...

Moreover, while the US is in the best shape demographically speaking, the overall picture is not especially pretty anywhere as retired boomers require medical benefits at an ever-increasing pace with real wages stagnant at best for those fresh out of college.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2012 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.